Archive for the ‘Finance’ Category

Global and Local Data

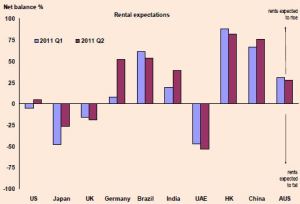

Two important economic research pieces hit our desks this week — the RICS Global Commercial Property Survey, and the Dr. Bill Conerly’s Businomics Newsletter. The former, as its name implies, has a very global reach (the U.S. included), and gives a great basis for comparison of how the U.S. commercial real estate economy is doing relative to other economies. Naturally, this begs the question, “Are there OTHER economies?” From an investment perspective, all “economies” are integrated, and while each occupies a different place on the risk/reward graph, they are all viewed through the same lens by the equity and debt markets. Dr. Conerly’s work focuses narrowly on the Pacific Northwest, and gives us a great snapshot on how our local economy is doing. It’s a “must-do” resource piece for any work we do in our backyard.

RICS, of course, stands for Royal Institution of Chartered Surveyors. First charted by Queen Victoria in 1881, it is now the world’s oldest and largest property-focused organization, with 100,000 professional members and 50,000 students in 140 countries. Greenfield has been pleased to be affiliated with RICS here in the U.S. for quite a few years.

The headlines speak for themselves:

For your own copy of the report, or one of the regional reports, visit the RICS web site by clicking <here>

Dr. Bill Conerly, based out of the Portland, Oregon, area, is a great friend of ours here at Greenfield and one of the region’s top consulting economists. His newsletter presents key national economic trends (along with his pithy comments) and then focuses on how these play out in the Pacific Northwest. He calls national GDP growth since the start of the recovery “disappointing”, and notes that while consumers seem to be rebounding and business equipment capital spending is growing moderately, construction spending is still “weak”. Housing starts are still troubling (for more on this, see some of my prior blogs on the housing market) and despite gas prices, inflation still seems to be under control (actually near the lowest levels in the past 5 years.) The spread of junk-bond yields over treasuries hit a peak of nearly 2000 basis points in 1009, and is back down to between 500 and 1000, but still above the roughly 300 basis point level of 2007. Dr. Conerly suggests there is still some worry about risk, although I would posit that 700 or so basis points is probably a healthy level. Finally, on a national view, Dr. Conerly is looking for “decent but not dramatic gains” in the stock market.

On the local front, Dr. Conerly notes that both Oregon and Washington bankruptcy filings have turned downward from their peak levels last year, although both are still well above levels pre-2009. Through the recession, both states have seen substantial net in-migration (Oregon at about half of Washington’s level), although Oregon’s in-migration had trended slightly downward and Washington’s slightly upward.

For more information on Dr. Bill Conerly or copies of his charts, visit him here.

REIS reports on apartment & office markets

Our friends at REIS just sent out their May ReisReports titled, “The Multifamily Gravy Train Keeps Rolling”. They report that 77 out of 82 major apartment markets that they track showed occupancy increases, up from 63 in the same quarter last year. Effective rents increased in 79 of these markets.

This contrasts with office performance — occupancies either improved or were flat in 42 of 82 markets, and effective rents only increased in 37, which is a slight improvement over 2010.

Click “here” for your own version of their reports, which we find very helpful here at Greenfield.

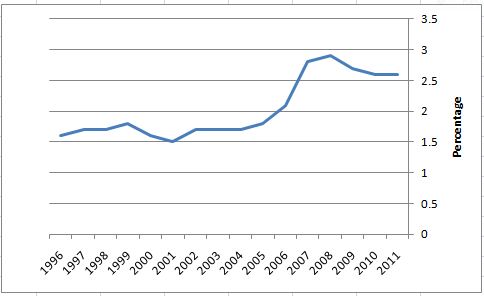

Home-ownership vacancy rates

Regular readers will recall that we’ve linked continuous decline in home ownership rates to price instability. In short, prices won’t start rising again until home ownership rates stabilize. (They’re down from about a recent peak of 69.5% to about 66%, and we believe they will continue to fall to about 64%). One MORE piece of important data just hit our desks, in the form of the Census Bureau’s 1st quarter home ownership survey.

The report is full of useful data. For one, the number of owner-occupied units in the U.S. actually fell from 1st quarter 2010 to 1st quarter 2011 (as we would expect), while rental occupancies continue to increase. Rental market supply (in essence, construction of new apartments) is keeping pace with demand, and rental vacancy is just below 10%, slightly lower than the 10% -11% range we’ve seen in the past few years, but not so low as to put inflationary pressure on rental rates. (Of course, this varies from one part of the country to another.)

Among “owner-occupied” homes, though, the vacancy rate continues to rise. See the chart below for a vivid explanation —

If this was a classroom exercise, I’d ask the students to identify the pre-recession equilibrium level, which appears to be about 1.6% to 1.8%. We can then identify the point-of-inflection signalling the impending disequilibrium in the housing market (when vacancy rates increased significantly — 2005). This inflection point, of course, signaled a great time to start shorting mortgage-backed securities, since it signaled the beginning of an increase in default rates. Of course, once can point at this and say “hindsight is 20-20”, but we know that the folks inside many of the banks, who were hawking mortgage-backed securities to their customers, were reading those very tea leaves back mid-decade, and shorting the very same securities they were promoting as safe investments.

Japan Earthquake

Just confirmed — I’m speaking at two big legal conferences on the Japan Earthquake, with focus on the insurance and re-insurance issues. I’ve been asked to address the valuation questions and the impacts on Japanese banking, finance, and housing.

The conferences will be held on May 17 in San Francisco and in June in Philadelphia. For more information, including an agenda, roster of speakers, and sign-up form, visit http://litigationconferences.com/?p=19825

Second quickie from the WSJ

On the same page (C-1), Nick Timiraos contributes “Critical Signs in Foreclosure Talks”. This is the followup to issues I discussed a few months ago regarding the botched foreclosure processes at many banks. Regulators had hoped to put in place a far-reaching settlement, to forestall many state Attorneys General from filing state suits which would put all of this in a variety of courtrooms (probably ultimately in a multi-district litigation in the Federal Courts, and from there… no one knows…). The regulators and the AG’s are on opposite sides, although both seem to agree that the banks need to be taken out back of the woodshed and given a good spanking.

I have zero sympathy for the banks — it’s one thing to create a high-speed mortgage assembly line, but even the auto makers have figured out how to keep track of the documentation on each car they make. Bankers (and the thousands of lawyers they employ) are supposed to be good at this stuff. If they can’t keep track of a $100,000 mortgage, how exactly do they keep track of a $100 checking account balance? (They do seem to be great at keeping track of every $1 I owe on my visa card.)

However, from a market perspective, this all has extremely serious implications. As I discussed some weeks ago, if the foreclosure log-jam isn’t fixed, the home credit market won’t get fixed either. Housing starts, existing home sales, and millions of jobs depend on straightening out this problem. Hence, this is not just a trivial argument about who gets to spank the bankers.

Two quickies from the WSJ

Page C1 today has two important articles that caught our eyes. I’ll write about the first right now, and follow up with the other one later today. First, Kelly Evans contributes “Overlooked Inflation Cue: Follow the Money.” It shouldn’t come as a surprise to anyone that money supply growth in the western economies was rampant during the run-up to the current recession. In the U.S. and the U.K., M-2 growth peaked in late ’07 to early ’08 (you don’t have to be a monetarist to figure that out). The Eurozone kept pumping money at faster rates right up to mid ’09

Where money supply growth went from there, though, was a bit of a mixed bag. In the U.S., the annual growth in M-2 fell from a peak of about 12% right before the recession to a low of about 1.5% in early ’10, and has stayed below 3% since. (This basically supports my contention that the sturm-and-drang over QE-2 was all politics.) The U.K.’s growth rate peaked at about 9%, fell earlier than ours, and hit its bottom (about 2%) in mid ’09. Intriguingly, the U.K. money supply growth rate bounced back immediately, with the virtual money presses running full-speed to get the money supply growth rate back up to about 6% in early ’10, but then falling off to about 4% today.

In the Eurozone, the money supply growth tracked very closely with the U.S., bottoming with ours in mid ’10, but since then, the European bankers have started pumping money back into the system, with their M-2 growth rate headed continuously back upwards (at about 4% today).

There are two important implications for all of this (plus my afore-mentioned observation about QE-2). First, the three big western currencies are on decidedly different tacks. The idea of opposing viewpoints among the big western central bankers is not well explored in today’s decidedly multi-polar world economy. (Back when western banking was a closed system, everyone else in the world could only sit back and watch. Now that the Chinese — and even the Japanese with all their other troubles — are more than sidelines spectators, one can only wonder how disagreements among the western bankers will play out.)

Second, though, the really significant point is that despite all of the different paths of M-2 since 2009, all of the growth rates are decidedly down from the earlier peaks. From a real estate perspective, this has major implications. As investors diversify away from stocks, real estate and bonds have a certain equivalency. In a no- or low-inflation scenario, bonds are viewed as the more secure investment. In a higher-inflation world, real estate is viewed as a bond with a built-in inflation hedge. Hence, lower inflation portends well for bonds but poorly for real estate.

One might argue that healthy bonds means low interest rates for real estate, but this ignores the fact that interest rates are already at historic lows. Hence, what real estate needs today is a nice raison d’être, which a tiny bit of inflation would give it. I’m NOT pro-hyper-inflation, mind you, and inflation flat-lines are overall healthy for the economy. However, if real estate investors are hoping for an inflation kick, it doesn’t look like they’re going to get it.

A last minute edit — Later in the day, I noticed that yesterday’s USA Today had a “snapshot” (a little graphic in the lower left corner of the front page) titled “Which Investment Will Perform the Best”, taken from a survey recently conducted by Edward Jones. Topping the list was Technology (33%), follwed by Gold (31%), Blue-chip stocks (10%), Real Estate (9%) and International stocks (9%). Given that gold and real estate are both thought to be inflation hedges, it appears that the market still worries in that direction.

Nevada

Just came back from a day in Reno. (Hard to type that without hearing Johnny Cash in my head.) Sitting in the airport, I struck up a conversation with a young man sitting next to me. He asked what I did for a living, and as soon as I told him, he wanted to know my “economic prognosis” for Nevada. Whether I had a good one or not, I gave him my two cents worth.

Nevada — and Florida, for that matter — primarily make their living from three things: tourists, retirees, and people who care and feed the first two categories. (One might be tempted to add Arizona into the mix, but that would be a bit of a mistake. Arizona’s economy is a bit more complex. One might argue that Florida and Nevada’s are, too, but let’s go with it for a while.)

One immediate “hit” to the economies of both Florida and Nevada was tourism, as families (and in the case of Las Vegas, conventioneers) had to tighten their belts. However, this segment is actually coming back a bit, albeit not totally to pre-recession numbers. For example, Florida’s Gulf Coast Panhandle (the nine counties in western Florida) were actually seeing a resurgence of tourism until the Gulf Oil Spill. Occupancies in the Gulf Coast region on Memorial Day, 2009, were quite good, but then the oil spill hit, and occupancies were dismal on that same weekend, 2010.

Las Vegas is certainly in trouble, but some of that came from overbuilding. The Saraha just closed — it had been slated for a makeover, but the owners have decided to “go dark” for a while instead, waiting for the economy to turn. The Las Vegas City Center continues to be a prime example of speculative overbuilding, both rooms and casino space.

But, Reno isn’t Las Vegas. Sure, Reno has casinos and some gambling, but it’s more of a retiree area. This segment of the population has been hurt in two ways. First, they can’t sell their houses. Moving to Reno (or Ft. Lauderdale) generally requires selling a house in Los Angeles or Groton. As I’ve noted previously, the supply of existing homes is pretty stable, and even though new construction has tanked, the demand for owner-occupied homes is actually shrinking from its pre-recession peak of about 69.5%. Thus, retirees may WANT to move to Reno, but no one will buy their home in Los Angeles.

Second, POTENTIAL retirees look at their 401-K’s and start thinking, “wow, I guess I’ll need to work a few more years.” This has some long-term issues for the economy. First, every retiree who “stays” on the job means one applicant at the beginning of the work-force pipeline who can’t “get” that job (or at least the job that leads to it.) Second, early retirement is more care-free (both personally and financially) than late retirement. Thus, early-retirees generally spent financial assets into the system without making many demands ON the system (health care being the biggie). Now, many retirees will defer retirement until the fateful day when they start demanding more of the system than they are able to put into it. If we think medicare and social security are problematic NOW, wait until that reality takes hold.

From a housing perspective, large parts of the U.S. (Nevada, Florida, and, yes, big swaths of Arizona) have been built to accommodate retirees in between the time they “sell the big house” and the time they move into assisted living. A prolonged “work-life” means a significant lowering of demand for this segment of the housing market.

Gulf Oil Spill — Lessons Learned conference

I’ve just been confirmed as a speaker at the big one-year “Lessons Learned” conference on the Gulf Oil Spill, sponsored by Tulane University Law Center, American Lawyer magazine, and the Brickel and Brewer Law firm. The conference will be held at the Weston Canal Street in New Orleans on April 28th. I’ll be one of the “wrap up” speakers that afternoon, focusing on the impact of the oil spill on the value of bank collateral portfolios.

For more info on the conference, click here. Hope to see you there!

Japan — take 2

A correspondent on one of the news shows seemed almost apologetic this week in discussing investment opportunities following the crisis in Japan. I concur with the sentiment — the focus today must be on humanitarian and environmental concerns.

Nonetheless, Japan will fix the immediate problems, and then must move rapidly toward the economic issues. People need to be fed, housed, clothed, provided jobs, and treated medically. To accomplish this, they need energy (over 10% of their nuclear generating capacity has been wiped out) and capital.

It’s too early to get good facts on the housing disruption, but it is safe to say that the housing shortage will be north of a million units. The final tally will depend on whether or not large swaths of “buffer” zone will be created around the melted-down nuclear plants (probably so, but we don’t know for sure or how big yet). In a typical year, Japan builds less than 1 million housing units (788,000 in 2009), down from about 1.3-ish million a decade ago. Thus, the housing shortage will likely exceed a year’s typical output for their housing industry.

Further, even though Japan is a heavily forested country, they are the least-self-sufficient in terms of lumber of any developed nation in the world. By the last statistics I’ve seen (and these are estimates — Japan itself isn’t very forthcoming with this stuff) they import about 44% of their lumber needs. Canada has historically been their biggest supplier, followed by Russia, Indonesia, Malaysia, and the U.S.

From a global-trade perspective, this is problematic in the extreme. Ironically, the U.S.-Japan lumber trade has declined dramatically in recent years, due to foresting limitations here. China has become a big importer of lumber in recent years, principally from the same markets as Japan. Both China and Japan have faced the same commodity-price increases of late, mainly driven up by increasing demand in emerging markets.

Lumber is not the sort of thing that can be spun-up quickly. Here at Greenfield, world lumber supplies are not our expertise, and we would note that demand in the U.S. is down (due to the housing crisis) by an annual amount roughly equal to the potential housing disruption in Japan. Thus, there may be some offsetting world-supply equilibrium, albeit with prices (and transport costs) going through the roof.

None of this portends good things for prices of new homes in the U.S. One of the saving graces of the construction industry has been that costs of construction have fallen sufficiently so that builders can construct homes at prices which match the overall price decline. If lumber prices soar, as is quite possible, then it may very well be that homebuilders won’t be able to deliver homes at market prices. Since home builders are very much economic “price takers” right now, this could really be a short-term death knell for that industry and many of its smaller — and even larger — players.

…of Japan, earthquakes, and real estate

It’s hard to overstate our sympathies for our friends in Japan who find their country in tatters, with hundreds — if not thousands — of their fellow citizens dead, thousands (tens of thousands? hundreds of thousands?) more homeless, and the economy at a standstill. Fortunately enough, the Japanese are a terrifically resilient and stoic people, with a hard-working culture and more experience dealing with earthquakes than any other developed nation. I have no doubt they started the clean-up and rebuilding process the moment the aftershocks ended.

At Greenfield, we’ve enjoyed a terrific relationship with the Japan Real Estate Institute over the years. It almost seems embarrassing to talk about business while people are still dying, but a quick “google” search on news about the earthquake shows that the top page of stories deals with how this will affect global business, ranging from impacts on energy prices to the availability of Apple’s Ipad-2. Our focus, of course, is real estate, and that may prove to be one of the more interesting problems in this aftermath.

After WW-II, the Japanese people adopted a new constitution which was largely written by U.S. General Douglas MacArthur, the commander of the occupying forces. MacArthur really thought of himself as a Viceroy, and fashioned himself as an expert in governance. (In actuality, his administration of post-war Japan was probably the highpoint of his stellar career.) Despite being relatively conservative in most things, he was a very traditional liberal (albeit in a Victorian sense) in governance. As a result, the Japanese constitution provided for women’s suffrage. It also provided extraordinary rights to small, private property owners, as a mechanism to break-up the hold feudal land holdings. Indeed, eminent domain “taking”, as we think of it in the U.S., is very hard to accomplish in Japan. Small property owners — even the owners of the smallest pea-patch — have exceptionally strong property protections under law.

As great as this sounds, it makes it very difficult to clean up after a disaster. In 1995, Kobe was struck with what is known in Japan as the Great Hanshin earthquake, with a magnitude of 7.2. About the same time (1989), California was hit with the Loma Prieta earthquake, which measured 7.1. Both earthquakes hit in highly populated areas, although the Kobe quake killed over 6,000 while the Loma quake only killed 63. The Kobe quake destroyed about 200,000 buildings, while Loma damaged about 18,000 (12,000 homes and 6,000 businesses).

Of more direct comparison was the destruction in California of Oakland’s Cypress Street Viaduct and a portion of the San Francisco-Oakland Bay Bridge. In Japan, about 1km of the Hanshin Expressway collapsed.

In California, the highway collapses were repaired quickly. Indeed, one of the repair contractors won a huge bonus award for completing a large chunk of the work in record time, and the Bay Bridge was reopened in 32 days. The Cypress Street Viaduct required longer to replace, but traffic was rerouted quickly.

In Kobe, on the other hand, rubble from the expressway was still piled up five years later. Why? At the heart of the problem was access to private property under, near, and surrounding the expressway. Many of these small parcels had hundreds of individuals listed on deeds, and each of those individuals had to be contacted and permissions gained before reconstruction could begin.

Eminent domain can be a contentious issue here in the U.S. — taking agencies typically try to acquire property on a shoe-string, and my own analyses of “takings” appraisals show that they’re not done very well. That having been said, at least we HAVE mechanisms for handling these problems in the U.S., and should be thankful for that.

Again, our best wishes to our friends and colleagues in Japan. They’re going to need a lot of support as they emerge from these trying times. I also don’t want to forget our friends in New Zealand who had, on a relative level, an equally devastating earthquake in Christ Church. I have great friends from that country, and have enjoyed doing business down there. Best wishes to all of them.