Archive for the ‘Valuation’ Category

Housing — and today’s WSJ

The front page of the Wall Street Journal today is plastered with the story of the continued problems with house prices, courtesy of info from the S&P-Case Shiller Index. I’ve commented on this several times before in this blog, but it bears further investigation.

Prior post-WWII real estate recessions (if we can call them that) have been quickly self-correcting. Stagnation in house prices lead to increased investment, as buyers look for deals and bankers need to make loans. As such, real estate recessions rarely have actual price declines, but instead are marked with volume slow-downs or price stagnation.

This recession is very different. Bankers are highly reluctant to make loans, in stark contrast to prior recession-exits. Regulatory problems, lack of bank capital, a doubling of REO portfolios, lack of cash from retail buyers, and a real fear (by both bankers and buyers) that collateral values will continue to decline puts the market in a continued downward spiral. To make matters worse, since many owner/sellers (particularly the most fragile ones — in the “zero down payment” starter homes) are themselves faced with economic travail and often the need to move to find work, the potential for further foreclosures down-the-road is very real, thus further driving down prices. Add to this the fact that a very big chuck of the U.S. economy is housing-related (contractors, developers, bankers, realtors, and many other intermediaries), it’s easy to see that a sustainable jobs market is hard to envision without “fixing” the housing problem.

We can re-examine the causes of this crisis over and over, but very few analysts are focused on the cure. Pilots are taught that when airplanes stall and go into a spin or a downward spiral, after “pulling the power” the pilot has to do something that’s rather counter-intuitive: point the nose downward and actually fly INTO the stall to get out of it. It’s like steering a car INTO the skid on an icy road. It’s very counter-intuitive, but it’s necessary. (The “black box” — it’s actually orange — recently recovered from the Air France 447 crash showed that the two very junior co-pilots who were at the controls when the plane went into a stall tried to pull BACK on the stick, when they should have pushed FORWARD. If they’d thought back to “Flying 101” they might be alive today.)

The “thing missing” from today’s market is the national policy in favor of affordable housing, which was manifested through Fannie-Mae and Freddie-Mac. Pulling the plug on the secondary market (which was at the core of the housing bubble) basically took our financial markets out of the housing business. Now that the price-bubble has bursts, our financial markets need to step back up to the plate and provide some liquidity. Admittedly, a “fixed” market will need to provide better risk-measures and possibly some hedging tools, but these are details that can be worked out once we get the plane flying again. I hate to say this — I’m generally a “free-market” kinda libertarian guy — but the government will need to step up to the plate as a guarantor of last resort…. and yes, I know the U.S. government is effectively broke. However, until it gets the housing market back on its feet, it’s going to stay broke. At some point, they need to steer the car into the skid.

Apartment Investing — Cap Rate Divergence

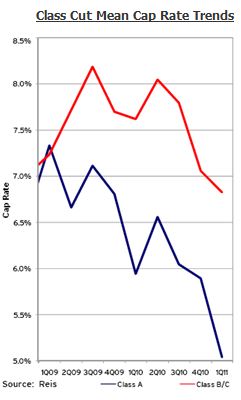

The fact that apartment “cap rates” are declining in the face of rising fundamentals is old news. (For the newbies — the “cap rate” is the ratio of net operating income, or NOI, to value or purchase price. If NOI is rising, then purchase prices must be rising even faster, indicating increased investor sentiment.) Indeed, as of April, nationwide, mean cap rates on apartments were back to early 2008 levels. (Again, for the newbies — cap rates on all property types rose during the recession, reflecting both declining fundamentals AND declining investor sentiment.)

The more interesting piece of news comes out of our friends at REIS, who just released a report today showing that Class “A” apartment cap rates have declined much faster than Class B/C, indicating that high-end, investment grade properties are much in favor today for their income by institutional investors.

Those same investors are wary of lower-grade apartment investments, although REIS suggests that this wariness should dissipate over time. This suggests some significant opportunities for developers, turn-around specialists, and other non-institutions during the coming months.

Mueller’s Market Cycle Monitor

Sorry it’s been so long — I’ve been traveling a good bit lately, and it’s hard to keep up!

One of my favorite real estate pieces hit my desk while I was gone — Dr. Glenn Mueller’ Market Cycle Monitor, published by Dividend Capital. He developed this model about 15 years ago, and it tracks occupancy and absorption of major commercial property types in about 50 geographic markets. As a property type (in a given market) sees increasing occupancy, market participants bring new property on-line. This creates an expansion. At the peak of the expansion curve, “hypersupply” begins, following which the new supply exceeds the market ability to absorb property. Vacancy rates increase, even as new property is still coming on line. This stimulates a recession. During the recession, no new property comes on-line, and occupancies hit a nadir. At that point, natural expansion of the economy stimulates a recovery, during which excess properties are absorbed and the cycle continues. The following, taken from Dr. Mueller’s excellent 1995 paper, captures the entire idea:

Currently, the market can be best described as “flat-lined”. Office occupancies were flat during the first quarter, and rents were actually down slightly (0.3%, on an annual basis). Industrial occupancies improved slightly, but rents actually fell signficantly (3.1% annualized). APartment occupancies improved slightly, and rental growth improved significantly (2.8% annually). Retail occupancy actually improved significantly, but rental growth trended downward (3.1% annually). Finally, hotel occupancies improved a bit (0.8%), and hotel income (measured as RevPAR, or Revenue per available room) increased 8.9% on an annualized basis.

For a complete copy of Dr. Mueller’s report, click here or write us at info@greenfieldadvisors.com.

Global and Local Data

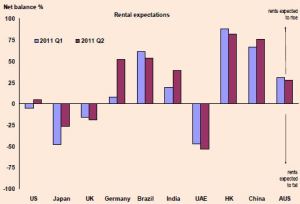

Two important economic research pieces hit our desks this week — the RICS Global Commercial Property Survey, and the Dr. Bill Conerly’s Businomics Newsletter. The former, as its name implies, has a very global reach (the U.S. included), and gives a great basis for comparison of how the U.S. commercial real estate economy is doing relative to other economies. Naturally, this begs the question, “Are there OTHER economies?” From an investment perspective, all “economies” are integrated, and while each occupies a different place on the risk/reward graph, they are all viewed through the same lens by the equity and debt markets. Dr. Conerly’s work focuses narrowly on the Pacific Northwest, and gives us a great snapshot on how our local economy is doing. It’s a “must-do” resource piece for any work we do in our backyard.

RICS, of course, stands for Royal Institution of Chartered Surveyors. First charted by Queen Victoria in 1881, it is now the world’s oldest and largest property-focused organization, with 100,000 professional members and 50,000 students in 140 countries. Greenfield has been pleased to be affiliated with RICS here in the U.S. for quite a few years.

The headlines speak for themselves:

For your own copy of the report, or one of the regional reports, visit the RICS web site by clicking <here>

Dr. Bill Conerly, based out of the Portland, Oregon, area, is a great friend of ours here at Greenfield and one of the region’s top consulting economists. His newsletter presents key national economic trends (along with his pithy comments) and then focuses on how these play out in the Pacific Northwest. He calls national GDP growth since the start of the recovery “disappointing”, and notes that while consumers seem to be rebounding and business equipment capital spending is growing moderately, construction spending is still “weak”. Housing starts are still troubling (for more on this, see some of my prior blogs on the housing market) and despite gas prices, inflation still seems to be under control (actually near the lowest levels in the past 5 years.) The spread of junk-bond yields over treasuries hit a peak of nearly 2000 basis points in 1009, and is back down to between 500 and 1000, but still above the roughly 300 basis point level of 2007. Dr. Conerly suggests there is still some worry about risk, although I would posit that 700 or so basis points is probably a healthy level. Finally, on a national view, Dr. Conerly is looking for “decent but not dramatic gains” in the stock market.

On the local front, Dr. Conerly notes that both Oregon and Washington bankruptcy filings have turned downward from their peak levels last year, although both are still well above levels pre-2009. Through the recession, both states have seen substantial net in-migration (Oregon at about half of Washington’s level), although Oregon’s in-migration had trended slightly downward and Washington’s slightly upward.

For more information on Dr. Bill Conerly or copies of his charts, visit him here.

REIS reports on apartment & office markets

Our friends at REIS just sent out their May ReisReports titled, “The Multifamily Gravy Train Keeps Rolling”. They report that 77 out of 82 major apartment markets that they track showed occupancy increases, up from 63 in the same quarter last year. Effective rents increased in 79 of these markets.

This contrasts with office performance — occupancies either improved or were flat in 42 of 82 markets, and effective rents only increased in 37, which is a slight improvement over 2010.

Click “here” for your own version of their reports, which we find very helpful here at Greenfield.

Home Prices Decline — Why?

Our neighbors down the street, zillow.com, just released a report showing that home prices nationally fell by 3% in the first quarter, or a total of 8.2% from March, 2010. The cumulative national average decline from the market peak (June, 2006) is 29.5%, and this quarter’s decline was the worst since 2008.

By the way — and this may seem totally obvious — but one of the biggest reasons people buy homes is because they are expected to go up in value, not down. Hence, a home is expected to be a storer of value and a hedge against inflation, not a dissipating asset. A buyer in June, 2006, would have reasonably expected his or her home to increase in value by 5% or so per year. For example, as Zillow’s chart shows, even back in the 1990’s, a home bought in 1996 (where their chart begins) went up by a total of about 20% by 1999 — slightly over 5% per year compounded. In five years, 5% compounded annually totals about 28%. Hence, not only are homes going down, they are totally contra to expectations by a total (28% plus 29%) of nearly 60%.

It sounds trivially obvious, but bankers also expected that. It’s one of the reasons why they fearlessly (and yes, foolishly) made loans to anyone who could sign their name (or make a “X”) back in the bygone days, because if the loan went sour (and they KNEW some of them would), they could always dump the collateral for more than they had in it. “Heads, we win. Tails, we don’t lose.”

CNBC had a nice piece on this topic this morning, featuring (among others), Dr. Susan Wachter, of U. Penn, who we’ve had the pleasure of knowing for many years. All of the talking heads agreed that banks won’t loan money today unless they’re absolutely sure of creditworthiness of the borrower. Hence, fewer people can borrow today, so fewer homes can get sold. Values decline due to lack of demand (pretty simple ECON 101 stuff happening here) and, as Prof. Wachter put it, the spiral will continue downward until an equilibrium is reached.

I’ve opined about that equilibrium in this column for quite some time. There is some significant albeit anecdotal evidence to suggest that the equilibrium home ownership rate will constitute the floor in all of this — probably somewhere around 64%, which is where we were back in “normal” times of the late 1980’s to mid-1990’s. I wish we had more data, but systemically declining housing markets don’t happen very often.

Musings of an expert witness

I JUST spent the entire week in booming, Towson, MD, testifying in a little-known, not-well-covered case called “Allison v. Exxon.” On the surface it seems like a fairly straight-forward case: In 2006, an Exxon station in rural Baltimore County spilled a lot of MTBE-laden gasoline (at least 26,000 gallons). The gasoline flowed into the drinking water aquifer, and contaminated the well water for a fairly large, up-scale neighborhood. Hundreds of houses and dozens of businesses are affected, and after 5+ years, the remediation is still ongoing. A small, preliminary case went to court a couple of years ago (we were not involved) and the significant jury award demonstrated that the subsequent cases, as they went forward, had the potential to be extremely expensive for Exxon and would potentially send a message about MTBE litigation.

The current trial, which has been ongoing for several months, will continue for at least another two months. Then it goes to a jury. As the stakes have gone sky-high, so have the players. Both Exxon and the plaintiffs up’d the ante on law firms. Exxon is now represented by DLA Piper, perhaps the largest corporate law firm in the world. The plaintiffs are represented by Peter Angelos, one of the most successful trial attorneys in America (and, coincidentally, the owner of the home-town Baltimore Orioles.) Naturally, we were called in as real estate valuation experts and economists to measure the monetary damages. I just testified this week, and of course my involvement behind the scenes is ongoing.

I actually testify in fewer cases than people might think. At Greenfield, we do a LOT of litigation support, but we’re glad that our work helps our clients settle the majority of cases outside of the courtroom. (For more on this, see a recent article on the website, LawyersandSettlements.com.) Success at the expert witness “business” requires thinking not only about what we do but more importantly thinking about HOW we do it. As such, the past week has caused me to focus a lot of attention on that “how” component, and I’m writing this blog entry more for my own memorialization than anything else.

As I think about the “how”, three things come to mind:

Experts have to be careful with their egos. The best experts have very strong egos — they have to, because in the run-up to trial, their opinions, expertise, and findings are challenged repeated. Good experts have very strong internal editorial systems within their organizations, and are constantly willing to put their own egos aside in favor of the pursuit of excellence. However, to get on the witness stand (and deposition, and meetings with clients, and inevitable reversals), the expert has to be able to withstand a withering intellectual assault. A strong enough ego, however, can be a two-edged sword. A clever opposing attorney can make mince-meat of an egotistical blow-hard on the witness stand. I’ve seen really fine testifying experts simply melt-down under that sort of pressure. It’s not pretty.

Stay at the cutting edge of your body of knowledge, but not beyond it. There is a “safety zone” right at the front edge of the body of knowledge. Whatever the field, there is always a “current body of thought” concerning methods and standards. In real estate valuation, it’s obvious that the older methods have been severely called into question during the current real estate melt-down. As it happens, there are great new methods that have been tested and found superior (hedonic modeling, time-series indices, contingent valuation, etc.). These are well tested and established methods. Ironically, many “old-hands” at testifying in court are too busy playing “witness” and spend very little time maintaining themselves as “experts”. They fail to keep up with the current literature. They may publish, but it’s usually about things that were old-hat 20 years ago. When faced with newer methods from the other side of the courtroom, they have no foundation to comment, and as such do a poor job for their clients.

Keep it simple Ironically, most “expert” work is highly technical. However, every testifying expert should be able to describe and discuss what he or she did in a very short “elevator pitch”. It has to be simple. In my experience, jury members are usually pretty bright, and typically want to be engaged in the “show”. However, they want to know that there is a simple theme to the expert’s work. If it’s too convoluted, even though it may be true, it doesn’t “seem” true, and hence won’t be compelling to the jury.

Nevada

Just came back from a day in Reno. (Hard to type that without hearing Johnny Cash in my head.) Sitting in the airport, I struck up a conversation with a young man sitting next to me. He asked what I did for a living, and as soon as I told him, he wanted to know my “economic prognosis” for Nevada. Whether I had a good one or not, I gave him my two cents worth.

Nevada — and Florida, for that matter — primarily make their living from three things: tourists, retirees, and people who care and feed the first two categories. (One might be tempted to add Arizona into the mix, but that would be a bit of a mistake. Arizona’s economy is a bit more complex. One might argue that Florida and Nevada’s are, too, but let’s go with it for a while.)

One immediate “hit” to the economies of both Florida and Nevada was tourism, as families (and in the case of Las Vegas, conventioneers) had to tighten their belts. However, this segment is actually coming back a bit, albeit not totally to pre-recession numbers. For example, Florida’s Gulf Coast Panhandle (the nine counties in western Florida) were actually seeing a resurgence of tourism until the Gulf Oil Spill. Occupancies in the Gulf Coast region on Memorial Day, 2009, were quite good, but then the oil spill hit, and occupancies were dismal on that same weekend, 2010.

Las Vegas is certainly in trouble, but some of that came from overbuilding. The Saraha just closed — it had been slated for a makeover, but the owners have decided to “go dark” for a while instead, waiting for the economy to turn. The Las Vegas City Center continues to be a prime example of speculative overbuilding, both rooms and casino space.

But, Reno isn’t Las Vegas. Sure, Reno has casinos and some gambling, but it’s more of a retiree area. This segment of the population has been hurt in two ways. First, they can’t sell their houses. Moving to Reno (or Ft. Lauderdale) generally requires selling a house in Los Angeles or Groton. As I’ve noted previously, the supply of existing homes is pretty stable, and even though new construction has tanked, the demand for owner-occupied homes is actually shrinking from its pre-recession peak of about 69.5%. Thus, retirees may WANT to move to Reno, but no one will buy their home in Los Angeles.

Second, POTENTIAL retirees look at their 401-K’s and start thinking, “wow, I guess I’ll need to work a few more years.” This has some long-term issues for the economy. First, every retiree who “stays” on the job means one applicant at the beginning of the work-force pipeline who can’t “get” that job (or at least the job that leads to it.) Second, early retirement is more care-free (both personally and financially) than late retirement. Thus, early-retirees generally spent financial assets into the system without making many demands ON the system (health care being the biggie). Now, many retirees will defer retirement until the fateful day when they start demanding more of the system than they are able to put into it. If we think medicare and social security are problematic NOW, wait until that reality takes hold.

From a housing perspective, large parts of the U.S. (Nevada, Florida, and, yes, big swaths of Arizona) have been built to accommodate retirees in between the time they “sell the big house” and the time they move into assisted living. A prolonged “work-life” means a significant lowering of demand for this segment of the housing market.

sushi or dead fish?

I’m at the semi-annual meetings of the Real Estate Counseling Group of America (RECGA), a small (capped at 30), invitation-only group of real estate experts founded by the esteemed Dr. Bill Kinnard back in the 1970’s. Over the years, RECGA members have included editors of major journals, presidents of various real estate academic and professional organizations, and advisors to major investment groups. We’ve nearly lost track of how many text books have been written by the members — well over several dozen, plus many hundreds of journal articles, book chapters, and scholarly papers.

A few somewhat random observations:

Investment activity is up, but the major impediments are lack of capital and excess inventory

Apartment “cap” rates are falling again, with lots of activity

The credit markets are still a mess, with no consensus on when they will be “fixed”

Wonderful presentations (patting myself on the back for one of them), with great interaction on complex issues in real estate analysis and valuation.

Why the title to this post? Simple — one real estate investor was quoted as saying, “The market today is like a platter of seafood. I have to figure out which are sushi and which are just dead fish.”

Gulf Oil Spill — Lessons Learned conference

I’ve just been confirmed as a speaker at the big one-year “Lessons Learned” conference on the Gulf Oil Spill, sponsored by Tulane University Law Center, American Lawyer magazine, and the Brickel and Brewer Law firm. The conference will be held at the Weston Canal Street in New Orleans on April 28th. I’ll be one of the “wrap up” speakers that afternoon, focusing on the impact of the oil spill on the value of bank collateral portfolios.

For more info on the conference, click here. Hope to see you there!