Yield curves and real estate

Every economist and his kid brother are out there touting the negative slope on the yield curve as a harbinger of the Apocalypse. I have to confess I raised the issue in a blog post back in August. (https://johnakilpatrick.com/tag/recession-risk/) Dr. Ed Yardini of Yardini Research released some charts yesterday which suggest that all this wailing and rending of clothes may be a bit premature (https://www.yardeni.com/pub/bearmktind.pdf). Nonetheless, none of this says anything about the yield curve and real estate.

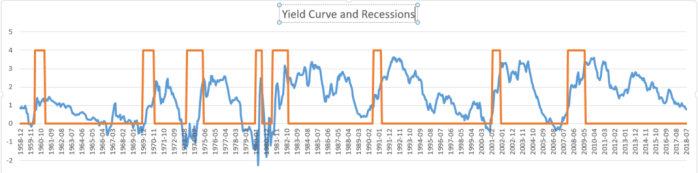

To reflect, here is the core chart I used back in August, although I’ve updated it to reflect end-of-February numbers. Note that as of the end of February, the yield curve was still positive. It didn’t turn negative until last week.

The orange line notes the incidence and length of recessions. (I happen to use 6-month t-bills in my data, while other analysts use 3-month. The difference is negligible.)

Last week, I took a look at the NAREIT index back to 1972 (the earliest data I have available). Admittedly, the NCREIF index might be a bit more telling, but NAREIT also includes income along with capital gains, and as a matter of simplicity, I don’t have NCREIF data handy right now. Anyway, I did two things. First, I replicated the chart above but rather than looking at the incidence of recessions, I looked at the incidence of down-turns in the NAREIT index. To smooth thing out, I used a 12-month moving average. The results are visually interesting, and in fact very conclusive.

As you can see, real estate returns, when viewed on a 12-month scale, have been fairly positive almost continuously since 1972, with the exception of course of the “great recession” of 2007-2009. Indeed, visually there appears to be no relationship at all between the yield curve and real estate returns.

To analyze this a bit further, I looked at the relationship with a simple regression. There is simply no relationship at all (p-value = 0.50) between the yield curve and real estate returns. Indeed, notably, the real estate downturn in 07-09 followed a yield curve inversion, but by over two years. I think few economists would disagree that the 07-09 downturn was related to a host of structural issues, and had very little to do with a yield curve inversion. Indeed, one might posit that the yield curve inversion was driven by real estate returns, and not the other way around!

In short, while the stock market may be shuddering from yield curve flu, the real estate markets are another thing entirely. That’s one of the reasons why properly and expertly curated real estate is usually viewed as an excellent diversifier in a portfolio.

Leave a comment