Latest from S&P Case Shiller

The always excellent S&P Case Shiller report came out this morning, followed by a teleconference with Professors Carl Case and Bob Shiller. First, some highlights from the report, then some blurbs from the teleconference.

The average home prices in the U.S. are hovering around record lows as measured from their peaks in December, 2006, and have been bounding around 2003 prices for about 3 years. Overall in 2011, prices were down about 4% nationwide, and in the 20 leading cities in the U.S., the yearly price trends ranged from a low of -12.8% in Atlanta to a high (if you can call it that) of 0.5% in (amazingly enough) Detroit, which was the only major city to record positive numbers last year. In December, only Phoenix and Miami were on up-tics.

The average home prices in the U.S. are hovering around record lows as measured from their peaks in December, 2006, and have been bounding around 2003 prices for about 3 years. Overall in 2011, prices were down about 4% nationwide, and in the 20 leading cities in the U.S., the yearly price trends ranged from a low of -12.8% in Atlanta to a high (if you can call it that) of 0.5% in (amazingly enough) Detroit, which was the only major city to record positive numbers last year. In December, only Phoenix and Miami were on up-tics.

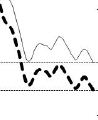

One thing struck me as a bit foreboding in the report. While housing doesn’t behave like securitized assets, housing markets are, in fact, influenced by many of the same forces. Historically, one of the big differences was that house prices were always believed to trend positively in the long run, so “bear” markets didn’t really exist in housing. (More on that in a minute). With that in mind, though, w-a-a-y back in my Wall Street days (a LONG time ago!), technical traders — as they were known back then — would have recognized the pricing behavior over the past few quarters as a “head-and-shoulders” pattern. It was the mark of a stock price that kept trying to burst through a resistance level, but couldn’t sustain the momentum. After three such tries, it would collapse due to lack of buyers. I look at the house price performance, and… well… one has to wonder…

One thing struck me as a bit foreboding in the report. While housing doesn’t behave like securitized assets, housing markets are, in fact, influenced by many of the same forces. Historically, one of the big differences was that house prices were always believed to trend positively in the long run, so “bear” markets didn’t really exist in housing. (More on that in a minute). With that in mind, though, w-a-a-y back in my Wall Street days (a LONG time ago!), technical traders — as they were known back then — would have recognized the pricing behavior over the past few quarters as a “head-and-shoulders” pattern. It was the mark of a stock price that kept trying to burst through a resistance level, but couldn’t sustain the momentum. After three such tries, it would collapse due to lack of buyers. I look at the house price performance, and… well… one has to wonder…

As for the teleconference, the catch-phrase was “nervous but hopeful”. There was much ado about recent positive news from the NAHB/Wells Fargo Housing Market Index (refer to my comments about this on February 15 by clicking here.) The HMI tracks buyer interest, among other things, but the folks at S&P C-S were a bit cautious, noting that sales data doesn’t seem to be responding yet.

There are important macro-economic implications for all of this. The housing market is the primary tool for the FED to exert economic pressure via interest rates. Historically (and C-S goes back 60 or so years for this), housing starts in America hover around 1 million to 1.5 million per year. If the economy gets overheated, then interest rates can be allowed to rise, and this number would drop BRIEFLY to around 800,000, then bounce back up. However, housing starts have now hovered below 700,000/year every month for the past 40 months, with little let-up in sight.

Existing home sales are, in fact, trending up a bit, but part of this comes from the fact that in California and Florida, two of the hardest-hit states, we find fully 1/3 of the entire nation’s aggregate home values. The demographics in these two states are very different from the rest of the nation — mainly older homeowners who can afford now to trade up.

An additional concern comes from the Census Bureau. Note that for most of recent history, household formation in the U.S. rose from 1 million to 1.5 million per year (note the parallel to housing starts?). However, from March, 2010, to March, 2011, households actually SHRANK. Fortunately, this number seems to be correcting itself, and about 2 million new households were formed between March, 2011, and the end of the year. C-S note that this is a VERY “noisy” number and subject to correction. However, the arrows may be pointed in the right direction again.

Pricing still reflects the huge shadow inventory, but NAR reports that the actual “For Sale” inventory is around normal levels again (about a 6-month supply). So, what’s holding the housing market back? Getting a mortgage is very difficult today without perfect credit — the private mortgage insurance market has completely disappeared. Unemployment is still a problem, and particularly the contagious fear that permeates the populus. Finally, some economists fear that there may actually be a permanent shift in the U.S. market attitude toward housing. Historically, Americans thought that home prices would continuously rise, and hence a home investment was a secure store of value. That attitude may have permanently been damaged.

“Nervous, but hopeful”

Leave a comment