Posts Tagged ‘Stock Market’

The K-Shaped Economy

“I’m mad as hell, and I’m not going to take it anymore!” (Howard Beale, played by the actor Peter Finch, in the movie “Network”, 1976)

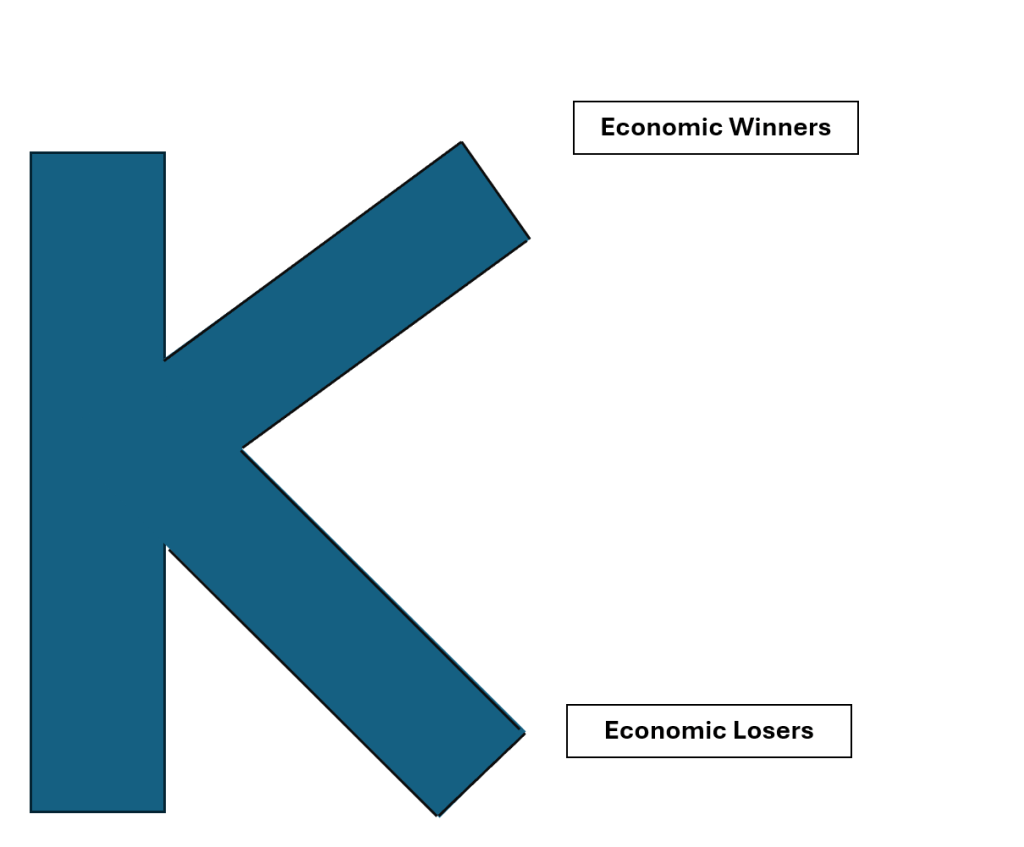

In the coming days you’re going to hear the phrase ‘K-Shaped Recovery’ bantered about by economists. It’s a little misleading, because it suggests we’re in the midst of some kind of economic recovery. In fact, we’re not, but it harkens back to basically everything that’s happened since the Pandemic, and it also explains the National and World politics, the state of the nation, and the state of everyone’s pocketbooks.

In a ‘K-Shaped’ economy, there are winners and losers. Now, you might say, “Hey, John, haven’t there always been winners and losers in the economy?” and I would say, “Yeah, but generally not so predictably systematic.

If you went into the pandemic with money/assets, or a job in high-demand sectors, or both, then you’ve done quite well over the past five years. If you didn’t have money/assets, and had a job in low-demand sectors, then you’ve done quite poorly.

The 2024 election turned on this issue. Most (but not all) economic winners were likely to vote to stay the course. Economic losers were likely to vote to change. Change won. Today, though, the economic losers are getting worse off, and the economic winners (amazingly enough) are getting better off.

So, what can be done to fix this? Pretty much the opposite of what’s being done right now. First, America benefits from wide-open free trade. We send dollars (which we can print by the bucketload) in return for cheap goods. We also sell lots and lots of stuff that provides lots and lots of employment, like soybeans and airplanes and Hollywood movies and the upper echelons of technology.

Second, the social safety net is crumbling. It’s crumbling because very short sighted billionaires wanted tax cuts, which in the long-run are counterproductive to their best interests. These billionaires generally sell stuff to consumers. If consumers at the bottom half of the economic ladder cannot afford to buy their stuff, then in the long run, Amazon and Walmart and Apple have unsustainable business plans. For example, people make bad economic decisions in the absence of a good health care system, a healthy housing market, or stable food prices.

Third, controlled and regulated immigration is and always has been extraordinarily healthy for the economy. It brings in hard workers who are anxious to take the lowest jobs on the ladder, and pushes higher-paying jobs up the economic ladder.

Fourth, education is key. Instead of eviscerating our schools, we should double-down on public education and add to that skilled trade education. Teachers should be among the best paid professionals in our society. (Right now, nursing schools cannot find professors because the private sector pays so much better than the nursing schools can manage.)

Fifth, we should develop trade alliances with the other democracies in the world, rather than force them into the arms of our economic enemies. China’s belt-and-road strategy was brilliant. We can duplicate that with agencies like USAID. The free nations of the world would much rather ally with us, but we’ve shut the door on them.

Sixth, our infrastructure – and particularly our energy grid – is in serious need of attention. This is a powerful investment, and would have the same multiplier effect as the development of the interstate highways in the 1950’s and 60’s.

Are you mad as hell? Yes, you ought to be. Particularly if you’re a soybean farmer, or a recent graduate looking for a job, or a contractor who can’t afford to buy lumber, an immigrant who just wants to put in an honest day’s labor, or a young person who wants to buy a house but can’t make the down payment.

A few thoughts about the stock market

As the Dow Jones Industrial Average creeps ever so slowly toward 13,000, I’m reminded of the words of William Shakespeare, from the famed “Seven Ages of Man” soliloquy in the comedy, As You Like It:

…and then the whining school-boy, with his satchel and shining morning face, creeping like snail, unwillingly to school…

Now of course this blog is primarily focused on real estate and the various economic forces that affect it. However, since so much of real estate is securitized, particularly in the U.S., and so many of the players in the real estate market are publicly traded companies, an occasional glance at the ticker-tape is in order.

With that in mind, I have a small idea. It’s not a huge one, but just a little observation, if you will, about why the market is creeping so slowly, even though so many pundits claim that it’s underpriced right now. (I neither agree nor disagree with that sentiment — I’m in a wait and see mode.)

However….. I serve on the board of a small Trust which is VERY conservative. Our sole manager also manages a lot of high-tech money (remember — Microsoft is headquartered here… duh…). We have a lot of liquidity, and even our bond investments have a very short average duration.

As one money manager put it to me, “Our clients aren’t interested in MAKING money in the stock market. They just don’t want to LOSE any more money in the stock market.”

Thus, there MAY BE some upside potential to this market. However, it may take a long time to realize it, because so many money managers got singed in the flames of the market burn-out a few years ago.

Conerly’s Businomics Newsletter

I’ve mentioned before that one of my favorite economic writers, particularly for the Pacific Northwest, is Dr. Bill Conerly out of Lake Oswego, Oregon. Even though Greenfield’s practice is national, we have to maintain a bit of a Northwest focus to our work. Dr. Conerly helps us with the underlying economics driving the economy of this salmon habitat in which I live.

Dr. Conerly’s “charts” are wonderfully informal and informative at the same time. In the ‘old days’ he would simply hand-write his thoughts on the charts then fax them to his subscribers (remember “faxing”?). Today, of course, it’s all digitized and stored on his web site, with an emailed link. Nonetheless, the succinct hand-written notes are still there, and the brevity is welcomed. (I could learn from that.)

Rather than reproduce the charts here, I’ll simply give you a link (here) and you can go view them yourself. If you’d like to contact Dr. Conerly — he’s a great speaker and consultant on economic issues — then the e-mail address is bill@conerlyconsulting.com. A quick synopsis may whet your appetite:

- Business equipment orders are still not back to the pre-2008 peak.

- Consumer sentiment is up, but not back to 2007 levels

- A January, 2012, Wall Street Journal survey pegged the risk of recession at 19%

- Private non-residential construction has “turned the corner”, but is still significantly lower than 2007-2009 levels.

- Unemployment: great headlines, but we’re a very long way from feeling good.

- Mortgage rates are at all-time lows, but only if you have great credit.

- Stock market: lots of up-side if Europe manages to muddle through

- Oregon and Washington bankruptcy filings on the way down, but still over double the 2007 rates

- Boeing orders may be tapering off, but still significantly exceed deliveries — no need to cut output

- Wheat prices (an important economic component in our area) are downturning, due to the global slowdown.

Well, folks, that’s about it — great reading from a great analyst.

Yet another comment about today’s economic news

It’s hard NOT to be pleased at today’s economic news. The unemployment rate is down, total employment is up (the two numbers don’t ALWAYS move in sync, due to the growth in the potential workforce), the stock market is up, the dollar is up versus the Euro, Yen, and Pound (not always a good thing), and bond yields are up (reflecting a potential demand for borrowing — a very “old school” view of stocks versus bonds). Intriguingly, oil is up but only by $0.59 a barrel as of this writing (12:35am EST on Friday the 3rd) — one would normally expect that great economic news would spur a run on oil.

Which may, in fact, reflect the continued anxiety in the marketplace. Recessions rarely happen in a straight line (see my post a few weeks ago on the relationship between the yield curve and the onset of a recession — click here for a shortcut). Real estate continues to be in disarray, and the banking sector is still in rehab, with the continued concern of a relapse if the Euro crisis doesn’t solve itself.

Ben Bernake’s testimony before the House Budget Committee this week was painful to watch — members of Congress would prefer to listen to themselves rather than the Chair of the Fed, and it was clear that members of that august committee had only a cursory understanding of what the FED actually DOES. Nonetheless, a piece of Bernake’s testimony had the tone of Armageddon. He noted that we’re on our way to addressing the CURRENT problems — the huge deficit overhang, the Euro crisis, etc. Congress still has ample work to do in those areas, but we are at least confronting the issues. The larger problem, in his mind, is what start happening in about 10 years or so when the demographic overhang starts hitting. The rapid shrinkage in the number of people PAYING into social security and medicare versus the number of people COLLECTING these transfer payments will be substantial, and this doesn’t even begin to address the productivity problems associated with a society in which a substantial number of people are retired and not contributing to the nation’s output.

Sigh…. at least it looks great today, right?