Archive for the ‘Uncategorized’ Category

Back rent problem — take 2

In my previous post, I talked about the accumulated “back rent” problem stemming from the COVID recession. It’s a growing problem, and one which the newly signed COVID relief bill only partially addresses. Here’s what we know today about rental assistance forthcoming.

I would stress at the onset that state and local agencies will be the conduits for this relief, as was done in the previous CARES Act. Notably, it took weeks or months for many of these agencies to spin-up the actual relief payments. Hopefully they have some lessons learned from earlier this year, but don’t expect relief to come in the next few days.

Relief payments must be used to fund the following:

- Rent and rental arrears

- Utilities and other home energy expenses, but current and in arrears

- Other pandemic-related housing expenses

Assistance may continue for up to 12 months, and in some circumstances for up to 15 months if situations warrant. Eligible tenant households must meet all of the following three criteria:

- An individual in the household has qualified for unemployment benefits or the household has experienced an income reduction, experienced significant pandemic-related costs, or can document other pandemic-related financial hardships. (Note: applicants must attest to this in writing.)

- One or more individuals in the household must demonstrate a risk of experiencing homelessness or other housing instability, such as a past-due utility or eviction notice or unsafe or unhealthy living conditions.

- The household income is less than or equal to 80% of the area median income, based either on total income for the year 2020 or confirmed monthly income at the time of the application.

Priorities will be given to households with income less than 50% of the area median and households where one or more persons have been unemployed for 90 days or more. Landlords may provide application assistance but will need to obtain the signature of the tenant, provide documentation of the application to the tenant for their records, and use any payments for current or past-due rent.

As noted, the conduit for all of this will be state and local government agencies and tribal units. Those agencies will be responsible for collecting and reporting certain documentation to the U.S. Treasury Department, including the number of eligible households receiving payments and average payments per household, the types of assistance provided, the acceptance rates, the average number of payments covered by the assistance, and the household income levels by median income category (e.g. — less than 30%, 30% to 50%, and 50% to 80%).

We’re all waiting to see how this pans out, and quite obviously this will not cure the problem. However, it is clearly a step in the right direction. Please stay in touch — we look forward to hearing from you all.

John A. Kilpatrick, Ph.D. — john@greenfieldadvisors.com

How bad is the back rent problem?

It is axiomatic that landlords do NOT want vacant space, and coupled with eviction moratoriums there is a growing backlog of unpaid rent, particularly by small businesses and residential tenants. Anecdotally, the problem is widespread and growing, but just how big is it? Experts differ, but generally agree it is huge and portends a huge humanitarian problem in 2021.

One of the most quoted experts on the topic is Mark Zandi, chief economist at Moody’s. He estimates that 11.4 million renters owe an average of $6,000 in back rent. Add to that late fees on utilities and such, and we’re probably looking at a $70 Billion problem, more or less. Most of this has accrued since the CARES Act expired last summer.

Even back in September, the overdue rent bill had already reached an estimated $34 Billion, according to a study commissioned by the National Council of State Housing Agencies. Note that this problem is not just limited to renters — Since August, the FHA mortgage delinquencies have been setting new records, at 15.6% on September 30th, the highest rate since 1979. Note that the peak during the Great Recession was between 14% and 15%. The Mortgage Bankers Association is tracking forbearances among lenders, and estimated that 5.5% of mortgages, or 2.7 million, were in some sort of forbearance in November. The delinquency rate in September was 7.6%, and while this is down from 8% in April, it is dangerously close to the 10% peak seen in 2009/10. The Credit Union Trends report released in late November forecasted delinquencies to “broadly rise in the fourth quarter and charge-offs to rise in the first quarter” of 2021.

The economy is definitely bifurcated right now. The upper tier has seen the value of their stock portfolios grow by well over $1 Trillion this year, but as Zandi notes, the renter population is at the bottom tier of the economy. They’ve already borrowed as much as they can. Over the weekend, the President signed the COVID relief package, but while the eviction moratorium continues, back rents continue to accrue. One recent study suggested that at present, as many as 14 million rental households are in arrears, and this number will clearly get worse over the winter. Another, issued by the National Low Income Housing Coalition, put this number at 6.7 million. The Census Bureau’s latest Housing Pulse Survey (from November) indicated that 11.6 million people would not be able to pay their rent or mortgage payment in December. Whatever the final number, at some point, the piper will need to be paid.

Notably, the bill signed yesterday includes $25 Billion in emergency rental assistance. Exactly how this will be distributed, and how much of the rental backlog this will actually assuage, will be seen in the coming days. Notably, when the CARES Act included such assistance, it took some state housing finance agencies months to actually enable rental aid programs.

Again, anecdotally, landlords have shown very real forbearance in this area. I would note that the rental market, ranging from single family housing to large apartments, are generally ultimately owned by individual investors. At the lower end of the spectrum (rental houses, for example), individual investors usually directly own and manage these properties. At the upper end, REITs or Trusts may own the properties, but the rental income flows to investors or their retirement accounts. Further, rental income employs property managers, maintenance people, and a host of other service providers. In short, this is a problem that reverberates across many sectors of the economy.

So what do we know about COVID relief?

I spoke with some folks “in the know” this morning, and the details are still unfolding. The real estate sector should pay very close attention to this, as so many aspects of the relief bill affect it.

First, what do we think we know? There are apparently 6 categories of aid in this package:

| Supplemental Employment Insurance | Weekly payments of $300 (half of what was provided in the original CARES Act) for up to 11 weeks |

| Direct Payments | One time payment of $600 for individuals making under $75,000 and for each dependent child (again, half of the CARES Act) |

| Small Business Relief | PPP loans of $284B (about $100B less than CARES) plus $15B specially allocated to theaters and live entertainment venues |

| Rental Assistance | $25 Billion, and the national moratorium on evictions extended until Jan 31 |

| Vaccine Assistance | $48 Billion for healthcare, and $20 Billion for vaccine distribution |

| Education | $82 Billion for local schools, colleges, & child care plus $13 Billion for supplemental nutrition programs |

It is axiomatic that the lowest wage earners, who have generally been hit the worst by this recession, are most likely to be renters. Further, a large portion of rental properties are owned by small real estate investors. Hence, there is a bit of a two-edged sword here, in that some parts of this may flow directly to those landlords who are often retirees or others dependent on rent collection. From a practical perspective, the eviction moratorium isn’t nearly as powerful as it seems, because so many landlords would rather keep a non-paying tenant in place than to go thru the cost of eviction only to have an empty property.

It’s far too early to even conjecture as to how much (or little) impact this will have. Many businesses kept their doors open only due to the CARES Act PPP loans, but all too many of those have now shuttered permanently. For example, CNN Business reported last week that 10,000 restaurants have closed for good in the past 3 months. Every one of those restaurants had a landlord who is now not getting paid. Back in September, YELP reported that 163,735 small businesses that they track had shut their doors, and that almost 98,000 of those were projected to be permanent closings. Of course, large chain bankruptcies and closures are well publicized.

One intriguing study from iPropertyManagement.com suggests that apartment and rental housing vacancies vary widely according to location — inner city versus suburbs. Apparently, major cities are seeing an uptick in apartment vacancies (Manhattan’s has tripled), but suburban vacancy rates are actually down, suggesting renters are fleeing congested cities. Indeed, non-metro area vacancy rates are also down.

By the way, this is usually the week I re-visit our REIT Fund-of-Funds, ACCRE LLC, and report on the S&P correlations and other diversification benchmarks. Going forward, I’m going to consolidate the two ACCRE reports into one at the beginning of each month. This mid-month blog post will now be just about economic and real estate issues.

This is also my last post (I think!) before the Christmas holiday. All of us at Greenfield hope you and yours are enjoying a safe holiday season. I know we’ve lost all too many friends and colleagues this year, and we look forward to getting COVID under control in the very near future. Best wishes,

John A. Kilpatrick, Ph.D. — john@greenfieldadvisors.com

Trophy Property and the Pandemic

I spend a significant amount of my time at two somewhat opposite ends of the real estate spectrum – “damaged” property (particularly environmentally damaged, such as brownfields) and “trophy” property. Neither of these sectors behave like “normal” real estate even in “normal” times. Damaged property may eventually be remediated, converted, or in some way improved into the normal market. Ironically, demand for some kinds of damaged property, such as foreclosures, may actually improve during recessions or other “normal” market disruptions.

Trophy property is typically any property in the top 2.5% of its subclass. The market for such properties transcends normal markets for that subclass. Consider all of the office buildings in a given city — even New York or London. Investments in Class C and B offices may appeal to local buyers, while Class A properties will typically be marketed to trusts, REITs, pension plans, or the like. However, at the very top — the “named” properties which really anchor the city as a whole — the investment market may be entities or individuals for whom the trophy investment will provide halo effects or collectable effects for the rest of the portfolio. Normal metrics — income or cash/on/cash rates of return and such — may not apply to trophy investments. Much like a fine painting or other object d’art, an investor may want to own a trophy property simply for the sake of owning it. Of course, it doesn’t hurt that over long periods of time, trophy real estate has a great history of maintaining and improving value. It doesn’t hurt that trophy property investors often have very long time horizons, perhaps even multi-generational.

So, how is trophy property faring during this pandemic-induced recession? As with any good analysis, it may be too early to tell, but some anecdotal info coming our way suggests that trophy investors look at this recession as a real opportunity to pick some low-hanging fruit. One case in point was the acquisition of the Viceroy L’Ermitage Beverly Hills Hotel in October by EOS Investors. Admittedly, this property had a “damaged” component — the property had been taken over by the U.S. Government as a result of prosecution of an international money laundering case. Further, hotels in general remain strained, with many transactions falling into the “damage” category. However, EOS ended up paying $100 million for the 116-room trophy property, nearly $1 million per room, a figure that bears almost no connection to the realities of the hospitality market today.

At the other corner of the country, Manhattan trophy residences recorded one of their best weeks of the year in late October, albeit with a fairly large inventory of top-tier properties coming on the market. As an example, a 30,000 square foot, 5-story home on West 11th Street in Greenwich Village sold this month for $45 million. Originally listed for $49.5 million in January, 2019, this was the second highest price residential sale in New York City this year, and the highest since the pandemic began. Another New York City trophy residence sale in late October was a Perry Street (Tribeca) 5-bedroom duplex, with a private pool, for $20 million. According to one source, the average sale-price-to-list-price discount for Manhattan trophy residences stands at 11%, and the average time on the market in this sector is about 2 years. The last week of October showed 5 New York City contracts at $10 million or more.

Finally, in the middle of the continent, trophy ranches continue to sell to investors looking for recreation, retirement, or just pure collection purposes. Recent top-tier sales include the Pole Mountain Ranch in Wyoming (2,300 acres, 8,000 square foot main home, $8 million), a vacant pond-side lot at the Elk Creek Ranch in Colorado ($1.1 million for 2,850 vacant acres), and the Winding River Ranch in Wyoming (376 acres, 1.5 miles of Platt River frontage, custom built 5-bedroom lodge, for $2.2 million).

In short, there is some disruption right now in the trophy property market, as many properties seem to be coming on the market and inventories are strong. However, buyers with cash and/or resources are definitely in the market, and are looking to cherry-pick trophies that come available.

2021?

This week, I sat thru a great presentation (virtual, of course) by John Chang, the Director of Research at Marcus and Millichap. Like any research report, it has to be taken in the context of all of the other information out there. However, I get a deluge of this stuff, and I thought Chang’s work on the subject was quite good.

He starts out by noting what we all pretty much know — four real estate subsectors were hit the hardest this year: Hotels, Senior Housing, Sit-Down Restaurants, and Experiential Retail. Three sub-sectors actually did quite well: Industrial (and I would note data-centers in particular), Self-Storage, and “Necessity” retail. Later in his presentation, he points out that Offices and Housing (I would note with the exception of student housing) also held onto some core value.

Chang comments — and I concur — that never in our memories have we seen a real estate recession that was so geographically broad and across so many sub-sectors. For example, the 2008/10 debacle was primarily focused on housing and the mortgage backed securities market, and while the entire real estate securities market declined, it was more related to correlations with the broader market than with underlying real estate fundamentals. Today, however, we’re seeing some very real systemic changes throughout the real estate economy.

So, what does 2021 look like? The first half of the year is, at best, a continuation of where we are right now. Small businesses, and the real estate that supports those businesses, are hanging on by fingernails. Chang suggests that a recovery in the 2nd half of 2021 depends on three variables:

- The size and quality of the next recovery package. In his opinion — and I agree — the mid-sized package would be in the range of $1.5 Trillion, and would include expanded unemployment, PPP expansion for small businesses, housing assistance, assistance for state and local governments, public health assistance, and provisions for vaccine distribution. If the next stimulus package is smaller than this, then business and real estate in the U.S. will face considerable headwinds.

- “How long” will a medical solution require? If a medical solution can be rolled out by mid-2021, then a 2nd half recovery may be in the offing. However, time is not our friend, and there will be continued attrition until a solution is in place.

- “How effective” will a medical solution be? There will undoubtedly be setbacks. How well will we overcome the medical road blocks along the way?

If all of this come to fruition in a timely fashion, then a recovery may come along slowly in the 2nd half. The “down” sectors, particularly tourism related and in regular tourist destinations like Orlando and Las Vegas, may see a slow recovery start up by the end of 2021. Other down sectors may see some light at the end of the tunnel. Conversely, sectors which enjoyed the greatest benefit during Covid (data centers, for example) may lag the market. Offices and housing should continue to hold their own.

Again, I don’t necessarily agree with everything Mr. Chang said, but his opinions are some of the best I’ve seen, and I wanted to share this with you all. If you have any questions, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D. — john@greenfieldadvisors.com

ACCRE, November, 2020

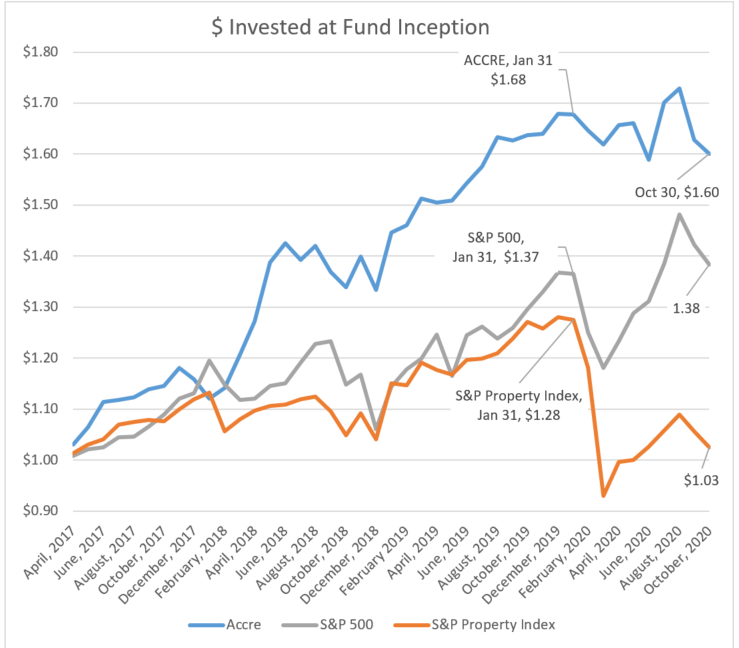

The chart says it all — the past 3 months have been the worst stretch in the history of ACCRE. Ironically, it has been a very good period for the S&P and for REITs and real estate as a whole. Why, you ask? Simply put, we had positions adverse to student housing and other holdings that were laggards due to COVID, but the good news of November — which is good news for us all — caught us by surprise. Indeed, all of our losses happened in just a few days mid-month.

It is axiomatic not to be too aggressive in clawing back losses. We made a small portfolio adjustment, and December is already looking positive. We’ll probably take on some other positions in the coming days. Note that one of our principal strategies is to stay sane with our portfolio — historically, we’ve only beaten the S&P 50% of the time, on a month-to-month basis. However, we try to stay away from big market moves, enjoying the upside without suffering big bear market moves.

As always, our subscribers receive same-day notification of any portfolio changes. Best wishes to you all — we hope you had a great Thanksgiving, and you’re all looking forward to a great holiday season.

ACCRE Mid-Month Report

It’s been a mixed-bag for REITs this month. While many sectors continue to lag, short positions can be dangerous. The market is hungry for good news, and leaps at anything tossed in the water. Case in point, we saw one REIT with terrible earnings projections, but the market price rebounded when Funds from Operations (FFO) came in “less bad” than previously forecasted. Another REIT has a spread of analysts targets of over 100% from bottom to top, proving that optimism has a home in the real estate sector.

This month, I’m going to provide both LAST month’s stats on ACCRE as well as this month, just to show what a difference a month makes:

| September, 2020 | October 2020 | |

| S&P 500 | ||

| Average Daily Excess Return | 0.0327% | 0.0290% |

| Standard Deviation | 1.3451% | 1.3429% |

| Sharpe Ratio | 2.4315% | 2.1576% |

| ACCRE Fund | ||

| Average Daily Excess Return | 0.0455% | 0.0426% |

| Standard Deviation | 1.1540% | 1.1520% |

| Sharpe Ratio | 3.9436% | 3.6984% |

| Correlation (overall) | 56.4666% | 55.8996% |

| Correlation (monthly) | 73.4120% | 57.0514% |

ACCRE continues to out perform the S&P, both on an unadjusted (Average Daily Excess Returns) and a risk-adjusted (Sharpe Ratio) basis, the correlation between ACCRE and the S&P really whip-sawed in October. In the previous month, we had a very tight correlation (73%) which is actually higher than we want it. A correlation in the 50’s serves our two-pronged goal of outperforming the benchmarks in the long run and providing diversification for a mixed portfolio.

Our private newsletter subscribers received some trade alerts today, and there will probably be more soon. This market has a great deal of volatility, as well as election-year and end-of-year roiling. We avoid run-and-gun trading (REITs really don’t day-trade well!) but the market we see right now requires some close inspection.

As always, if you have any questions or comments, please let me know.

John A. Kilpatrick, Ph.D. — john@greenfieldadvisors.com

OK, First the Good News…

The stock market revived quite nicely this month, with the Dow up about 12.5% in the first 11 trading days, although I’ll admit that real estate in general (and ACCRE, our in-house fund) had a couple of tough weeks. Why, you ask? I’m getting to that.

Now for the tough news. Fed Chair Jerome Powell today, speaking at the European Central Bank Forum, noted that “We’re covering, but to a different economy.” In short, the economy as we knew it is probably a “thing of the past.” We’ve suspected this for some time. In many ways, both macro and micro, the economy has shifted out from under us. Some examples, taken just from my personal experience, in no particular order…

- Technology has taken the place of in-person meetings. I probably attend more meetings per week now than I did a year ago, but they’re all on zoom or such. I have three scheduled for today, and that’s not unusual. The good news — my travel time, finding a parking space, calling for an Uber, etc., are way down. The bad news — the folks who drive those Ubers, the servers and cleaning staff who work in conference centers, the folks at Starbucks who get me my coffee for the drive, indeed the guy at Brooks Brothers who sells me neck-ties, are all out of work.

- Lack of in-person means dramatically less demand for hotel space. In an average month pre-Covid, I’d take two business trips with anywhere from 2 to 5 nights in a hotel. Now? None of the above. No need for office space, hotel meeting rooms, airplanes, etc.

- Ditto restaurants. I can’t remember the last time I darkened the door of a sit-down establishment.

The lowest paid workers, those in jobs requiring face-to-face contact, are shouldering most of this burden. The recovery, such as it is, can be decidedly described as “K” shaped, with some parts of the economy (those heavily invested in the stock market) doing very well, while others are running out of oxygen.

Not to belabor the point but this all has some very real implications for real estate. If Mr. Powell is correct — and I believe he is — then the tough sledding we’ve seen thus far in the property market is bound to get worse in 2021. The S&P property index, measured in terms of total return, is down 7% for 2020. Now, given how well it’s performed over the past 10 years, that’s not a bad pull-back. However, Mr. Powell suggests we may see ourselves oversupplied with property next year, particularly in categories where workers meet customers on a face-to-face basis. While the market has already discounted a lot of this, such as in REIT prices, the workout problems will be immense.

As always, I enjoy hearing from you. Please reach out if you have any comments or questions.

John A. Kilpatrick, Ph.D., MAI — john@greenfieldadvisors.com

The Election and Real Estate Investments

As of this writing (near the end of the business day on Monday) the Dow Jones Industrial Average is up 2.95% on the day, and has risen about 8.3% in the past 5 trading days. The broader S&P is up about 7.3%, and the NASDAQ is curiously down on the day but still up about 7% since last Monday. This morning, the bond market was up, consistent with expectations of lower interest rates. While real estate is only peripherally impacted by the securities markets, these liquid markets give some insight into investor sentiments in the wake of the election outcome.

As of today, it appears Joe Biden will be the 46th president, the Senate will still be in republican hands (although slightly less so) and the democrats will continue to control the house. This implies two very significant things for governance in the coming four years:

- The Biden Administration will need to govern much closer to the center than if they had a democratic-controlled Senate; and

- There will be considerably more stability in White House relations with capitol hill.

Clearly, the thousand pound gorilla is Covid, and any restoration of the economy to pre-pandemic state hinges on that. Wall Street is already discounting a small but very real stimulus package which should juice the GDP a bit — not as much as the first one, but something. What does all this imply for real estate?

Residential Investment

The homebuyer market and the rental investment market have done well this year despite the recession. Low interest rates have fed home buying, and the desire for social distancing has provided some marginal preference for single family rentals as opposed to apartments. Indeed, the apartment REITs are generally down on the year (there are exceptions) with particular problems in the student housing and eldercare sectors. However, built-to-rent REITs are doing fine.

The Biden administration is hoping to provide support for first time homebuyers (a group that the homebuilding community says is in short supply today) with a $15,000 tax credit. Biden would also propose some sort of tax credits for renters and increase Section 8 vouchers. We suspect this will be met with widespread support.

However, Biden has also proposed some sort of rent and mortgage forgiveness. This may have some struggles — in many cases, rental property is owned by small to medium sized investors, and the trickle-down impact on real estate service providers, who are already stretched thanks to foreclosure and eviction moratoriums, would be difficult. This would probably face head-winds on capitol hill.

Commercial Investment

The FTSI/NAREIT index of REITs was up 4.23% last week. Note that the index is down 15.61% for the year-to-date. Obviously, there are some gems in there — our ACCRE index was up about 2.4% last week but down about 2% on the year.

Every category of REIT showed positive movement last week with the exception of self-storage and regional malls. The big winners were residential, up 6.31% and industrial up 5.49%. Even lodging/hospitality, which has had an abysmal year, was up 2.97% on the week. Mortgage REITs, which have also had a terrible year, were also up marginally on the week.

This suggests broad optimism going into 2021, although it remains to be seen how all of this will play out. The best estimates we’ve seen thus far suggest three to four years for the worst-hit sectors to revive to pre-Covid levels after some sort of containment or vaccine is effective. That said, much of the worst is probably already captured in real estate prices, and absent some further or unexpected negative events, we may see some slow progress back to normalcy in the real estate markets.

As always, if you have any questions about this, please reach out! Best wishes, and stay safe!

John A. Kilpatrick, Ph.D. — john@greenfieldadvisors.com

ACCRE, October, 2020

Let’s just start by acknowledging that October was a terrible month for investments in general, and particularly real estate. The Covid-related recession tsunami is catching up with impacted RE sectors, and much of this is slowly being capitalized into both the REIT market and the broader indices. Case in point — this morning, two major retail REITs (CBL and PREIT) which between them own 130 shopping centers, had to file for Chapter 11. This came as little surprise, since some of their largest tenants, including JC Penney, Tailored Brands, and Ascena Retail Group, have also filed for bankruptcy.

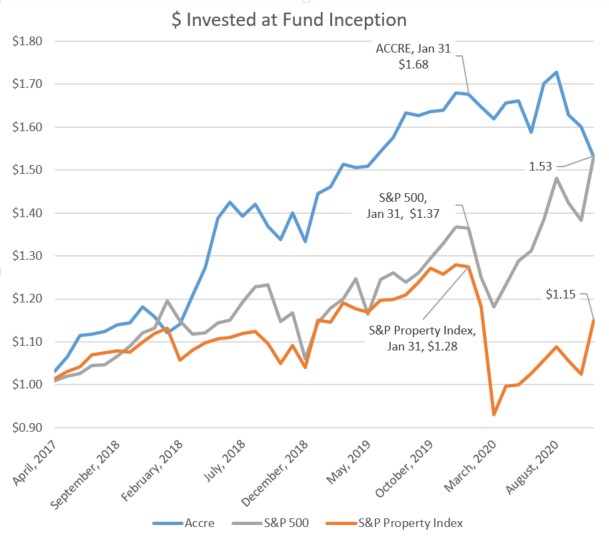

We feel very fortunate that ACCRE has continued to hold its value in the face of this wave. Our overall performance since January 31 (arguably, the end of the bull market) has been only slightly below the S&P 500 (which is now right back where it was 8 months ago) and is well above the overall S&P Property Index, which tanked in the spring and has had very real difficulty regaining its footing since then.

The Financial Times Stock Exchange (FTSE) tracks 159 equity REITs in conjunction with the National Association of Real Estate Investment Trusts (NAREIT). REITs are often bought for the inflation-hedged dividend yield, as as of the end of October, the average equity cash-on-cash yield was 3.98%, which of course compares well with corporate bonds. However, on a compound annual total return basis, the typical equity REIT has shown a total negative return of -16.25% for the year ending October 30. Peeling back the layers of the onion, we find that the actual returns have been all over the map. Not unexpectedly, lodging/resorts has been the worst major sector performer (-46.78%) followed by retail at -44.72%. However, even within retail, regional malls, as a sub-sector, have seen a -54.41% return.

That said, some sectors have done quite well. Data center are up 20.27% on the year, while infrastructure is up 11.95%, industrial up 8.28%, and self-storage is up 8.15%. Residential has suffered (-26.03% on the year) but within residential, single-family homes are almost breaking even (-3.42%).

By the way, mortgage REITs are suffering the same way they did in the 2008/10 debacle. At ACCRE, we avoid mortgage REITs, private REITs, and un-traded REITs.

Recent statistics suggest that as many as 44% of American households own REITs either directly or indirectly in their portfolios. Real estate is a nearly ubiquitous part of the global investment portfolio, and a well-curated REIT selection can add both diversification and positive returns to the portfolio. Drop us a line if we can help.

John A. Kilpatrick, Ph.D., MAI — john@greenfieldadvisors.com