Archive for the ‘Valuation’ Category

Housing equilibrium — part 1

This is going to be a bit convoluted, so bear with me.

This week, I’ve been at Renaissance Weekend, an annual gathering of top minds in a variety of fields (Nobel laureates, authors, actors, CEOs, etc) and I’ve been asked to make several presentations on real estate finance and economics. It’s a pretty heady experience, but more on that later.

One of the principle questions thrown my directions is, ‘When will real estate bottom?’ One might argue that commercial real estate has already bottomed, and there’s a fair amount of data to support that. (A weak “bottom”, I’ll grant you, but a bottom, none-the-less.) Apartments are coming back particularly strong, but even hotels and industrial are showing positive gains this year.

Owner-occupied residential is a completely different story. We’ve really never had a phenomenon like this, and according to both the Federal Housing Finance Authority and Case-Shiller, housing prices continue to collapse all across the country. Indeed, C-S just released a report two days ago indicating that new lows were hit in 6 out of 20 top markets. Overall, housing prices have been downtrending every quarter since mid-2007.

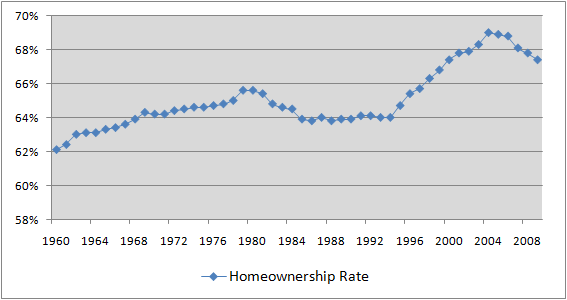

When will this bottom? I’m toying with a set of models which suggest that the pricing market won’t bottom until the ownership rate reaches an equilibrium. Heuristically, that optimal rate appears to be around 64%. Why? I’m looking at the last time ownership rates ballooned, which was at the end of the hyper-inflation period of the late 1970’s. Pricing markets stabilized after the ownership rates stabilized.

This posting is a deviation from my normal routine — My thinking on this topic is evolving, and I’m hoping to trace that evolution here on the blog until I reach something that I can actually flesh out into a paper. I’d appreciate any comments you have, either added as a comment here on the blog or, if you’d like privacy, e-mail them directly to me (john@greenfieldadvisors.com)

Fa.. la… la… la.. la…

Having a good holiday season yet?

About 20 years ago (darn, time flies…) I wrote a paper using Monte Carlo simulation to model the potential failure rate in shopping centers. Ended up presenting it (of all places) at a major Economic Geography conference, and it got published in the proceedings of that conference.

Now fast forward to today. As regular readers know, we do a LOT of environmental valuation work. I don’t use M/C simulation, even though it has been used in the valuation literature. Well, this year, the 5th Circuit Court of Appeals was faced with an environmental case in which the testifying expert used M/C simulation to aid in allocating damages between two responsible parties, Lyondell Chemical Co. v. Occidental Chemical Corp., 608 F.3d 284 (5th Cir. 2010).

“The other side” opposed M/C, arguing that it hadn’t been applied in these cases, and that the error rate could not be determined. The Appeals Court rejected those arguments, and ruled in favor of M/C.

Neat. I need to work up a working paper on this, but I can already see some significant applications to what we do.

Tis the season….

Intriguing mixed messages from the economy. Employment continues to lag, but holiday shopping was up. Go figure?

Two or three things may be in store. First, I’m sure that some of the more profitable businesses, fearing future tax increases, were holding off spending tax-deductable money until 2011 rather than 2010. The key lesson for lawmakers — get some stability and predictability into the tax system.

Second, while “on-line” shopping went up, the unmeasured impact of on-line was the ability to target shopping. Lots of holiday shopping went at bargain prices, and I’m interested to see how much sustainability there will be in the increases. It’s very difficult to imagine, with the underlying instability in economic fundamentals, just how long the shopping bubble can be sustained.

But, on to real estate. What looks good right about now? What looks bad? We continue to be doom-sayers on housing construction into 2011. Normally, in a recession, there’s a build-up of excess supply (construction in the pipeline pre-recession get unsold DURING the recession). However, past recessions rarely have a contemporaneous melt-down in homeownership rates (see the following).

Note that since we began keeping records in 1960, ownership rates have inexorably trended upward but for two instances — this one and the 1980-84 period. After 1984, it took until the mid-1990’s for rates to start trending upward again, and many would suggest that this up-trend was only the result of Greenspan’s “easy money” policies. In a more cautious lending environment, it’s hard to say where the true equilibrium might lie. However, it’s intriguing that the run-up in the 1970’s is often blamed on the high levels of inflation (making home ownership the favored “inflation hedge” for families) and that in the post-recession, low-inflation period of the late 80’s and early 90’s, rates seemed to hover around 64%.

If in fact that’s where the equilibrium lies, then the U.S. has about three more percentage points in owner-occupied homes to absorb. This absorption occurs in one of three ways — growth in the population, conversion of homes to other uses (usually rental in lower-end or transitional neighborhoods), or demolition. Whatever the reason, with the current slope of the trend-line (which, intriguingly, matches the slope of the 1980-84 period), we see that it took about 5 years (2004 through 2009) to get from about 69% to about 67%. At this rate, getting to 64% will take another 7 – 8 years, suggesting a best case scenario of stability in the 2016 range.

This scenario, interestingly enough, matches some of the employment-growth scenarios I’ve seen, which suggest we’re looking at the mid-to-late teens for unemployment to get back down to pre-recession levels.

So, if owner-occupied housing stinks, what looks good on the menu? Apartments. In very rough numbers, we WERE building about 1.5 million homes per year prior to the recession (year-in, year-out, with a HUGE amount of variance from year to year). Now-a-days, we’re building about a third of that or less, suggesting an un-met demand for housing of about a million units per year, more or less. Apartment construction also flat-lined during the recession, primarily because banks simply didn’t have the money to lend for construction financing. (Permanent money comes from other sources, and it’s available, but the construction financing problem is still with us.)

As credit continues to ease — particularly with the recent announcements by the FED in that regard — we can see some strong lights at the end of that tunnel. Good news for construction workers — their unemployment rates have been huge lately, but the same folks who drive nails for owner-occupied homes can also drive nails in apartment complexes. Easing credit in this area will thus fuel job growth, which also fuels consumption, home purchases, etc. Thus, addressing the housing demand/supply problem may be the most important single thing policy makers can do to restore the economy to good health.

Post Thanksgiving, time to go back to work…

In past years (say, pre-2008), the Thanksgiving thru New Years period at Greenfield was always slow, as clients and projects seemed to hunker down for the holiday season. Naturally, 2008 was an aberration on a number of levels — the real estate let-down was in full force, and while our business flow was down, we were busy “hunkering down” for what we projected would be a long recession trough.

Last year (2009) was unpredictable. The first half of the year was dreary, but the last half was a rebuilding period for us, as has been 2010. We’re not yet where we want to be (that is to say, back on our pre-recession growth curve), but the accumulations of lessons-learned have put us in a great position for the future.

I’m commenting on our specific experience at Greenfield for a reason. I think our own company experiences are emblematic of what is happening at tens of thousands of other businesses across the U.S. and other countries, and has significant implications for the future of real estate, the economy, and finance for the next few years. I’m always reluctant to get into the prediction business (I’ll leave that up to Faith Popcorn and her ilk), but I can make a few generalizations, particularly as the parallel what I saw back in the 1970’s —

1. Business profits (and valuations — as we see from the stock market) are headed upward, not so much from increased sales (flat across the board) but also thru extraordinarily increased efficiency. One might wonder, if firms are so doggone efficient today, why weren’t they acting efficiently a few years ago? Simply put, “efficient” firms don’t grow very well. Growth usually requires a significant degree of wastage. Hewlett Packard was famous for this — they would budget engineers a certain amount of time and support to just tinker with things, knowing that the sort of Edison-esque profitability that came out of such tinkering. At one time, Xerox was so inventive that they thru away lots of great ideas, the Graphical User Interface being the best known example. Additionally, efficient firms cut wa-a-a-a-a-y back on hiring, training, and marketing. We see this now on college campuses, as new graduates (even in the “vocational” schools like business and engineering) are getting no offers or offers far beneath what their big brothers and big sisters got a few years ago.

2. This “hunkering down” not only cuts the demand for commercial real estate, but also means we may have a substantial excess supply of offices, warehouses, and shopping centers for some time to come. Ironically, business travel is coming back (as executives work harder to sell the same amount as before) but everyone is going “down” a notch on the hotel food chain — executives who used to stay at a Ritz Carleton are now at Marriotts, and former Marriott customers are now at Courtyard Marriotts. (Intriguingly, the Marriott organization is highly vertically integrated, and so actually takes great advantage of this phenomenon). The interesting off-shoot is that while aggregate hotel room counts are up, hotel employment lags (as customers move from “full-service” to “limited service” stays). The same is true with hotel restaurants, as dining-out budgets get slashed.

3. The “trainee” employment picture is worsening in some ways, but may actually improve in others. As noted, new graduates are having real problems getting placed, and are having to accept entry-level jobs far below expectations. I spoke with a young woman recently who graduated in 2010 in Finance. She had great grades and a stellar resume, and fully expected to get an entry-level job commensurate with her expectations. Guess what? No one is hiring. After several frustrating months, she accepted a job as a teller at a Credit Union at about half the starting salary she’d previously expected. Is there a silver lining in this? Yes, two. From the business’ perspective, they’re getting entry-level talent at bargain basement prices, and if they’re willing to mentor and foster these kids, they’ve got talent who will have a much greater familiarity with the nuts-and-bolts of the business once expansion does return. From the “hiree’s” perspective, a foot in the door builds experience and puts her at the starting gate ahead of the rest of the pack.

4. The early 1980’s recession was actually the last of a series dating back to the late 1960’s (the period was called “stag-flation”). While the early-80’s recession was the worst of the bunch, it seemed to have wrung the last of the “bad stuff” out of the economy, and set the stage for two decades of nearly continuous growth. Many credit the pro-business agenda of the Reagan Administration, but that ignores the tremendous pent-up inventiveness which had been waiting for an opportunity. Gates, Allen, Jobs, and Wozniak had been tinkering with computers and software for a decade, but needed a business expansion to really get themselves going. Sam Walton had great ideas about merchandising, but the explosive growth of WalMart depended in no small part on the availability of cheap construction and development credit to build mega-stores at seemingly every street corner. We decry the sloppiness of the mortgage market of the past few years, but no one seems to complain about the millions of construction workers and realtors who rode from apprenticeship to retirement on the wave of the housing boom. Recessions do not last forever, although this one does have the symptoms of lasting for a while longer. When 4% GDP growth returns (and remember, folks, that’s really all it takes), we should be poised for a period of expansion not-unlike the one that started in the mid-1980’s.

Well, folks, that’s really it. Like most of you, I have a lot to be thankful for. I live in a fairly free country, with an economy that considers 9% unemployment and 2% GDP growth to be unacceptable. I get the opportunity to interface with students and young folks on a daily basis, and they constantly refresh my positive outlook for the future.

Valuation Colloquium

I’m writing this from the audience at an invitation-only colloquium on real estate valuation, held at Clemson University and sponsored by a number of high profile groups, including Argus Software, the Appraisal Institute, the Homer Hoyt Institute, the Maury Seldin Advanced Studies Institute, and of course Greenfield Advisors.

This is the third in a series of such advanced meetings, begun in 1964 and held roughly every 20 years. The first was at the U. Wisconsin, and the second at U. Connecticut. The purpose of these gatherings is to bring together both top academic scholars as well as the top practitioners to discuss the future of the profession, both organizationally and methodologically. The past meetings were decidedly U.S. in focus, while this year’s meeting is co-hosted by Nick French (U.K.) and Elaine Worzala (U.S.) and has substantial European, Latin American, and Pacific Rim participation. Consistent with the rapid changes in the field, future colloquia will be held more frequently, and the next one is tentatively slated for Oxford, England.

Papers and proceedings of the meeting will be published in the Journal of Investment and Finance in the near future.

Foreclosure fiasco, redux

It’s not normally my practice to imbed other people’s videos, but this is absolutely a hoot, and frankly quite informative. Sad, but true.

http://www.thedailyshow.com/watch/thu-october-7-2010/foreclosure-crisis

October 10 — Update #2

Since my last post, I also had the privilege of attending (and speaking) at the semi-annual meeting of the Real Estate Counseling Group of America (RECGA). RECGA is a small but highly influential group, founded in the 1970’s by the great real estate valuation leader, Dr. Bill Kinnard, and over the years has counted in its membership many of the presidents of the Appraisal Institute and other leading groups, editors of several of the top real estate journals, noted professors and highly influential authors in the field.

The Fall meeting was held in Washington, DC, and the core of the meeting was Friday’s educational session. Max Ramsland opened up with a presentation demonstrating the impact of the number of anchor tenants on the appropriate cap rate of shopping centers. Carl Shultz, a member of the Appraisal Standards Board, followed with a discussion of impending changes to the Uniform Standards of Professional Appraisal Practice (USPAP). These changes are currently discussed in an Exposure Draft, which he invited RECGA members to revieww and submit comments about, and will be incorporated (with appropriate changes) in the 2012 edition of USPAP. Both Mr. Ramsland and Mr. Shultz are also RECGA members.

Two non-members followed with somewhat related presentations on eminent domain. Scott Bullock from the Institute for Justice was one of the attorneys who argued the famed Kelo case before the U.S. Supreme Court, and he discussed the status of eminent domain law since that landmark case. With a somewhat different perspective, we heard from Andrew Goldfrank, a U.S. Justice Department attorney who heads up all Federal takings litigation.

The afternoon session kicked off with David Lenhoff, a RECGA member and former editor of the Appraisal Journal, who discussed the complex issues surrounding hotel valuation. I followed with a brief synopsis on the Gulf Oil Spill, focusing on the current status of the claims and litigation processes. Reeves Lukens, a RECGA member, and his son, Tripp Lukens, discussed the state of pharmaceutical properties in the U.S. Joe Magdziarz, who is the incoming president of the Appraisal Institute (AI) discussed the current issues facing that organization, with a particularly emphasis on the recent controversies between AI and the Appraisal Foundation (AF). Notably, the founding Chair of AF, Jeff Fisher, is a RECGA member and was able to provide some historic commentary. RECGA members Jeff Fisher and Ron Donahue brought the day to a conclusions with discussions about the state of the securitized real estate market, including REITs.

For more information about RECGA, visit the web site, www.recga.com.

Foul weather, foul moods

It’s fall. The time of year when Seattle’s absolutely beautiful summer turns into yechy autumn.

With all of that in mind, three yechy pieces of economic info hit my desk all at once today. First, the Conference Board’s Consumer Confidence Index hit a 7-month low of 48.5, which was not only lower than last month (53.2) but also much lower than economists consensus forecast (52.1). Why? The general public has internalized the notion that significant levels of unemployment will be with us for quite a while.

Then, the Business Roundtable released it’s 3rd quarter 2010 CEO survey. You’d think, with corporate profits on the rise, that this bunch would be breaking out the good champagne. But no, even though major corporations plan to increase capital spending over the next few months, they have lower expectations of both revenues and employment.

Finally, S&P Case Shiller, who normally send out quarterly reports, sent me a July update (dated September 28), which shows housing prices continue to be disappointing. While prices are, indeed, up from a year ago (by about 4%), the price index has been cycling below 2003 levels for over a year. Among major markets, the best year-on-year performance was in San Francisco (up 11.2%) while the worst was in Las Vegas (down 4.9%). Intriguingly, all of the California major markets are looking strongly up.

My upcoming schedule

The next couple of months will be pretty busy, “speaking engagement” wise. Thought I’d keep you up-to-date on what’s in store.

This month, most of my travel is for business meetings, with only ONE presentation on tap — I’m a member of the Real Estate Counseling Group of America (and allegedly the Membership Chair, but I’m not quite sure yet what that means) and our semi-annual meetings are scheduled for D.C. the last weekend in September. I’ll speak in Friday morning on the Gulf Oil Crisis (naturally). Right now, I’m figuring out how to embed YouTube videos into a powerpoint presentation. Wish me luck.

On October 7, I’m back in the Pacific Northwest as the keynote speaker for the annual Brownfields Conference, sponsored by the Northwest Environmental Business Council.

We TENTATIVELY have a web-in-ar planned for October 29 on the Gulf Oil Spill. More on that later. If you want info (as soon as we have scheduling), please send us an e-mail at info@greenfieldadvisors.com and we’ll be sure to keep you up-to-date.

Finally (well, not FINALLY, but at least for this list…) I’m scheduled to be in Miami Beach on November 4 to speak on the Gulf Oil Crisis at the Ritz Carleton Miami Beach (Yeah — terrible job I have, right?). For more info on that conference, click here.

wow!

I hate to brag (not really… but I needed to say that…)

I JUST got the word that my paper, “Appraisal Error Terms and Confidence Intervals” won the “Best Appraisal Paper” award at the 2010 American Real Estate Society conference. The award — which includes a non-trivial cash prize, as well — is sponsored by the Appraisal Institute.

Thanks to everyone here at Greenfield who contributed to this paper. I’ll soon post a copy to our web site.