Posts Tagged ‘Philadelphia FED’

Phily Fed — Econ Forecast

One of my favorite economic touchstones is the quarterly survey of professional economists by the Philadelphia Federal Reserve Bank. Forty-four economists are surveyed, including such notables as Mark Zandi from Moodys, John Silvia from Wells Fargo, and Neal Soss from Credit Suisse. The focus is on “practicing” economists rather than “academics”, and as such gives a great snapshot of what decision makers at major corporations are thinking.

The Phily Fed then takes a synopsis — both a mean and a distribution — of their collective thinking in several key areas, such as Real GDP growth, unemployment, monthly payroll growth, and inflation. The interesting factors include both the current thinking, the CHANGE in current thinking (from the previous projections) and the probability distribution.

Current thinking about GDP growth is a bit less optimistic than it was before. As noted in the graph below (reproduced from the Phily Fed’s report), prior consensus thinking put GDP growth in the 3.0% to 3.9% range, while the current consensus mid-point is between 2.0% and 2.9%. Good news — hardly anyone projects negative GDP growth for this year. As we get into out-years (the graphics are on the Phily Fed’s report), which you can download by clicking here ), the consensus is a bit blurry, but in general most economists still see GDP growth postiive and between 2% and 4%. Unfortuantely, this isn’t the best of news — for the U.S. economy to really get back on track, much stronger GDP growth is needed (solidly high 3% range and even above 4%).

Unemployment projections for 2011 are somewhat rosier. In the prior survey, the mean projection was in the range of 9.0% to 9.4%, with a significant number of economists projecting from 9.5% to 9.9%. Currently, the mean is 8.5% to 8.9%, and a signficant number project in the 8.0% to 8.4% range — a very real shift in the outlook for the nation’s economy as we head into the second half of the year. On the downside — projections for out-years (2012, 2013, and 2014) show a very slow restoration of “normality”, with mean unemployment projections above 7% in all years.

One piece of good news — and this may be the FED patting itself on the back a bit — is that its inflation projections have been quite accurate over the years, and they continue to forecast exceptionally low CPI changes over the next ten years. While the median forecast is up slightly from last quarter (2.4% up from 2.3%), this continues to be great news for consumers and bond-holders. Notably, as you can see from the graphic, there is a fair degree of agreement among economists surveyed — the interquartile range is less than a percentage-point.

Two in one day?

Yeah…. Friday seems to be busy.

Two of my favorite newsletters hit my desk today — the Conerly Businomics Newsletter from Dr. Bill Conerly and the Philadelphia FED’s Survey of Professional Forecasters. You can reach the first one via the link on the right of this page (scroll down and look for Conerly). I’ll take a couple of minutes on the second one, though.

For quite a few years, the Phily FED has surveyed a host of leading economic forecasters (this quarter, it’s 43), and reported their median expectations on inflation, GDP growth, etc., as well as the dispersion around the median. The median gives a fairly good idea of the central tendency of economic thinking, and the dispersion measures let us know how “solid” that central tendency is. In general, this group tends to move together, which means that the dispersion measures usually aren’t very great, and when they’re wrong, they’re all wrong together. (Intriguingly, that means that economic markets are efficient but for unpredictable economic shocks. That in and of itself could lead to a wonderful discussion of Arbitrage Pricing Theory, but I don’t have time or patience for that…)

Even more interesting — and this may be the best stuff in the report — is the change in sentiment from one quarter to another. In short, how is new information being captured in economic forecasts? The magnitude and direction of change is often a more important element in the market than the absolute value of things. For example, prices are what they are, but the CHANGE in prices over time, and the magnitude of that change, is called inflation. Get it?

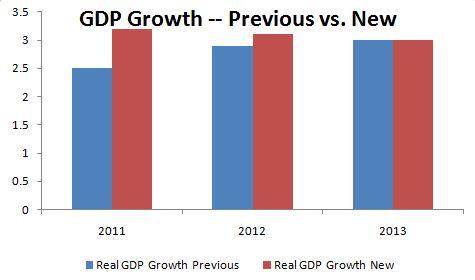

The following chart shows the consensus opinions on GDP growth for the coming 3 years. As you can see, there is a generally higher consensus for this year and next, and in fact (as not reflected on this chart) the biggest “jump” is in near-term growth rates, which are expected to be particularly robust during the first half of 2011.

Coupled with that, we see marginal improvement in the unemployment picture, although (and consistent with our own thinking) unemployment will continue to be a drag on the economy for quite a few years to come.

For a complete copy of the survey results, visit the Philadelphia FED by clicking here.