The K-Shaped Economy

“I’m mad as hell, and I’m not going to take it anymore!” (Howard Beale, played by the actor Peter Finch, in the movie “Network”, 1976)

In the coming days you’re going to hear the phrase ‘K-Shaped Recovery’ bantered about by economists. It’s a little misleading, because it suggests we’re in the midst of some kind of economic recovery. In fact, we’re not, but it harkens back to basically everything that’s happened since the Pandemic, and it also explains the National and World politics, the state of the nation, and the state of everyone’s pocketbooks.

In a ‘K-Shaped’ economy, there are winners and losers. Now, you might say, “Hey, John, haven’t there always been winners and losers in the economy?” and I would say, “Yeah, but generally not so predictably systematic.

If you went into the pandemic with money/assets, or a job in high-demand sectors, or both, then you’ve done quite well over the past five years. If you didn’t have money/assets, and had a job in low-demand sectors, then you’ve done quite poorly.

The 2024 election turned on this issue. Most (but not all) economic winners were likely to vote to stay the course. Economic losers were likely to vote to change. Change won. Today, though, the economic losers are getting worse off, and the economic winners (amazingly enough) are getting better off.

So, what can be done to fix this? Pretty much the opposite of what’s being done right now. First, America benefits from wide-open free trade. We send dollars (which we can print by the bucketload) in return for cheap goods. We also sell lots and lots of stuff that provides lots and lots of employment, like soybeans and airplanes and Hollywood movies and the upper echelons of technology.

Second, the social safety net is crumbling. It’s crumbling because very short sighted billionaires wanted tax cuts, which in the long-run are counterproductive to their best interests. These billionaires generally sell stuff to consumers. If consumers at the bottom half of the economic ladder cannot afford to buy their stuff, then in the long run, Amazon and Walmart and Apple have unsustainable business plans. For example, people make bad economic decisions in the absence of a good health care system, a healthy housing market, or stable food prices.

Third, controlled and regulated immigration is and always has been extraordinarily healthy for the economy. It brings in hard workers who are anxious to take the lowest jobs on the ladder, and pushes higher-paying jobs up the economic ladder.

Fourth, education is key. Instead of eviscerating our schools, we should double-down on public education and add to that skilled trade education. Teachers should be among the best paid professionals in our society. (Right now, nursing schools cannot find professors because the private sector pays so much better than the nursing schools can manage.)

Fifth, we should develop trade alliances with the other democracies in the world, rather than force them into the arms of our economic enemies. China’s belt-and-road strategy was brilliant. We can duplicate that with agencies like USAID. The free nations of the world would much rather ally with us, but we’ve shut the door on them.

Sixth, our infrastructure – and particularly our energy grid – is in serious need of attention. This is a powerful investment, and would have the same multiplier effect as the development of the interstate highways in the 1950’s and 60’s.

Are you mad as hell? Yes, you ought to be. Particularly if you’re a soybean farmer, or a recent graduate looking for a job, or a contractor who can’t afford to buy lumber, an immigrant who just wants to put in an honest day’s labor, or a young person who wants to buy a house but can’t make the down payment.

A bit about tariffs.

We know, as a matter of empirical evidence, that chaotic tariff wars are horrendous for the economy. The research on that sailed a long time ago. So why do some countries still use them?

First, it’s helpful to understand an economic truism of the Law of Comparative Advantage. We teach a simplified version of this to undergraduates (at least the ones who pay attention) and Nobel Prizes have been won in its wake. Indeed, if you ever saw the movie “A Beautiful Mind” about the life of the great John Nash, you may be interested to know that while his Nobel was about game theory, it in fact was based on his observations about world trade.

It goes a bit like this. Let’s say there are two countries (in the classic example, we use Britain and Belgium). Let’s say Britain is wealthier than Belgium (which at the time, it was) and let’s also say that these two countries both make two things — Wine and Wool, in the classical example. Now Britain, being the wealthier and more advanced nation, is better and more efficient at both products than Belgium. This would suggest that Britain should make both products and simply ignore any trade with Belgium. Britain could do that by establishing huge trade barriers — tariffs — against Belgium, much like the U.S. is doing today against, well, everyone.

However, and here’s the rub — internally, Britain is better at wine than at wool. Make no mistake, it’s better at both than Belgium, but it make wine more efficiently and more cost effectively than it does wool. Belgium, on the other hand, is better at wool than at wine. Again, it’s less efficient than Britain at both, but internally, it’s better at wool than at wine.

The Law of Comparative Advantage has proven, time and time again, that Britain would be better off making nothing but wine, and Belgium at making nothing but wool, and the two countries trading freely with one another. Tariffs, in such cases, are not only bad for the poorer country (Belgium) but also for the richer one (Britain)!

Late last year, the conservative journal The Economist proclaimed that the U.S. economy was the ‘envy of the world.’ We had amazingly low unemployment, our inflation was coming down, our GDP had been growing constantly since the pandemic, and our stock market was on a tear. Yes, we had some internal inefficiencies, but these tended to be granular and needed to be addressed with a surgeon’s scalpel, not a sledgehammer. Yes, middle class incomes had not kept up with the cost of living over the past half century, but this was a matter of income inequality and not trade imbalance, and needed to be dealt with accordingly.

Over the years, America has made LOTS of things that other countries wanted. We export vast quantities of oil and natural gas. We export significant quantities of computers, vehicles, electrical machinery and equipment, aircraft, optical and medical apparatus, and pharmaceuticals. Vast swaths of America are devoted to growing exported agricultural products, such as soy beans and corn.

Further, and this may come as a shock to some, but one of the things other countries wanted was our dollar. They hoarded it. The rest of the world used it as a default currency, the one stable currency (along with, arguably, the Euro) which could be considered strong during chaotic times. It served the purpose that gold had served a hundred years ago. And yes, we produced it by the boat load (metaphorically speaking), and foreign countries had an insatiable appetite for it.

Poor nations use tariffs in order to protect and stabilize emerging businesses. In the previous example, if Belgium wanted to build up its own domestic wine industry, it would enact a tariff on imported British wine. In the short run, and in small doses, this may work. However, in the long run, it reduces British exports to Belgium, and thus the quantity of Belgian money they have to spend on Belgian wool. (The ‘what goes around comes around’ model of the economy.) Canada has an interesting tariff on imported milk products, which was agreed to during the current president’s prior administration. Indeed, he signed off on it as part of the replacement for NAFTA. Canada admits American milk products, but only up to a certain limit, and then above that taxes American milk heavily. Make no mistake, though, this Canadian tariff is a tax on Canadian consumers. Indeed, some emerging or mid-level economic countries prefer a mix of tariffs (which are like a sales tax on their own consumers) and income taxes to finance their governments. However, tariffs, being a sales tax, are highly regressive and depress the well-being of the middle class.

Rich nations, like the U.S., prefer to use income taxes (since there is so much income to tax, and it’s more efficient and less regressive) and let the middle class prosper without burdensome tariffs. Indeed, free trade benefits rich nations, like ours, more than it benefits poor nations. Nonetheless, the Law of Comparative Advantage tells us that both rich nations and poor ones are better off without burdensome and chaotic tariffs.

But, as the country song said, “not no mo’…” It takes a long time to craft a stable relationship with our trade allies. Like dropping a valuable vase on the floor, it only takes a moment to shatter it.

John A. Kilpatrick, Ph.D.

Some Thoughts on Housing Crisis

Last month, I had the very real pleasure of delivering a major, hour-long address at a conference in Charleston, South Carolina, on the nation’s housing crisis. In it, I discussed the overarching problem and some potential solutions, as well as some problematic ideas which are being bandied about. I’ll synopsize here today.

Right now, we have about 131.5 million households in America, a number which has been growing steadily almost without a break since WW-2. Right now, we ad about one and a quarter million households to that total each year. About two-thirds of us live in owner-occupied dwellings, a number which has remained constant for most of my lifetime.

Just focusing for a moment on the owner-occupied sector, median house prices have gone up about 317% since 1991. However, median household income has increased only about 167%. Over the past three decades, owner-occupied housing has only appeared to be affordable most of the time because (1) we had a sub-prime bubble with artificially easy money in the 1990’s, and then (2) we had very easy money – in fact, a liquidity flood — following the meltdown, and then (3) we have had extremely low interest rates until just a couple of years ago. Owner-occupied demand spiked during the recession, and as everyone knows, cheap money disappeared. Those of us with long memories recognized that today’s supposedly high interest rates were actually the norm a few decades ago. If the FED target of 2% inflation is achieved, it is still very hard to imagine mortgage interest rates coming down much below 5%.

In a reasonably efficient economy, home prices rising would stimulate homebuilders to flood the market with new product. However, a new home is the nexus of several different inputs – materials, skilled labor, land, and ‘soft costs’ (insurance, permits, mitigation fees, taxes, fees, etc.). Unfortunately, these inputs have all been problematic. Material, land, and soft costs have all risen rapidly, and skilled labor is in short supply. In many ways, builders are in worse shape than their customers.

In 2020, the Goldman Sachs housing affordability index stood at 135%, which meant that a median household had 135% of the income necessary to ‘afford’ payments on a typical 30-year conventional mortgage (with 20% down) on a median priced dwelling. Today that index stands at 70%. It is widely agreed that getting that index back up above 100% will be a herculean task.

By the way, what do we mean by ‘affordable’? In general, the total housing burden shouldn’t exceed 30% of a household’s take-home income. What do we mean by ‘housing burden’? For a homeowner, that includes payments on the mortgage (principal and interest), plus homeowner’s insurance and property taxes. Not only have mortgage interest rates soared in recent years, but also, we’ve seen insurance and property tax rates climb at above-inflation rates. While mortgage interest rates may come down in the near future, higher insurance and tax rates may be with us permanently. Indeed, there is every reason to believe that those will actually continue to significantly increase, particularly in hard-hit areas like California and Florida.

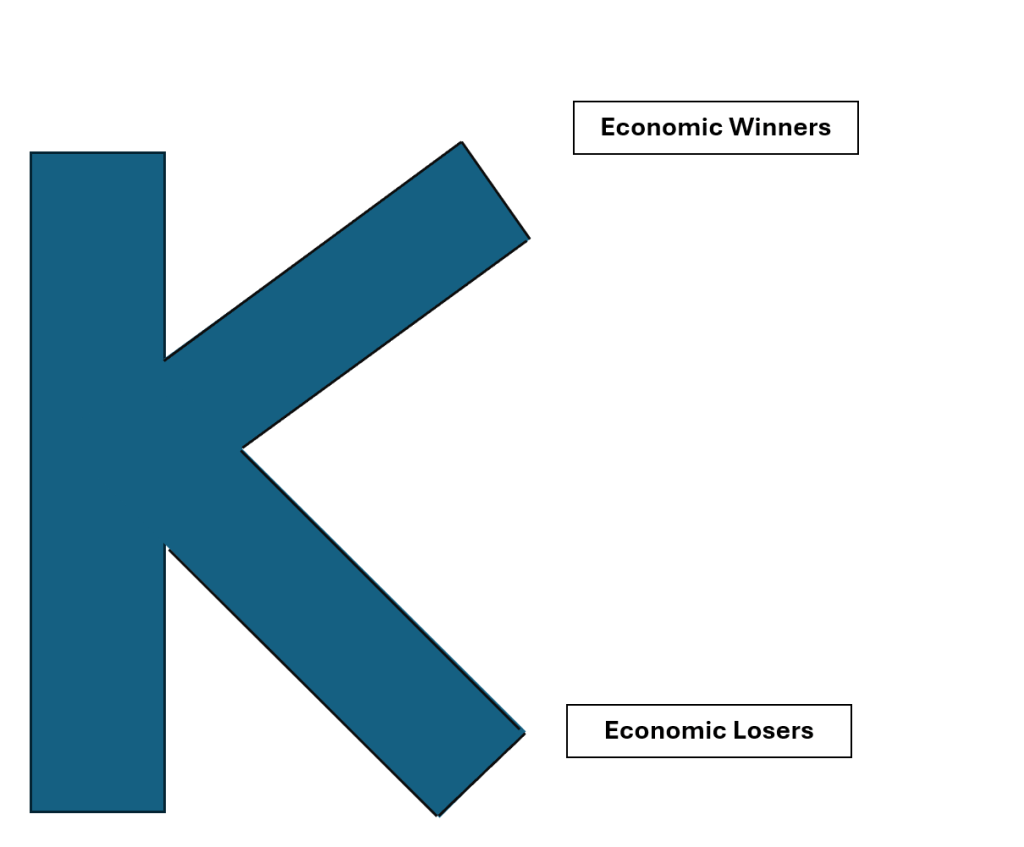

Amazingly, the rental community – about two-thirds of American households – have actually been hit worse. Note that as a general rule of thumb, renters come from the lower deciles of the income strata. Right now, the median household income in America sits at about $80,000 per year. However, the median income for the 40th percentile of Americans is only about $62,600. In other words – and this is a very rough approximation – about 40% of American households make less than about $62,200 per year. And remember, these households are more likely to be renters.

Right now, the median apartment rent in America is $1,595 per month. (The median rent on a single family detached dwelling is $2,000). Add to that about $300 per month for utilities and such, multiply by 12, divide by 30% (the threshold for ‘unburdened’ rent) and you get a household income of $75,800 per year to be considered ‘unburdened’ renting a median apartment in America. And remember, that’s a median, so fully half of the apartments in America are unaffordable for households making $75,800 per year.

Nobody in the bottom 40% of households makes that much money.

Indeed, an estimated 20 million households in America spend over 50% of their income on housing.

So how do we address these problems? We have two major sources of aid for low-income housing. First, the Low-Income Housing Tax Credit program provides indirect Federal support in the form of tax credits for developers of affordable housing. This program was created out of the 1986 Tax Reform Act, and until 2016 was responsible for building about 115,000 affordable units per year. However, since 2016, for a variety of reasons, the program has only helped finance about 75,000 units per year. As a result of this, in most of the country, we have fewer than 45 affordable and available units for every 100 low-income families, and in the hardest hit states, such as California, Florida, Virginia, and my home state of Washington, the number is under 30 units.

The other major source is the Section 8 voucher system. Funded by the Federal Government through the Department of Housing and Urban Development (HUD), but administered by local governments, this program provides full or partial rental vouchers for needy families earning less than 50% of local median income. However, the wait times for a voucher are awful (averaging 28 months nationwide) and only about one in four eligible households ever receive anything.

David Holt, the Republican Mayor of Oklahoma City, speaking on TV talk shows this weekend in his role with the national mayor’s association, noted widespread agreement among the country’s mayors that housing availability and affordability was their number one concern right now. So, what can we do to fix the problem.

Three ‘fixes’ come to mind immediately. First, a bipartisan group of both Senators and Congressional representatives have co-sponsored the Affordable Housing Credit Improvement Act (Senate bill 1557 and House Resolution 3238). This bill would fix some of the long-standing problems in the program and increase credits overall by 50%. However, the bill is currently stagnating in committee, and even though it has some powerful sponsors, it is simply not at the top of anyone’s agenda right now.

Second, some expansion of the Section 8 program is long overdue. However, the incoming administration is all in favor of massive belt-tightening. In the case of Section 8, this is woefully shortsighted, as the economic problems caused by unaffordable housing far outweigh the cost of this program. However, the attitudes on Capitol Hill are decidedly negative.

Finally, I would propose some significant overhaul in the HUD loan program (known back in my boyhood as ‘FHA Loans’). These loans provide Federal insurance – at no cost to the taxpayers – for homebuyers who meet stringent credit requirements. The loans carry extremely low down-payments – very close to zero. In the early 1980’s, when mortgage interest rates were soaring, many states were allowed to use tax exempt bonds to fund state housing finance programs which routed funds into HUD loans. This was a win-win for all concerned, and the economic stimulus of expanded housing construction far outweighed any lost revenue to the Federal coffers. However, the spread between tax-exempt and taxable bonds was somewhat greater back then, and so there was some meaningful leverage to be applied in lowering the mortgage interest rates, particularly for first-time buyers. That said, some kind of program like this, most likely using HUD leadership, would go a long way to breaking the logjam.

There are, unfortunately, some dumb ideas out there. First, a recent RAND study indicates that local governments, despite meaning well, have actually gotten in the way of affordable housing construction. The local restrictions are myriad, but as a result, the cost of building a new, affordable apartment in California, as an example, has risen to about $1 million per unit. This is utterly unsustainable.

Second, the incoming administration has posed the idea of building new homes on Federal land. Time and space will not permit me to list and discuss all of the reasons why this is a bad idea. As examples, however, it constitutes an intolerable wealth-transfer from existing homeowners to new homeowners, it runs afoul of the Federal mandate that any transfer of Federally owned land be at market value, and let’s face it, there is little available Federal land in any of the places where people actually want to live.

Finally, the incoming Administration has made it a priority to re-privatize Fannie Mae and Freddie Mac. These private sector groups, with the implicit guarantee of the full faith and credit of the US Treasury, are the primary secondary market makers for mortgage loans. During the housing meltdown, they were in effect ‘taken over’ by the U.S. Treasury, under the auspices of the Federal Housing Finance Authority, and now all of their considerable profits flow into the U.S. coffers. Both political parties have agreed that reprivatization is a goal, albeit for different reasons. However, the devil is in the details here, and a slap-dash reprivatization of organizations with combined balance sheets exceeding $4 TRILLION, would, in some estimation, add considerable burden to the current mortgage interest rates.

In the end, though, the real crisis is less about housing and more about affordability. In the owner-occupied sector, for example, house prices have been going up, on average about 2% above inflation year-after-year since WW-2. That’s really not a bad thing. It means that home ownership is a really good investment and a nearly perfect hedge against inflation. Even during the housing crisis following 2006-ish, while house prices dipped, they soon reverted to the mean, and today house prices are about where they would have been had the housing crisis never occurred. Over the same post-world war period, household incomes generally also trended upward, more or less, until the 1970’s. However, since then household income has simply failed to keep up with the cost of housing. In short, this current crisis has less to do with the cost of housing and more to do with the stagnating fortunes of middle-class Americans.

As always, if you have any comments or questions on this or any other real estate related topic, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI

RAND Study on the Housing Crisis

The RAND Institute, headquartered in Santa Monica, is (in my humble opinion) one of the top-tier sources for research on public policy issues. Founded in 1948 as a partnership between Douglas Aircraft and the Air Force, its founding members included Curtis LeMay and Hap Arnold. The affiliated Pardee Rand graduate school offers a well-regarded Ph.D. in public policy.

Two of the faculty members, economist Jason Ward and Sarah Hunter, a behavioral scientist, recently shared some of their research on the subject. First, they note that interest rates alone have driven up the monthly payment on typical home by as much as 40% over the past 3 years. I would note that this doesn’t factor in the increased cost of the home itself, increasing property taxes and insurance, and increasing costs such as utilities. The Harris campaign has proposed a $25,000 tax credit for first time buyers to assist with down payments. However, a similar pilot-project in California did not fare well and has been linked to driving up the cost of housing in some areas.

Conversely, rent costs have actually moderated a bit very recently, but only because rent growth was so high during and immediately after the pandemic. That said, the RAND researchers noted that a record number of renters are experiencing housing cost burden, that is, a total housing cost above 30% of gross income. Government incentives for renters are a mixed bag. The Low-Income Housing Tax Credit program provides about $13.5 Billion per year for developers of income restricted, subsidized housing. This program produces about 100,000 housing units per year. However, land use and zoning regulations — a local function — have actually been counterproductive in recent years, with restrictions on multi-family locations, density, energy efficiency, and parking requirements all driving up the cost of solving the housing problem. In much of California, for example, local regulations have driven up the cost of producing an efficiency apartment to nearly $1 million.

The current administration has provided $3.16 Billion to address homelessness, providing funding for over 7,000 local projects to provide housing assistance or support services. Some local governments are also stepping up to the plate. For example, Los Angeles passed a one-quarter cent sales tax in 2017 to fund about $355 million per year for homeless prevention services. This year, they have another measure on the ballot which would provide a $1.2 Billion bond measure to build supportive housing. Houston, Texas, is held up as a model for addressing homelessness with a housing-first approach. As a result, the Houston region has reduced homelessness by 63% over the past 10 years, with an emphasis on coordination across agencies.

Their research continues, and I’m reaching out to Professors Ward and Hunter in the coming weeks as I prepare for a talk I’m giving on this subject in late December. I’ll continue reviewing some of the issues and current research on the complex housing crisis we face in America, with an eye toward finding some consensus on steps forward to solve these issues and share my findings with you as I go along. As always, if you have any comments or questions on this or any other real estate related topic, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI

Where will YOU sleep tonight?

Over the past few years, I’ve focused this blog on Real Estate Investment Trusts. While I’m NOT backing away from investments in that arena (I still own ACCRE, which is a small REIT fund-of-funds), I am presently focusing more of my attention on housing. Where most of us sleep at night comes in several different varieties – single family detached homes, owner-occupied condominiums and other attached housing, rental homes and condos, and of course rental apartments.

According to the most recent statistics I have, there were about 145.3 million ‘housing units’ in America as of July 1, 2023, or about 1 for every 2.3 people. Of the occupied units, about 65.8% are ‘owner occupied’ (both single-family and attached), while the remainder are some sort of rental units, such as single family rental houses or apartments. Over the past couple of years, we’ve seen an increase in housing units of about 1% per year, more or less. That’s about two to three times the rate of growth in the population, so… sounds like everything’s OK, right?

Yet, there is enormous angst about housing availability and affordability in all corners. At the low end of the economic spectrum, about 1.25 million people experienced homelessness a some point in 2020, the last year for which HUD has published data (according to the US Government’s Interagency Council on Homelessness). As we move up the economic ladder, the working poor, when they can find housing, are forced to pay increasingly large portions of their budget for shelter, thus crowding out food, health care, and other necessities of life. Even the so-called ‘middle class’, if you can still call it that, find homeownership prohibitive.

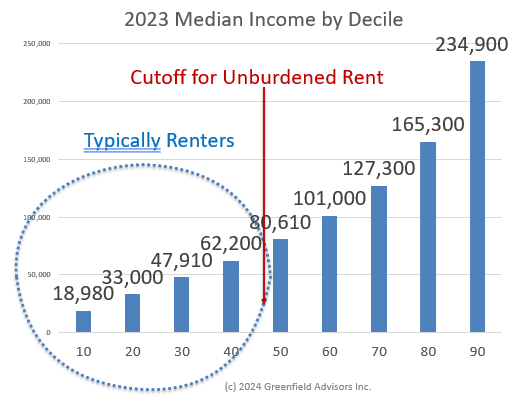

Most pundits (and I’m citing CNBC here) tell us that as a general rule, the total cost of housing (rent or mortgage payment plus utilities) should be no more than 30% of the household’s budget. Ironically, renters, who are often the ones who cannot afford home ownership, seem to have it worse. As of the 2021 American Housing Survey, over 50% of renters report paying over that 30% threshold. When broken down by income level, about 64% of households earning less than $50,000 per year report paying over the 30% benchmark. According to Harvard’s Joint Center for Housing Studies, rent has increased over 20% since 2001 even after accounting for inflation, while median household income is virtually unchanged.

For those trying to join the ranks of homeownership, the story is even worse. Taking the longer view, in 1985, the median household income in America was $22,400, and the median home price was $78,200, for a ratio of 3.5. Even back then, steep interest rates consumed nearly half of a typical household income in mortgage payments. Today, in America, with lower interest rates fueling a housing demand, the median sales price of a dwelling is $433,100, and the median household income is $74,600, resulting in a ratio of 5.8.

Wells Fargo and the National Association of Homebuilders conduct an annual survey of homebuilder sentiment, which is a weighted average of current housing starts, anticipated starts over the next 6 months, and ‘buyer traffic’, which is essentially a measure of buyer interest in new homes. As of October, 2024, the index stood at 43, which for the sake of comparison, is about where it stood in the middle of the 2008-10 housing crash. Not surprisingly, housing starts right now are only 992,000 per year, about where it stood 40 years ago.

Many buyers and apartment developers blame interest rates, but that’s only part of the story. Costs have skyrocketed all across the nation, not just ‘hard costs’ (sticks, bricks, and labor) but also ‘soft costs’ such as regulatory burdens, permitting fees, and marketing costs. In the ‘hottest’ areas – the places where people want to live – the cost of land has also become burdensome. Forty years ago, merchant builders considered land should cost between 30% and 40% of the selling price of a single family dwelling. Today, in the top markets, that number can exceed 50% or more.

Over the course of the next few weeks and months, I’m going to explore some of these issues in more detail. As always, if you have any specific questions or comments, please let me know.

John A. Kilpatrick, Ph.D., MAI

Are you rich yet?

What a terrible thing to ask, and yet Kiplinger’s tells us that the top 1% of Americans (about 1.3 million households) have a minimum household net worth of about $6 million. Those households control about 23% of all wealth in America. Another block of about 1.3 million households — those between the top 2% and the top 1% — have a minimum household wealth of about $2.5 million, more or less. Of course, these numbers are highly inexact, because… well… I’ll get to that.

By some estimates, real estate makes up as much as 50% of the total net worth for the top 2% of Americans. Again, this is hard to estimate, since typical households don’t have their real estate re-appraised on a daily basis. However, some real estate sectors have done very well, particularly residences, real estate supporting private businesses, and some industrial properties. Before the pandemic, I generally used the VERY heuristic rule of thumb that the super-wealthy (lets say, half a billion net worth and above) had about 25% of their net worth in real estate of some kind or another.

If you’re Jeff Bezos or Warren Buffett or such, you have people who look at this stuff regularly. However, of you’re in one of those 1.3 million households who have a net worth between, say, $2.5 million and $6 million, you probably don’t give it much thought. But maybe you should. I wrote about this in my most recent book, Valuation and Strategy. Here are just a few points, in no particular order:

- Have you considered intergenerational transfers? How exactly will your estate be divided? Is there a way to structure it in an advantageous fashion, considering the often onerous costs of selling property out of an estate?

- Do you own real estate supporting a family business? Is it coupled with the business itself, or is it a separate entity? Do your children or other family members want to continue the business, and do all of them want to participate? Perhaps there are ways to separate the business from the real estate in order to equitably prepare your family members for the inevitable.

- Is any of your real estate financed? What does that look like now? As I write this, interest rates are trending downward after a couple of years at uncomfortable levels. Does this change anything?

- How has your investment real estate changed in value relative to your non-realty investments? Are your asset allocations where you want them to be? Are you comfortable with the risks moving forward?

I would note that the average registered investment advisor is pretty good at not losing you money in the stock market, but ill-prepared to advise on the nuances of real estate investing. That said, most real estate brokers are ill-equipped to advise on wealth management issues. There are people out there who can help you, and with the economy in some flux, now would be a good time to take a long hard look at your real estate holdings.

As always, if you have any questions about this, please don’t hesitate to reach out!

John A. Kilpatrick, Ph.D., MAI

REIT Report — Data Centers

After some work-related delays (it’s been a VERY busy winter!) I’m back with my regular series on publicly traded REITs. Today, I’m looking at the small but exciting niche of data center REITs. There are three in the NAREIT universe, although one is presently not trading. The continued growth in the tech field has led to real opportunities here, but expansion, particularly driven by AI, has often been with debt, which has come with a high cost in recent years. Further, REITs in this sector are faced with energy consumption challenges and customer churn as this market matures.

Digital Realty Trust (DLR) owns, operates and invests in carrier-neutral data centers across the world. As of June 2023, Digital Realty has 300+ facilities totaling about 52.3 million rentable square feet in 50+ metros across 25+ countries on six continents, with its largest presence in Northern Virginia (17.3% of total annualize rents), Dallas, Chicago, New York State, Silicon Valley, and London. As of December 31, they had another 8.5 million square feet under development and 4.1 million square feet held for development. Earnings per share for 2023 was $3.01, compared with $1.12 for 2022 and $5.84 for 2021. FFO per share for the same periods were $6.20, $6.03, and $6.36, respectively. Their one-year return as of March 22 was 46.15%, but 5-year returns, while positive, were been anemic due to a slump in 2022-23 driven in no small part by negative analyst reports that the stock offered a poor risk/reward bet. As of the end of 2023, debt made up about 52% of their capital stack.

Equinix (EQIX) specializes in internet connection and multi-tenant data centers. The company has 260 data centers in 33 countries on five continents, although about 44% of 2023 revenues came from the Americas. Earnings per share for 2023 was $10.31, compared with $7.67 in 2022 and $5.53 in 2021. FFO per share. FFO from 2022 to 2023 increased by 11.2%. As of the end of 2023, debt made up about 61% of their capital stack. The one-year stock price return, as of March 22, was 15.3%, and the 5-year return was 74.96%.

Cyxtera Technologies (CYTX) has a footprint of 60 data centers in 30 markets serving over 2,300 enterprise and government customers. CYTX is presently not traded, and the company filed for bankruptcy protection in June, 2021, two years after going public. The company’s liquidity crisis was reportedly driven by rising interest rates, an inability to sell or refinance the company, customer churn, and rising utility costs. As of most recent reporting (second half of 2023), the creditors have agreed to a recapitalization and restructuring of the company’s balance sheet, eliminating about $950 million in debt. Revenue is reportedly rising, up over 9% year-over-year, and EBITDA is positive.

As always, I’m not an investment advisor, and this is not a solicitation or recommendation to invest in anything. Further, I and the entities I’m involved with may have positions or interests in one or more of the securities discussed here. However, if you have any questions about this, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI

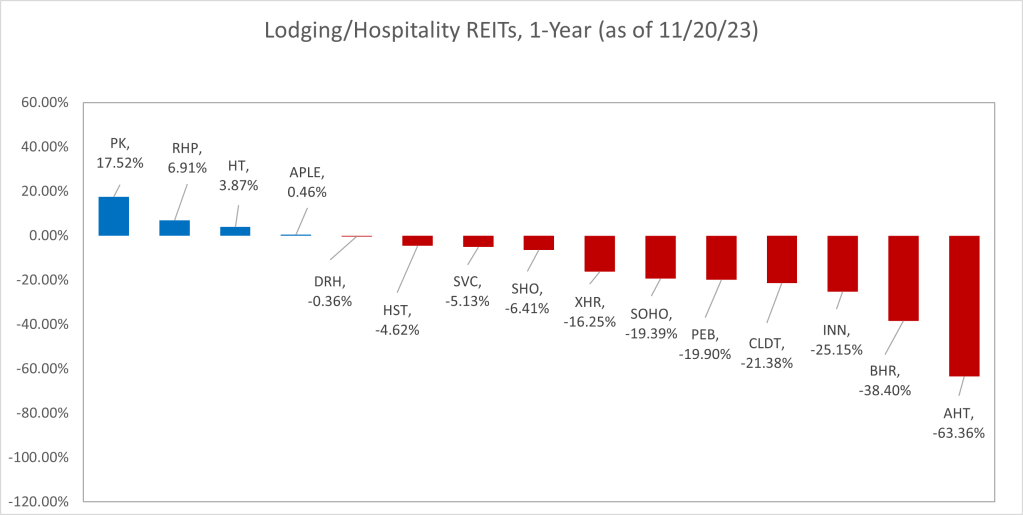

REIT Report — Lodging Sector

Overall, the lodging sector was probably hit the worst by the pandemic meltdown. While some of the REITs in this sector have managed to recover, others continue to be plagued, particularly by high interest rates and shifting market patterns.

Park Hotels & Resorts (PK) stock has enjoyed a one-year return of 17.52%. Like most hospitality and other REITs with huge retail exposure, they suffered during the pandemic, losing nearly 72% of their stock value in about a month between February 21 and March 20, 2020. Also, like many (but not all) of these REITs, they clawed their way back over the ensuing 12 months. However, PK has languished since then, with a 5-year return of negative 52.68%. PK was a 2017 spin-out of Hilton, and as of the end of the 3rd quarter, they own 43 properties, including 12 resorts, 13 city-center hotels, 5 convention center hotels, and 13 strategic airport and “other” properties. Notably, they also own the Hilton San Francisco Union Square and the Parc 55 Hotel, also in San Fransisco, both of which are presently in receivership. EPS for the third quarter was $0.13, compared to $0.15 in the same quarter in 2022. Third quarter adjusted FFO was $0.5 per share, compared to $0.42 per share for the same quarter in 2022. Debt makes up 60% of their capital stack.

Ryman Hospitality (RHP) is up 6.91% over the past 12 months, and up 27.33% over the five year term, including the beating it took during the pandemic. Ryman owns hotel, resort, entertainment, and media properties, and is headquartered in Nashville, TN, where their signature properties include the Grand Ole Opry and Ryman Auditorium. Their entertainment segment is operated as a taxable REIT subsidiary. For the quarter ending September 30, they reported EPS of $0.64, compared to $0.79 for the same quarter last year. FFO, while not reported on a per-share basis, increased by about 1%$ from the 3rd quarter, 2022, to the 3rd quarter of this year.

Hersha Hospitality Trust (HT) had a one-year return of 3.87%, but this is somewhat misleading. The stock bounded about 60% in one day back in August when it was announced they were going private and would be acquired by KSL Capital Partners. The stock is still traded, however, but has moved very little since that announcement. The deal is supposed to close before the end of this year. Hersha owns 25 hotels with 3,811 rooms in New York, DC, Boston, Philadelphia, Miam, Key West, and California.

Apple Hospitality (APLE) owns 223 hotels totaling about 29,400 rooms in 87 markets across 37 states. The hotels are all branded by either Marriott (99), Hilton (119), or Hyatt (5), almost all in the limited service category, which is sensitive to business travel. EPS for the third quarter was $0.26, the same as the corresponding quarter last year, and FFO was up about 1% over the same period. APLE is up 0.46% over the past year, and up 5.67% over the 5-year period.

DiamondRock Hospitality (DRH) owns 36 premium hotels with 9,700 rooms, aimed at “lifestyle” brands and leisure-focused destination markets (Sedona, Lake Tahoe, Key West, Charleston, etc.). EPS was $0.12 for the 3rd quarter, the same as last year, although FFO was down about 10%. DRH stock is down 0.36% over the past 12 months. DRH went public in August, 2020, after the pandemic meltdown, and is up 1.66% since then.

Host Hotels (HST) purports to be the largest US lodging REIT, with 77 properties totaling 42,000 rooms. They also own non-controlling interests in eight joint ventures. Hotels are generally partnered with up-scale brands, such as Ritz Carleton, St. Regis, and Four Seasons. EPS for the 3rd quarter was $0.16, the same as the corresponding quarter last year. FFO per share was $0.41, compared to $0.38. HST shares are down 4.62% over the past twelve months, and down 8.48% over the past five years.

Service Properties Trust (SVC) owns 221 hotels in 46 states plus DC, Puerto Rico, and Canada, mostly in the extended stay niche operated by Sonesta. (Conversely, SVC owns 34% of Sonesta.) They also own 750 service-focused net lease retail properties totaling 13 million square feet, diversified by tenant, industry, and geography. EPS for the 3rd quarter was negative $0.03, down from positive $0.05 the same quarter last year. The principal difference appeared to be a sharp increase in interest expenses. Notably, debt makes up about 83% of their capital stack. SVC’s stock is down 5.13% over the past 12 months, and down 72.38% over the past five years. Unlike many of the other hospitality REITs, SVC never rebounded after the pandemic downfall.

Sunstone Hotels (SHO) owns 14 hotels totaling 6,675 rooms, generally flagged with well-recognized brands. EPS for the 3rd quarter was $0.23, compared to $0.24 the same quarter last year, and FFO was also $0.23, but they currently expect a downturn in FFO in the 4th quarter to somewhere in the $0.14 to $0.17 range. SHO’s stock is down 6.41% over the past 12 months, and down 34.58% over the 5-year period. The stock rebounded after the pandemic, but has languished since then.

Xenia Hotels & Resorts (XHR) owns 32 hotels, mostly in the sunbelt, with 9,511 rooms. EPS for the 3rd quarter was negative $0.08, compared with a negative $0.01 the same quarter last year. The change was apparently due to a decline in room revenues. Debt makes up about 54% of their capital stack, but there was little change in interest expenses from 2022 to 2023. FFO for that same period is down about 19%. The stock is down 16.25% over the past 12 months, and down 36.28% over the preceding 5 years.

Sotherly Hotels (SOHO) focuses on acquiring, renovating, and up-branding up-scale hotels in the southern U.S. They own all or part of 10 hotels with 2,786 rooms and two commercial condominium properties. EPS for the 3rd quarter was negative 0.20, compared with essentially zero the same quarter last year. The change was largely due to a large increase in interest expenses. Notably, debt makes up about 87% of their capital stack. However, FFO per share for the 3rd quarter was zero, compared with positive $0.12 the same quarter last year. SOHO’s stock is down 19.39% for the past 12 months, and they also did not recover after the pandemic melt-down, resulting in a stock decline of 76.13% over the past 5 years. As of this morning, their stock is trading at under $2 per share.

Pebblebrook Hotel Trust (PEB) aims at upscale hotels in gateway cities. They own 47 properties totaling 12,142 rooms. EPS for the 3rd quarter was negative $0.57, compared to $0.10 the same quarter last year. A number of problems appear on their income statement for the 3rd quarter, including a slight decline in room revenues, an increase in business interruption insurance, a recognition of impairment on some properties, and an increase in interest expenses. FFO, while positive, was down about 16% over the same period. The stock is down 19.9% over the past 12 months, and down 64.23% over the past 5 years.

Chatham Lodging Trust (CLDT) owns 39 hotels with 5,915 rooms as well as four restaurants in California, Texas, and Georgia. EPS for the 3rd quarter was $0.11, down from $0.21 the same quarter 2022. FFO for the same period was down about 20%. Chatham stock is down 21.38% for the past 12 months, and down 47.99% over the past 5 years.

Summit Hotel Properties (INN) owns either all or part of 101 properties in 24 states totaling 15,035 rooms, aimed at the “upscale” segment. EPS was negative $0.05 for the 3rd quarter, down from essentially zero the same quarter last year. The principal reason for the loss was an increase of about 25% in interest expenses. FFO for the same period was $0.22, compared with $0.25. Summit’s stock is down 25.15% over the past year, and down 41.02% over the past 5 years.

Braemar Hotels & Resorts (BHR) owns all or part of 16 hotel properties in 7 states, DC, Puerto Rico, and the Virgin Islands with a total of 4,192 rooms. They focus on high REVpar luxury hotels and resorts. However, about 62% of their capital stack is in debt, and as a result interest expenses nearly doubled. As such, EPS per share in the 3rd quarter was negative $0.50, compared with negative $0.24 the same quarter last year. Additionally, FFO was negative in the 3rd quarter. BHR’s stock is down 38.4% over the past 12 months. While the stock rebounded a bit after the pandemic, it continued to languish, and is now down 76.77% over the past 5 years. As of this morning, the stock was trading slightly above $2 per share.

Ashford Hospitality Trust (AHT) focuses on upscale full-service hotels. They own 100 properties with 22,316 rooms, generally branded by Marriott, Hilton, Hyatt, and Intercontinental. Their debt/asset ratio is about 105.7%, and thus they have a negative book value. EPS for the 3rd quarter was negative $1.99, compared to a negative $0.73 the same quarter last year. While room revenues were slightly up, interest expenses were up about 62%. FFO for the 3rd quarter, while positive, was down about 84% over the same quarter last year. As such, the stock is down 63.36% over the past year, and down 99.5% over the 5-year period, trading at just over $2 per share this morning.

As always, I’m not an investment advisor, and this is not a solicitation or recommendation to invest in anything. Further, I and the entities I’m involved with may have positions or interests in one or more of the securities discussed here. However, if you have any questions about this, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI

REIT Report — What do the fundamentals say?

Last week, I purposely looked at one of the smallest REIT sectors, Gaming/Leisure, with only two publicly traded REITS (VICI and GLPI) so that this week we could explore some simple tools for fundamental analysis.

VICI, as you recall, is a highly diversified gaming/leisure company with properties in various subsectors all across the US. The stock has trended downward this year and was trading today at $29.17. GLPI is a more focused gaming company that closed today at $46.38. Nonetheless, analysts generally have a favorable view of these two REITs, which begs the question: why?

To address this, I’m going to look at three different fundamental analysis methods useful for studying REITs: the AFFO multiple, the Dividend Discount Model, and the Net Asset Value. AFFO stands for “adjusted funds from operations” and basically measures the cash flow from the business operations, exclusive of cash that may come in from borrowing, asset sales, etc. AFFO gives a good measure of cash available for dividends and/or operational growth. For a given REIT, the price typically trends around a multiple of annual AFFO.

Pure dividend plays (preferred stocks, for example, and low-growth dividend stocks like utilities) can be analyzed as a discounted present value of the future dividends. If those dividends are expected to grow in perpetuity, then this growth can be factored into the equation.

In the above, P is the intrinsic price, D1 is next year’s dividend, r is the expected return on equity capital, and g is the expected perpetuity growth rate.

Finally, every REIT (and any derivative instrument, such as a mutual fund) has a determinable net asset value. For REITs this is simply the expected net operating income capitalized by the expected cap rate, minus any debt. I’ve run these models for the most recent years data, and arrived at the following:

| Price (11/14/23) | AFFO Model | Dividend Model | NAV Model | Overall Value | |

| VICI | $29.17 | $28.75 | $27.44 | $31.17 | $29.12 |

| GLPI | $46.38 | $45.71 | $44.53 | $73.73 | $54.52 |

As you can see, these two REITs are currently trading very close to their estimated intrinsic value, which suggests the markets are working fairly efficiently. What does this say about investment opportunities? I would note that most value investors look for some cushion below the intrinsic value for a buying opportunity — perhaps even a 25% to 40% discount off intrinsic value. Of course, your investment objectives may differ. I would also note that all three of these models depend on a host of assumptions about market discount rates, growth rates, and cap rates, so different intrinsic value models may produce significantly different results.

Thanks to Eli Breece of Dividenology who developed this really great REIT analysis tool. I’ll return to this again in the not too distant future.

As always, I’m not an investment advisor, and this is not a solicitation or recommendation to invest in anything. Further, I and the entities I’m involved with may have positions or interests in one or more of the securities discussed here. However, if you have any questions about this, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI