Posts Tagged ‘housing’

Some Thoughts on Housing Crisis

Last month, I had the very real pleasure of delivering a major, hour-long address at a conference in Charleston, South Carolina, on the nation’s housing crisis. In it, I discussed the overarching problem and some potential solutions, as well as some problematic ideas which are being bandied about. I’ll synopsize here today.

Right now, we have about 131.5 million households in America, a number which has been growing steadily almost without a break since WW-2. Right now, we ad about one and a quarter million households to that total each year. About two-thirds of us live in owner-occupied dwellings, a number which has remained constant for most of my lifetime.

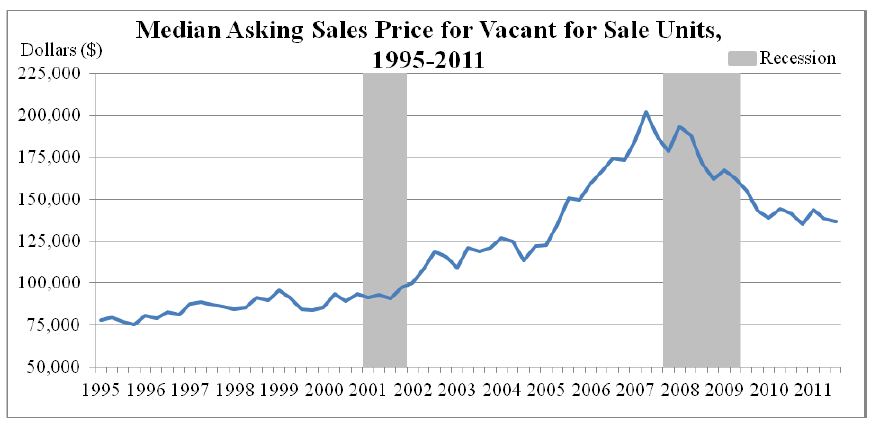

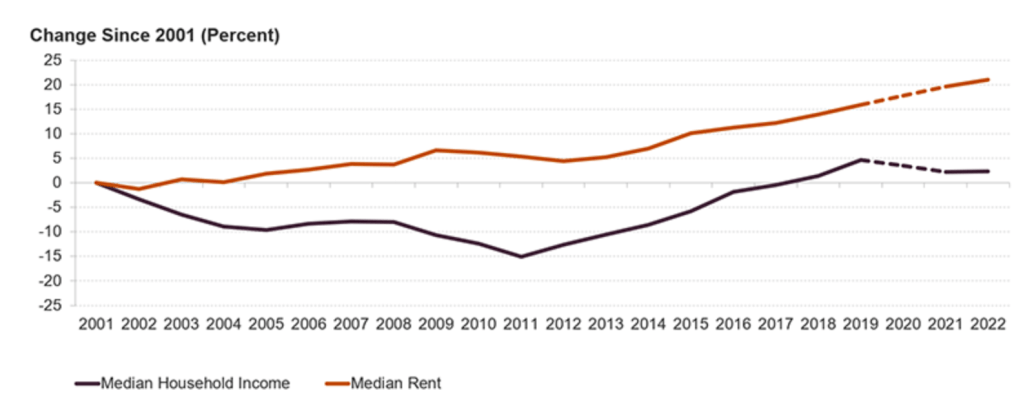

Just focusing for a moment on the owner-occupied sector, median house prices have gone up about 317% since 1991. However, median household income has increased only about 167%. Over the past three decades, owner-occupied housing has only appeared to be affordable most of the time because (1) we had a sub-prime bubble with artificially easy money in the 1990’s, and then (2) we had very easy money – in fact, a liquidity flood — following the meltdown, and then (3) we have had extremely low interest rates until just a couple of years ago. Owner-occupied demand spiked during the recession, and as everyone knows, cheap money disappeared. Those of us with long memories recognized that today’s supposedly high interest rates were actually the norm a few decades ago. If the FED target of 2% inflation is achieved, it is still very hard to imagine mortgage interest rates coming down much below 5%.

In a reasonably efficient economy, home prices rising would stimulate homebuilders to flood the market with new product. However, a new home is the nexus of several different inputs – materials, skilled labor, land, and ‘soft costs’ (insurance, permits, mitigation fees, taxes, fees, etc.). Unfortunately, these inputs have all been problematic. Material, land, and soft costs have all risen rapidly, and skilled labor is in short supply. In many ways, builders are in worse shape than their customers.

In 2020, the Goldman Sachs housing affordability index stood at 135%, which meant that a median household had 135% of the income necessary to ‘afford’ payments on a typical 30-year conventional mortgage (with 20% down) on a median priced dwelling. Today that index stands at 70%. It is widely agreed that getting that index back up above 100% will be a herculean task.

By the way, what do we mean by ‘affordable’? In general, the total housing burden shouldn’t exceed 30% of a household’s take-home income. What do we mean by ‘housing burden’? For a homeowner, that includes payments on the mortgage (principal and interest), plus homeowner’s insurance and property taxes. Not only have mortgage interest rates soared in recent years, but also, we’ve seen insurance and property tax rates climb at above-inflation rates. While mortgage interest rates may come down in the near future, higher insurance and tax rates may be with us permanently. Indeed, there is every reason to believe that those will actually continue to significantly increase, particularly in hard-hit areas like California and Florida.

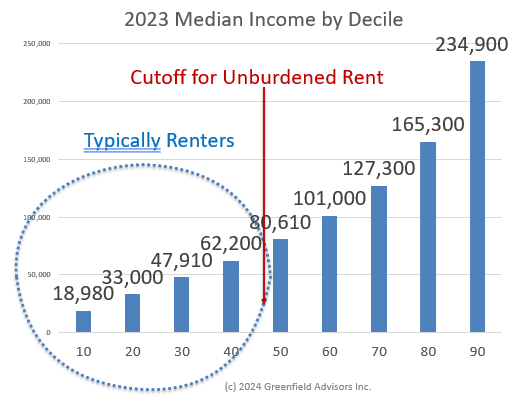

Amazingly, the rental community – about two-thirds of American households – have actually been hit worse. Note that as a general rule of thumb, renters come from the lower deciles of the income strata. Right now, the median household income in America sits at about $80,000 per year. However, the median income for the 40th percentile of Americans is only about $62,600. In other words – and this is a very rough approximation – about 40% of American households make less than about $62,200 per year. And remember, these households are more likely to be renters.

Right now, the median apartment rent in America is $1,595 per month. (The median rent on a single family detached dwelling is $2,000). Add to that about $300 per month for utilities and such, multiply by 12, divide by 30% (the threshold for ‘unburdened’ rent) and you get a household income of $75,800 per year to be considered ‘unburdened’ renting a median apartment in America. And remember, that’s a median, so fully half of the apartments in America are unaffordable for households making $75,800 per year.

Nobody in the bottom 40% of households makes that much money.

Indeed, an estimated 20 million households in America spend over 50% of their income on housing.

So how do we address these problems? We have two major sources of aid for low-income housing. First, the Low-Income Housing Tax Credit program provides indirect Federal support in the form of tax credits for developers of affordable housing. This program was created out of the 1986 Tax Reform Act, and until 2016 was responsible for building about 115,000 affordable units per year. However, since 2016, for a variety of reasons, the program has only helped finance about 75,000 units per year. As a result of this, in most of the country, we have fewer than 45 affordable and available units for every 100 low-income families, and in the hardest hit states, such as California, Florida, Virginia, and my home state of Washington, the number is under 30 units.

The other major source is the Section 8 voucher system. Funded by the Federal Government through the Department of Housing and Urban Development (HUD), but administered by local governments, this program provides full or partial rental vouchers for needy families earning less than 50% of local median income. However, the wait times for a voucher are awful (averaging 28 months nationwide) and only about one in four eligible households ever receive anything.

David Holt, the Republican Mayor of Oklahoma City, speaking on TV talk shows this weekend in his role with the national mayor’s association, noted widespread agreement among the country’s mayors that housing availability and affordability was their number one concern right now. So, what can we do to fix the problem.

Three ‘fixes’ come to mind immediately. First, a bipartisan group of both Senators and Congressional representatives have co-sponsored the Affordable Housing Credit Improvement Act (Senate bill 1557 and House Resolution 3238). This bill would fix some of the long-standing problems in the program and increase credits overall by 50%. However, the bill is currently stagnating in committee, and even though it has some powerful sponsors, it is simply not at the top of anyone’s agenda right now.

Second, some expansion of the Section 8 program is long overdue. However, the incoming administration is all in favor of massive belt-tightening. In the case of Section 8, this is woefully shortsighted, as the economic problems caused by unaffordable housing far outweigh the cost of this program. However, the attitudes on Capitol Hill are decidedly negative.

Finally, I would propose some significant overhaul in the HUD loan program (known back in my boyhood as ‘FHA Loans’). These loans provide Federal insurance – at no cost to the taxpayers – for homebuyers who meet stringent credit requirements. The loans carry extremely low down-payments – very close to zero. In the early 1980’s, when mortgage interest rates were soaring, many states were allowed to use tax exempt bonds to fund state housing finance programs which routed funds into HUD loans. This was a win-win for all concerned, and the economic stimulus of expanded housing construction far outweighed any lost revenue to the Federal coffers. However, the spread between tax-exempt and taxable bonds was somewhat greater back then, and so there was some meaningful leverage to be applied in lowering the mortgage interest rates, particularly for first-time buyers. That said, some kind of program like this, most likely using HUD leadership, would go a long way to breaking the logjam.

There are, unfortunately, some dumb ideas out there. First, a recent RAND study indicates that local governments, despite meaning well, have actually gotten in the way of affordable housing construction. The local restrictions are myriad, but as a result, the cost of building a new, affordable apartment in California, as an example, has risen to about $1 million per unit. This is utterly unsustainable.

Second, the incoming administration has posed the idea of building new homes on Federal land. Time and space will not permit me to list and discuss all of the reasons why this is a bad idea. As examples, however, it constitutes an intolerable wealth-transfer from existing homeowners to new homeowners, it runs afoul of the Federal mandate that any transfer of Federally owned land be at market value, and let’s face it, there is little available Federal land in any of the places where people actually want to live.

Finally, the incoming Administration has made it a priority to re-privatize Fannie Mae and Freddie Mac. These private sector groups, with the implicit guarantee of the full faith and credit of the US Treasury, are the primary secondary market makers for mortgage loans. During the housing meltdown, they were in effect ‘taken over’ by the U.S. Treasury, under the auspices of the Federal Housing Finance Authority, and now all of their considerable profits flow into the U.S. coffers. Both political parties have agreed that reprivatization is a goal, albeit for different reasons. However, the devil is in the details here, and a slap-dash reprivatization of organizations with combined balance sheets exceeding $4 TRILLION, would, in some estimation, add considerable burden to the current mortgage interest rates.

In the end, though, the real crisis is less about housing and more about affordability. In the owner-occupied sector, for example, house prices have been going up, on average about 2% above inflation year-after-year since WW-2. That’s really not a bad thing. It means that home ownership is a really good investment and a nearly perfect hedge against inflation. Even during the housing crisis following 2006-ish, while house prices dipped, they soon reverted to the mean, and today house prices are about where they would have been had the housing crisis never occurred. Over the same post-world war period, household incomes generally also trended upward, more or less, until the 1970’s. However, since then household income has simply failed to keep up with the cost of housing. In short, this current crisis has less to do with the cost of housing and more to do with the stagnating fortunes of middle-class Americans.

As always, if you have any comments or questions on this or any other real estate related topic, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI

RAND Study on the Housing Crisis

The RAND Institute, headquartered in Santa Monica, is (in my humble opinion) one of the top-tier sources for research on public policy issues. Founded in 1948 as a partnership between Douglas Aircraft and the Air Force, its founding members included Curtis LeMay and Hap Arnold. The affiliated Pardee Rand graduate school offers a well-regarded Ph.D. in public policy.

Two of the faculty members, economist Jason Ward and Sarah Hunter, a behavioral scientist, recently shared some of their research on the subject. First, they note that interest rates alone have driven up the monthly payment on typical home by as much as 40% over the past 3 years. I would note that this doesn’t factor in the increased cost of the home itself, increasing property taxes and insurance, and increasing costs such as utilities. The Harris campaign has proposed a $25,000 tax credit for first time buyers to assist with down payments. However, a similar pilot-project in California did not fare well and has been linked to driving up the cost of housing in some areas.

Conversely, rent costs have actually moderated a bit very recently, but only because rent growth was so high during and immediately after the pandemic. That said, the RAND researchers noted that a record number of renters are experiencing housing cost burden, that is, a total housing cost above 30% of gross income. Government incentives for renters are a mixed bag. The Low-Income Housing Tax Credit program provides about $13.5 Billion per year for developers of income restricted, subsidized housing. This program produces about 100,000 housing units per year. However, land use and zoning regulations — a local function — have actually been counterproductive in recent years, with restrictions on multi-family locations, density, energy efficiency, and parking requirements all driving up the cost of solving the housing problem. In much of California, for example, local regulations have driven up the cost of producing an efficiency apartment to nearly $1 million.

The current administration has provided $3.16 Billion to address homelessness, providing funding for over 7,000 local projects to provide housing assistance or support services. Some local governments are also stepping up to the plate. For example, Los Angeles passed a one-quarter cent sales tax in 2017 to fund about $355 million per year for homeless prevention services. This year, they have another measure on the ballot which would provide a $1.2 Billion bond measure to build supportive housing. Houston, Texas, is held up as a model for addressing homelessness with a housing-first approach. As a result, the Houston region has reduced homelessness by 63% over the past 10 years, with an emphasis on coordination across agencies.

Their research continues, and I’m reaching out to Professors Ward and Hunter in the coming weeks as I prepare for a talk I’m giving on this subject in late December. I’ll continue reviewing some of the issues and current research on the complex housing crisis we face in America, with an eye toward finding some consensus on steps forward to solve these issues and share my findings with you as I go along. As always, if you have any comments or questions on this or any other real estate related topic, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI

Where will YOU sleep tonight?

Over the past few years, I’ve focused this blog on Real Estate Investment Trusts. While I’m NOT backing away from investments in that arena (I still own ACCRE, which is a small REIT fund-of-funds), I am presently focusing more of my attention on housing. Where most of us sleep at night comes in several different varieties – single family detached homes, owner-occupied condominiums and other attached housing, rental homes and condos, and of course rental apartments.

According to the most recent statistics I have, there were about 145.3 million ‘housing units’ in America as of July 1, 2023, or about 1 for every 2.3 people. Of the occupied units, about 65.8% are ‘owner occupied’ (both single-family and attached), while the remainder are some sort of rental units, such as single family rental houses or apartments. Over the past couple of years, we’ve seen an increase in housing units of about 1% per year, more or less. That’s about two to three times the rate of growth in the population, so… sounds like everything’s OK, right?

Yet, there is enormous angst about housing availability and affordability in all corners. At the low end of the economic spectrum, about 1.25 million people experienced homelessness a some point in 2020, the last year for which HUD has published data (according to the US Government’s Interagency Council on Homelessness). As we move up the economic ladder, the working poor, when they can find housing, are forced to pay increasingly large portions of their budget for shelter, thus crowding out food, health care, and other necessities of life. Even the so-called ‘middle class’, if you can still call it that, find homeownership prohibitive.

Most pundits (and I’m citing CNBC here) tell us that as a general rule, the total cost of housing (rent or mortgage payment plus utilities) should be no more than 30% of the household’s budget. Ironically, renters, who are often the ones who cannot afford home ownership, seem to have it worse. As of the 2021 American Housing Survey, over 50% of renters report paying over that 30% threshold. When broken down by income level, about 64% of households earning less than $50,000 per year report paying over the 30% benchmark. According to Harvard’s Joint Center for Housing Studies, rent has increased over 20% since 2001 even after accounting for inflation, while median household income is virtually unchanged.

For those trying to join the ranks of homeownership, the story is even worse. Taking the longer view, in 1985, the median household income in America was $22,400, and the median home price was $78,200, for a ratio of 3.5. Even back then, steep interest rates consumed nearly half of a typical household income in mortgage payments. Today, in America, with lower interest rates fueling a housing demand, the median sales price of a dwelling is $433,100, and the median household income is $74,600, resulting in a ratio of 5.8.

Wells Fargo and the National Association of Homebuilders conduct an annual survey of homebuilder sentiment, which is a weighted average of current housing starts, anticipated starts over the next 6 months, and ‘buyer traffic’, which is essentially a measure of buyer interest in new homes. As of October, 2024, the index stood at 43, which for the sake of comparison, is about where it stood in the middle of the 2008-10 housing crash. Not surprisingly, housing starts right now are only 992,000 per year, about where it stood 40 years ago.

Many buyers and apartment developers blame interest rates, but that’s only part of the story. Costs have skyrocketed all across the nation, not just ‘hard costs’ (sticks, bricks, and labor) but also ‘soft costs’ such as regulatory burdens, permitting fees, and marketing costs. In the ‘hottest’ areas – the places where people want to live – the cost of land has also become burdensome. Forty years ago, merchant builders considered land should cost between 30% and 40% of the selling price of a single family dwelling. Today, in the top markets, that number can exceed 50% or more.

Over the course of the next few weeks and months, I’m going to explore some of these issues in more detail. As always, if you have any specific questions or comments, please let me know.

John A. Kilpatrick, Ph.D., MAI

Home prices up, sales down

Reuter’s reported this morning that sales of existing homes are down and prices are up. Economists had forecasted an increase year-over-year of 0.6%, according to National Association of Realtors statistics, which would have been a pretty good jump. In fact, sales actually fell by 2.2% from June, 2017 to June, 2018.

Sales rose in the northeast and Midwest, but fell in the west and south. Existing home sales make up about 90% of the market (the other 10% from new homes). As we’ve reported before, rising costs and lack of infrastructure are driving up new home prices and driving down new home availability. This means that demand drives up prices, and ultimately drives down volume. (This was the part of the supply/demand equilibrium lecture that drove so very many college freshmen to major in something other than economics.) Annual wage growth has been stuck below 3% for some time now, and median house prices are now up 5.2% from last year, to a record high of $276,900. According to NAR, this is the 76th consecutive month with year-to-year price gains.

Supply at the lower end of the market — starter homes and rental homes — dropped by 18% from last year. This is problematic since first-time buyers accounted for 31% of all transactions in June. However, economists estimate that in a healthy market, first-time buyers would account for a 40% market share. All in all, these are not the signs of a healthy housing market.

Lumber and other simple stuff

Tariffs anyone? Jann Swanson wrote a great piece for Mortgage News Daily last week, titled “NAHB: Lumber Shortages and Prices Hamper Affordability.” In short, the shortages of framing lumber are “now more widespread than any time” since the National Association of Homebuilders began tracking in 1994. About 31% of single-family builders reported shortages of framing lumber in the most recent survey, along with shortages in other building materials. A full 95% of homebuilders reported that prices of these materials were having an adverse impact on housing affordability.

While there are numerous reasons for this, including a shrinkage in the building infrastructure during the several years following the housing melt-down, the NAHB notes that the top five building materials with shortages are on the Trump Administrations list of tariff targets.

Trump’s Tax “Reform”

Mark Twain is usually — and incorrectly — quoted with the phrase “No man and his money are safe while Congress is in session. (The actually quote goes to 19th century NY politico Gideon Tucker, but I digress.) There’s little to be said, in general, about TheDonald’s proposals yesterday, simply because there’s little substance to analyze. However, I’m old enough to remember the last tax overhaul, in the early stages of the Reagan administration, and perhaps I can offer a few observations. I’ll limit my mental meanderings to real estate for now.

First, the Reagan tax re-hab (the 1986 Tax Act) was a disaster for real estate investing, particularly at the individual, atomistic investor level. One of the “loopholes” to be cured was the elimination of deductibility of passive losses on real estate investments. The real estate community reluctantly supported the tax act, in trade for increases in the deductibility of home mortgage interest and a guarantee that passive losses on then-existing real estate deals would be grandfathered. Indeed, in the run-up to passage, there was a flurry of investing (by Main Street USA folks — the kind of folks who still, amazingly, support Trump) in just such “grandfathered” investments. At the last minute, the grandfathering was removed, costing Main Street USA investors tons of alternative minimum tax payments on now-sour investments. Some pundits suggest that this grandfathering-revocation, alone, led to the downfall of the Savings and Loan industry, but that excuse is a bit to simplistic. It did, however, shut down the time share industry for a while.

Today, according to news reports, single family residences are enjoying record demand (which may or may not be good news). The hottest market is among first-time buyers, and the demand is greatest among starter homes. The Trump proposals would double the standard deduction for a married couple filing jointly. While, on the surface this seems like a good idea, it will drastically shrink the number of tax payers who itemize mortgage interest and property taxes. In short, for the biggest tranche of homebuyers, the biggest differentiation between ownership and renting would be effectively removed. As a guy who invests in rental property, that’s nice, but the home building industry won’t react well.

Otherwise, I don’t see lowering the marginal tax rate on corporations as having much of an effect on real estate investing. For one, most of those projects are either done thru tax-advantaged REITs or thru other pass-thru entities, like partnerships and LLCs. Even if it did, the demand / supply of investment grade real estate depends on other factors, and slight changes in the tax rate may have an impact on the debt/equity mix, but not on the aggregate output of new commercial construction. The ONE area most affected will be low income housing, which is funding in no small part by tax credits. The value of those credits will be slashed, requiring a complete re-thinking in the finance side of low income housing. The last time such a tax cut went into effect, it was a real mess for low income housing.

If I was the government, and I wanted to create good paying construction jobs, I’d embark on a long-term infrastructure redevelopment plan. That would probably require actually raising tax rates a bit, but would have marvelous returns on investment for middle America. But that’s just me….

And yet another post about housing

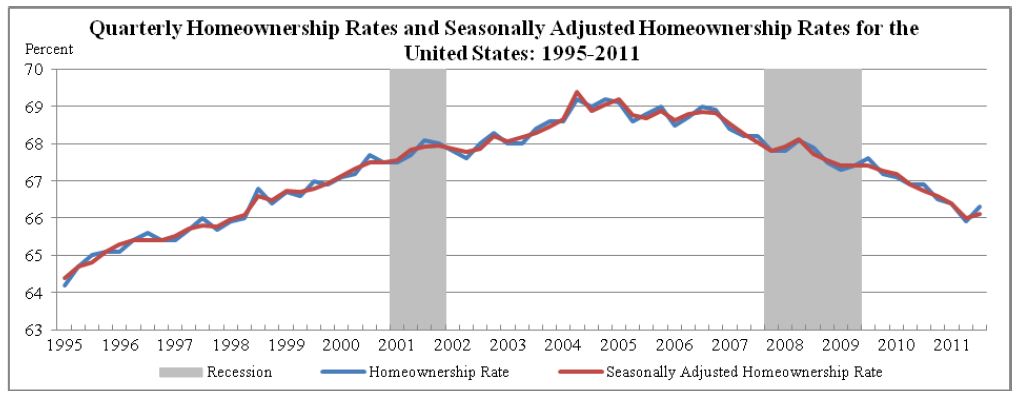

With all the negative news about housing, the market may have a tendency to grasp at any straw that floats along. In today’s news, that straw is a report from the census bureau that home ownership rates — which have been declining steadily for two years, and are now at a 13-year low — seemed to reverse trend in the 3rd quarter and rise by 0.4% to 66.3%.

Of course, a quick read of the footnotes belies the problem with this pronouncement. First, as you can see, there’s a fair amount of cycling around long-term trends, and that’s probably what this is. Second, on a seasonally adjusted basis (which is really where the truth can be found), the increase was only 0.2%, which is statistically insignificant. Further, on a year-to-year basis, we’re still lower than where we were a year ago, which really underscores the long-term trend. I continue to believe that ownership rates will stabilize somewhere above 64%, but probably pretty close to it. At the current trend, that may take 3 – 5 years.

More importantly, though, an increase in housing demand (and prices) led us out of prior recessions, but housing is continuing to be a drag on the market following this most recent one. Unless and until the housing market doldrums stabilize, solid economic growth will elude us.

Home Prices Decline — Why?

Our neighbors down the street, zillow.com, just released a report showing that home prices nationally fell by 3% in the first quarter, or a total of 8.2% from March, 2010. The cumulative national average decline from the market peak (June, 2006) is 29.5%, and this quarter’s decline was the worst since 2008.

By the way — and this may seem totally obvious — but one of the biggest reasons people buy homes is because they are expected to go up in value, not down. Hence, a home is expected to be a storer of value and a hedge against inflation, not a dissipating asset. A buyer in June, 2006, would have reasonably expected his or her home to increase in value by 5% or so per year. For example, as Zillow’s chart shows, even back in the 1990’s, a home bought in 1996 (where their chart begins) went up by a total of about 20% by 1999 — slightly over 5% per year compounded. In five years, 5% compounded annually totals about 28%. Hence, not only are homes going down, they are totally contra to expectations by a total (28% plus 29%) of nearly 60%.

It sounds trivially obvious, but bankers also expected that. It’s one of the reasons why they fearlessly (and yes, foolishly) made loans to anyone who could sign their name (or make a “X”) back in the bygone days, because if the loan went sour (and they KNEW some of them would), they could always dump the collateral for more than they had in it. “Heads, we win. Tails, we don’t lose.”

CNBC had a nice piece on this topic this morning, featuring (among others), Dr. Susan Wachter, of U. Penn, who we’ve had the pleasure of knowing for many years. All of the talking heads agreed that banks won’t loan money today unless they’re absolutely sure of creditworthiness of the borrower. Hence, fewer people can borrow today, so fewer homes can get sold. Values decline due to lack of demand (pretty simple ECON 101 stuff happening here) and, as Prof. Wachter put it, the spiral will continue downward until an equilibrium is reached.

I’ve opined about that equilibrium in this column for quite some time. There is some significant albeit anecdotal evidence to suggest that the equilibrium home ownership rate will constitute the floor in all of this — probably somewhere around 64%, which is where we were back in “normal” times of the late 1980’s to mid-1990’s. I wish we had more data, but systemically declining housing markets don’t happen very often.

Housing equilibrium — part 1

This is going to be a bit convoluted, so bear with me.

This week, I’ve been at Renaissance Weekend, an annual gathering of top minds in a variety of fields (Nobel laureates, authors, actors, CEOs, etc) and I’ve been asked to make several presentations on real estate finance and economics. It’s a pretty heady experience, but more on that later.

One of the principle questions thrown my directions is, ‘When will real estate bottom?’ One might argue that commercial real estate has already bottomed, and there’s a fair amount of data to support that. (A weak “bottom”, I’ll grant you, but a bottom, none-the-less.) Apartments are coming back particularly strong, but even hotels and industrial are showing positive gains this year.

Owner-occupied residential is a completely different story. We’ve really never had a phenomenon like this, and according to both the Federal Housing Finance Authority and Case-Shiller, housing prices continue to collapse all across the country. Indeed, C-S just released a report two days ago indicating that new lows were hit in 6 out of 20 top markets. Overall, housing prices have been downtrending every quarter since mid-2007.

When will this bottom? I’m toying with a set of models which suggest that the pricing market won’t bottom until the ownership rate reaches an equilibrium. Heuristically, that optimal rate appears to be around 64%. Why? I’m looking at the last time ownership rates ballooned, which was at the end of the hyper-inflation period of the late 1970’s. Pricing markets stabilized after the ownership rates stabilized.

This posting is a deviation from my normal routine — My thinking on this topic is evolving, and I’m hoping to trace that evolution here on the blog until I reach something that I can actually flesh out into a paper. I’d appreciate any comments you have, either added as a comment here on the blog or, if you’d like privacy, e-mail them directly to me (john@greenfieldadvisors.com)

Tis the season….

Intriguing mixed messages from the economy. Employment continues to lag, but holiday shopping was up. Go figure?

Two or three things may be in store. First, I’m sure that some of the more profitable businesses, fearing future tax increases, were holding off spending tax-deductable money until 2011 rather than 2010. The key lesson for lawmakers — get some stability and predictability into the tax system.

Second, while “on-line” shopping went up, the unmeasured impact of on-line was the ability to target shopping. Lots of holiday shopping went at bargain prices, and I’m interested to see how much sustainability there will be in the increases. It’s very difficult to imagine, with the underlying instability in economic fundamentals, just how long the shopping bubble can be sustained.

But, on to real estate. What looks good right about now? What looks bad? We continue to be doom-sayers on housing construction into 2011. Normally, in a recession, there’s a build-up of excess supply (construction in the pipeline pre-recession get unsold DURING the recession). However, past recessions rarely have a contemporaneous melt-down in homeownership rates (see the following).

Note that since we began keeping records in 1960, ownership rates have inexorably trended upward but for two instances — this one and the 1980-84 period. After 1984, it took until the mid-1990’s for rates to start trending upward again, and many would suggest that this up-trend was only the result of Greenspan’s “easy money” policies. In a more cautious lending environment, it’s hard to say where the true equilibrium might lie. However, it’s intriguing that the run-up in the 1970’s is often blamed on the high levels of inflation (making home ownership the favored “inflation hedge” for families) and that in the post-recession, low-inflation period of the late 80’s and early 90’s, rates seemed to hover around 64%.

If in fact that’s where the equilibrium lies, then the U.S. has about three more percentage points in owner-occupied homes to absorb. This absorption occurs in one of three ways — growth in the population, conversion of homes to other uses (usually rental in lower-end or transitional neighborhoods), or demolition. Whatever the reason, with the current slope of the trend-line (which, intriguingly, matches the slope of the 1980-84 period), we see that it took about 5 years (2004 through 2009) to get from about 69% to about 67%. At this rate, getting to 64% will take another 7 – 8 years, suggesting a best case scenario of stability in the 2016 range.

This scenario, interestingly enough, matches some of the employment-growth scenarios I’ve seen, which suggest we’re looking at the mid-to-late teens for unemployment to get back down to pre-recession levels.

So, if owner-occupied housing stinks, what looks good on the menu? Apartments. In very rough numbers, we WERE building about 1.5 million homes per year prior to the recession (year-in, year-out, with a HUGE amount of variance from year to year). Now-a-days, we’re building about a third of that or less, suggesting an un-met demand for housing of about a million units per year, more or less. Apartment construction also flat-lined during the recession, primarily because banks simply didn’t have the money to lend for construction financing. (Permanent money comes from other sources, and it’s available, but the construction financing problem is still with us.)

As credit continues to ease — particularly with the recent announcements by the FED in that regard — we can see some strong lights at the end of that tunnel. Good news for construction workers — their unemployment rates have been huge lately, but the same folks who drive nails for owner-occupied homes can also drive nails in apartment complexes. Easing credit in this area will thus fuel job growth, which also fuels consumption, home purchases, etc. Thus, addressing the housing demand/supply problem may be the most important single thing policy makers can do to restore the economy to good health.