Archive for the ‘Real Estate’ Category

Back again!

I’ve been gone for over a month, but hopefully not forgotten! One of the big stories around Greenfield has been the continues soft-launch of our REIT Fund-of-Funds, ACCRE. We’re rolling this out as a subscription-based newsletter, rather than an actual managed fund. However, non-subscribers wishing to follow our progress can simply tune into the blog itself, ACCRE.Com, and follow our periodic posts, but without access to the actual fund itself:

www.accre.com/2018/11/fund-status-for-october-2018/

A picture of America

This is a great picture. I wish I had thought of it, but it comes courtesy of the great people at Bloomberg News.

Full disclosure — I’ve had the pleasure of working with the good folks at Bloomberg as an expert consultant on occasion. They’re great folks to work with.

Top of the residential market?

Ever wonder where the top of the residential market is? A small part of our practice at Greenfield over the years has been consulting on really top-tier, “trophy” real estate. Valuing these properties is part art, part science, and everyone in that rarified realm is always trying to figure out where the top might be.

It appears that some of the very top of this market is softening, according to an article yesterday on CNBC.com by Robert Frank, their wealth editor. As it happens, tax law changes and a pull-back by foreign investors (particularly from China) means that the very top tier of properties have seen pricing reductions this summer. Indeed, the top 500 homes on the market saw total price reductions of $1 Billion of late.

For example, the Ziff family estate in Florida was previously on the market for $195 million. After two price reductions in a year, it is now down to $138 million, a reduction of over a quarter in its offer price, and still with no takers. Sean Elliott, one of the leading brokers for mansions such as this, notes that there are no comparable transactions to go on. Indeed, often such properties have to test the market first, and then adjust prices accordingly.

The article makes good reading, even if you’re not presently in the market for a $100 million beach house: The $1 billion price cut: Luxury real estate gets slashed.

REITs vs Open Ended Funds

There is a great article in the current edition of REIT Magazine, by Michele Chandler, celebrating the 25th anniversary of the creation of REITs in Canada. Ms. Chandler does a great job explaining why Canada has a REIT system in the first place, and why Canada’s REITs came into being in 1993.

In short, Canada’s commercial real estate market collapsed in 1993, and open-ended funds were flooded with investors redeeming shares. The funds quickly appealed to the government which allowed them to suspend redemption. This, of course, led to liquidity problems for investors. The solution was to turn those funds into close-end REITs which would then be listed on the Toronto Stock Exchange. Investors could sell their shares on the exchange to gain liquidity. Today, the exchange has 38 Canadian REITs with total capitalization of about C$57.7 Billion as of the end of 2017.

This article illustrates one of the subtle but important benefits of REITs as opposed to a private equity fund or an open-ended fund — liquidity without having to sell off the underlying assets in a down market.

WSJ Property Report

Three things caught my eye in the Wall Street Journal’s Property Report this morning. The first two were a positive note about Home Depot — which is doing a land-office business — and a related note about the aging of American homes. Let’s start with the second point first.

The National Association of Homebuilders reports that the median age of a home in America is now 37 years, up from 31 years just a decade ago. Mathematically, that’s an extraordinary increase. It basically means that very few new homes have entered the housing stock in the past 10 years, and almost no homes have been torn down or in some way converted to some other use. That’s the point NAHB is trying to make. Our aging housing stock is a drag on the economy. People who might have been employed in higher wage construction jobs are now serving coffee at Starbucks. This ultimately means that our flat-line inflation in America has, to at least some degree, been achieved on the backs of stagnating wages.

Of course, this means good things for home re-hab shops like Home Depot. If you’re house is getting older, you have two choices. You can sell it and buy a new one (making the NAHB happy) or you can buy a can of paint or some new kitchen cabinets at Home Depot. (Full disclosure — the folks at my local Home Depot know me by name.)

As for the third point, while wage stagnation is decidedly affecting the middle class, there is no such problem in the luxury class. Belmond Hotels, owners of some of the world’s premier hotels, are considering buy-out offers. Financially, this suggests they think we may be at the top of a cycle, and it’s hard to imagine that they could wring any more profits out of their properties than they do already. Ergo, it may be time for them to cash in, and rumor has it some sovereign wealth funds are offering top dollar. (Full disclosure — Belmond owns the Charleston Place in Charleston, SC, where I spend every New Years. It is one of my favorite hotels in the world.)

By the way, Belmond is one of those fascinating stories that underscores the globalization of commerce. Belmond was actually founded with the acquisition of the Hotel Cipriani in Venice, Italy. It owns the Orient Express, which is run out of its Paris Office. Corporate offices are in London, and today owns properties in 22 countries, including the historic 21 Club in New York and the Copacabana in Rio. The legal headquarters, however, are in Hamilton, Bermuda, and the stock trades on the NYSE. Go figure….

Need a job?

I pulled up behind another car at a stop light yesterday and couldn’t help but notice a license plate surround for the local construction laborers union, plus a labor bumper sticker in the back window. This attracted my attention because the vehicle in question was a late-model Cadillac Escalade.

Admittedly this may have been an outlier, but all across the U.S. there is a huge demand for entry level construction trainees. Here in Seattle (a high-wage, high cost-of-living area) entry level “no experience, no education” wages are in the high-teens per hour, rising rapidly to $50k per year with a modicum of experience. Take some winter months to go get trained in plumbing, electrical, or HVAC and the annual income gets into the high 5 to low 6 figures pretty quickly. (The average plumber in Seattle makes $95,000 per year, according to Salarylist.com.) Some sources put this number somewhat lower, but you get the point.

Ironically, these jobs are going begging, and the reasons are varied. Many young people are scared off from a job that evidently requires a lot of outdoor work and physical stamina. Yet, as one young woman in a carpenter training program noted, “If you work hard and you put in your effort, they’ll take you over somebody else who is muscle…” Baby boomers seem to think that if their children don’t go to college, they’ve failed as parents, and so the percentage of construction workers under age 24 has declined in 48 states since the peak of the housing boom.

Wall Street Journal has a great article this morning called “Young people don’t want construction jobs. That’s a problem for the housing market.” It is indeed. It is one reason why home construction per household in America is at its lowest level in 60 years of keeping records, according to the article. The reasons include lack of vocational programs in high schools, although many of these are coming back. The Home Builders Institute, affiliated with the National Association of Homebuilders, has as many as 6,000 young people in their training pipeline at any given time.

I’m not suggesting — nor is the WSJ, that flooding young people into construction jobs will change the housing affordability metric overnight. The homebuilding industry is still replete with problems such as a trade war with our principle material suppliers, a lack of housing infrastructure, and short-term financing issues. Nonetheless, young people might want to be reminded that a surprisingly large number of CEOs in the construction field got started with a hammer in their hands.

Home prices up, sales down

Reuter’s reported this morning that sales of existing homes are down and prices are up. Economists had forecasted an increase year-over-year of 0.6%, according to National Association of Realtors statistics, which would have been a pretty good jump. In fact, sales actually fell by 2.2% from June, 2017 to June, 2018.

Sales rose in the northeast and Midwest, but fell in the west and south. Existing home sales make up about 90% of the market (the other 10% from new homes). As we’ve reported before, rising costs and lack of infrastructure are driving up new home prices and driving down new home availability. This means that demand drives up prices, and ultimately drives down volume. (This was the part of the supply/demand equilibrium lecture that drove so very many college freshmen to major in something other than economics.) Annual wage growth has been stuck below 3% for some time now, and median house prices are now up 5.2% from last year, to a record high of $276,900. According to NAR, this is the 76th consecutive month with year-to-year price gains.

Supply at the lower end of the market — starter homes and rental homes — dropped by 18% from last year. This is problematic since first-time buyers accounted for 31% of all transactions in June. However, economists estimate that in a healthy market, first-time buyers would account for a 40% market share. All in all, these are not the signs of a healthy housing market.

Inflation outpacing wages. Fed expectations?

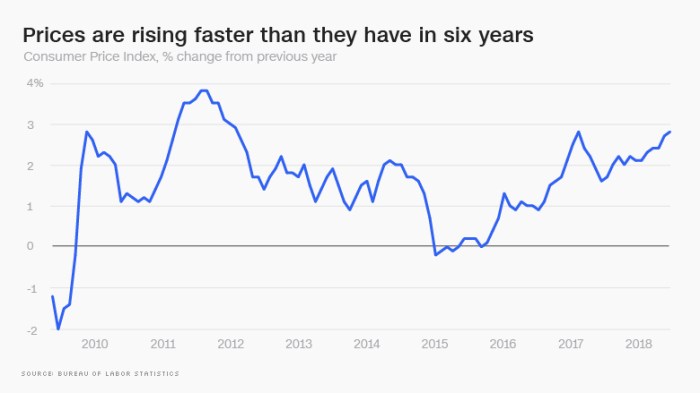

Those of us who lived through the 1970’s may think that 3% or 4% inflation is childsplay, but the FED doesn’t necessarily look at it that way. Indeed, they’re an “inflation conservative” bunch, and don’t take too kindly to the CPI heading northward.

An article this morning in CNN Money offers two painful scenarios. First, inflation is nudging up, in no small part from housing costs and health care costs. Add to that the impending impact of the coming Trade War, and the news isn’t very good.

Graphic courtesy money.cnn.com

Second – and we’ve been predicting this – consumer prices are rising higher than wages. The difference isn’t very big at the median, only 0.2 percentage points, but given the disparate increases in incomes in America of late, and the disparate consumptions patterns, this means that the burdens of cost inflation are being disproportionately felt by working families.

More to come….

Commercial property prices

First, a happy 4th of July to all of our U.S. readers! I’ve spent the day catching up on reading, writing, and napping. I hope you’ve all done the same.

Part of my reading was a recent piece by Calvin Schnure for the members at NAREIT titled Commercial Property Prices Continue Steady Gains. It’s an interesting read, and factually correct. However, Mr. Schnure and I might arrive at somewhat different conclusions. Case in point is illustrated by the graphic below, taken from his article:

Now, if you are running a REIT and want to convince potential investors that the world is rosy, then this is a very pretty graphic. On the other hand, if you are a real estate analyst (ahem…. please hold your applause) you have to wonder what the heck is going on here. I’m particularly concerned with multi-family, which has increased in value on the order of about 60% since the previous peak (December, 2007) but is up by something close to 160% since the trough of 8 years ago. Yeah. That’s a huge run-up. Couple that with the observations (anecdotal, at present) that multi-family vacancies are on the rise nationwide, and particularly, surprisingly, in formerly hot markets like Seattle (just to name names).

I’m not preaching a long-term or even intermediate term demise for multi-family. Far from it, in the long term, these are still worth considering. However, in the short-term, these annualized gains may not be sustainable.

By the way, there’s a lot more in the NAREIT article, and it’s worth reading in its entirety.

Watch this space. We’ll keep you posted.

And yet more on housing

Twice burned, you know? I think we should all be a bit gun-shy about rapidly increasing house prices. Are we looking for a bubble or a peak?

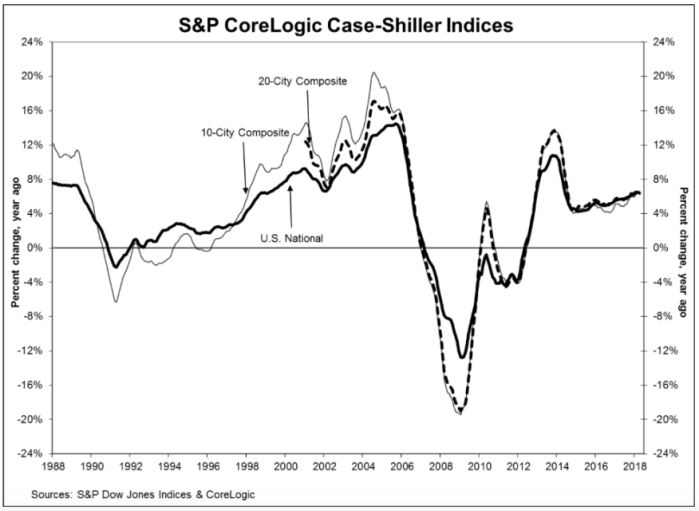

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, reported a 6.4% annual gain in April, slightly down from an annualized rate of 6.5% in March. While they produce a few other indices, all of them basically report the same thing. Oh, by the way, my home city of Seattle leads the pack with an annualized rate north of 13%.

Glancing at the graphic, below, the slope of the current pricing graph looks suspiciously like what we saw during the bubble run-up. As I’ve noted here previously, house prices increasing at a rate higher than 2 points over inflation is emblematic of a bubble. That would suggest a nationwide rate somewhere around 4% – 5% right now. You do the math.