Posts Tagged ‘history’

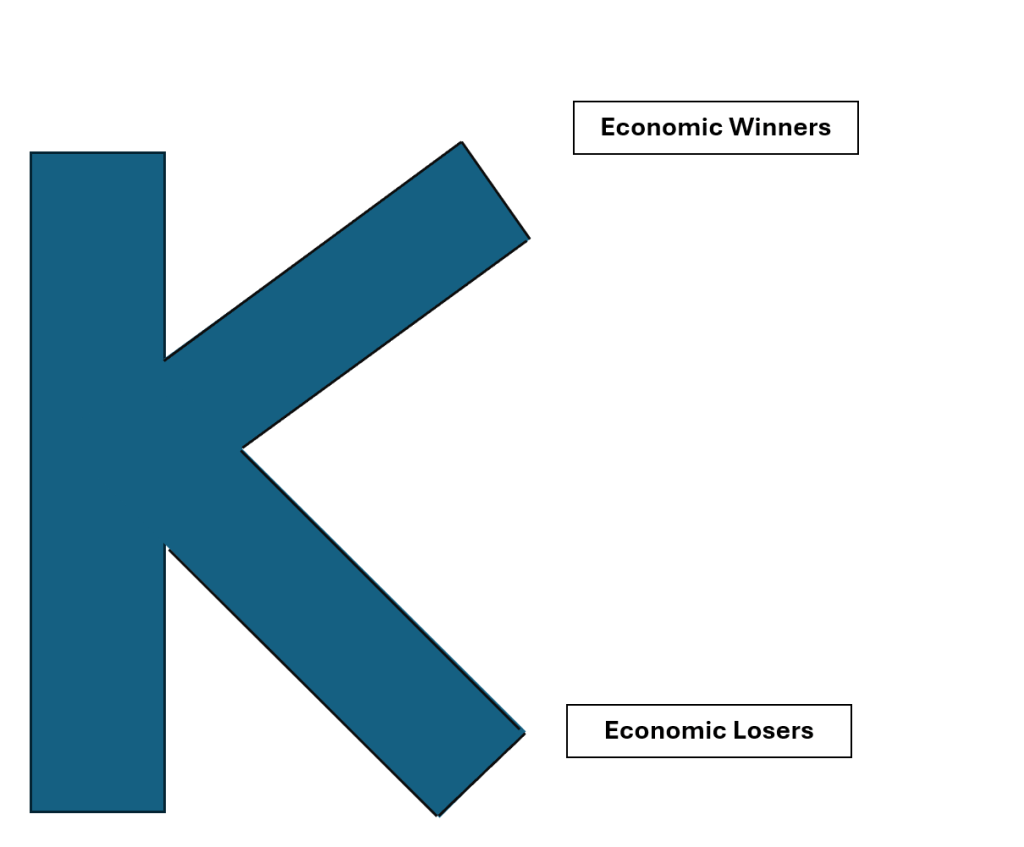

The K-Shaped Economy

“I’m mad as hell, and I’m not going to take it anymore!” (Howard Beale, played by the actor Peter Finch, in the movie “Network”, 1976)

In the coming days you’re going to hear the phrase ‘K-Shaped Recovery’ bantered about by economists. It’s a little misleading, because it suggests we’re in the midst of some kind of economic recovery. In fact, we’re not, but it harkens back to basically everything that’s happened since the Pandemic, and it also explains the National and World politics, the state of the nation, and the state of everyone’s pocketbooks.

In a ‘K-Shaped’ economy, there are winners and losers. Now, you might say, “Hey, John, haven’t there always been winners and losers in the economy?” and I would say, “Yeah, but generally not so predictably systematic.

If you went into the pandemic with money/assets, or a job in high-demand sectors, or both, then you’ve done quite well over the past five years. If you didn’t have money/assets, and had a job in low-demand sectors, then you’ve done quite poorly.

The 2024 election turned on this issue. Most (but not all) economic winners were likely to vote to stay the course. Economic losers were likely to vote to change. Change won. Today, though, the economic losers are getting worse off, and the economic winners (amazingly enough) are getting better off.

So, what can be done to fix this? Pretty much the opposite of what’s being done right now. First, America benefits from wide-open free trade. We send dollars (which we can print by the bucketload) in return for cheap goods. We also sell lots and lots of stuff that provides lots and lots of employment, like soybeans and airplanes and Hollywood movies and the upper echelons of technology.

Second, the social safety net is crumbling. It’s crumbling because very short sighted billionaires wanted tax cuts, which in the long-run are counterproductive to their best interests. These billionaires generally sell stuff to consumers. If consumers at the bottom half of the economic ladder cannot afford to buy their stuff, then in the long run, Amazon and Walmart and Apple have unsustainable business plans. For example, people make bad economic decisions in the absence of a good health care system, a healthy housing market, or stable food prices.

Third, controlled and regulated immigration is and always has been extraordinarily healthy for the economy. It brings in hard workers who are anxious to take the lowest jobs on the ladder, and pushes higher-paying jobs up the economic ladder.

Fourth, education is key. Instead of eviscerating our schools, we should double-down on public education and add to that skilled trade education. Teachers should be among the best paid professionals in our society. (Right now, nursing schools cannot find professors because the private sector pays so much better than the nursing schools can manage.)

Fifth, we should develop trade alliances with the other democracies in the world, rather than force them into the arms of our economic enemies. China’s belt-and-road strategy was brilliant. We can duplicate that with agencies like USAID. The free nations of the world would much rather ally with us, but we’ve shut the door on them.

Sixth, our infrastructure – and particularly our energy grid – is in serious need of attention. This is a powerful investment, and would have the same multiplier effect as the development of the interstate highways in the 1950’s and 60’s.

Are you mad as hell? Yes, you ought to be. Particularly if you’re a soybean farmer, or a recent graduate looking for a job, or a contractor who can’t afford to buy lumber, an immigrant who just wants to put in an honest day’s labor, or a young person who wants to buy a house but can’t make the down payment.