Archive for the ‘Uncategorized’ Category

Been to the movies lately?

It’s a bit off topic for me, but I was struck by an article this morning about the movie business. I spend very little time in that subsector, but naturally have been intrigued given the impact of COVID. While the pandemic has damaged many sectors, it has absolutely eviscerated the movie chains. Given the amount of real estate devoted to this sector, it’s worth taking a peek.

Most movie goers — even those of us in the real estate biz — have little understanding of how movie real estate works, and indeed there is no exact one-size-fits-all. Going into the pandemic (as of March, 2020), there were 5,477 movie theaters in the U.S. (not including 321 drive-ins). The unit of comparison in that industry is the “screen”, much like the unit of measure for a hotel is “rooms” and for apartments is individual apartment units. As of that same date, there were 40,449 screens, for an average of slightly over 7 screens per theater. In recent years, however, the trend has been toward fewer but larger locations, and the modern movie multi-plex has more like 11 screens. About 20 years ago or so, there was a very real consolidation, with many theater locations closing but many more screens popping up, as shown below.

Data courtesy the National Association of Theater Owners

The typical modern theater has an owner and an operator who may be different entities. For example, AMC, the largest operator in the U.S., operates 8,218 screens. Their nearest competitor, Regal, operates 7,350. Of course, these numbers were as of pre-COVID. In the same way that Marriott “operates” many hotels that they do not actually own, many (most?) of these theaters are owned by private entities. EPR Properties, for example, is a specialty REIT focused on “experiential” real estate, such as theaters, day-care centers, golf courses, and such. They own 179 theaters as of the end of 2019, although there is no report on exactly how many screens they have. They don’t operate any of these, but rather lease them out to operators like AMC.

Measuring the market value of this real estate is tough. Based on recent data from EPR and AMC, we can very roughly estimate that the value of a stand-alone movie theater is about $2 million per screen. With that, we have about $81 Billion in movie theater real estate in the U.S., including the furniture, fixtures, and equipment. These have been basically dark since the onset of the pandemic, much like other hospitality real estate, such as hotels and restaurants. Of course, when the pandemic is finally over, hotels and restaurants will eventually fill up again. However, movie theaters had already been feeling the headwinds of Netflix and other on-line services even before the pandemic came along. The industry is facing the very real possibility that movie-going habits will significantly change when the restrictions are lifted. Indeed, the streaming services are banking on that, and investing billions to back up that theory.

Movie-going has enormous spin-offs, including adjacent restaurants, parking lots, and shopping. Some large multi-plexes are part of malls, and some small boutique theaters are attached to bowling alleys and other experiential venues. Much like the change in brick-and-mortar retail, the impact of this shift on the real estate landscape may be very large and very real.

“May you live in interesting times”.

As always, if you have any questions or comments on this, please reach out!

John A. Kilpatrick, Ph.D., MAI — john@greenfieldadvisors.com

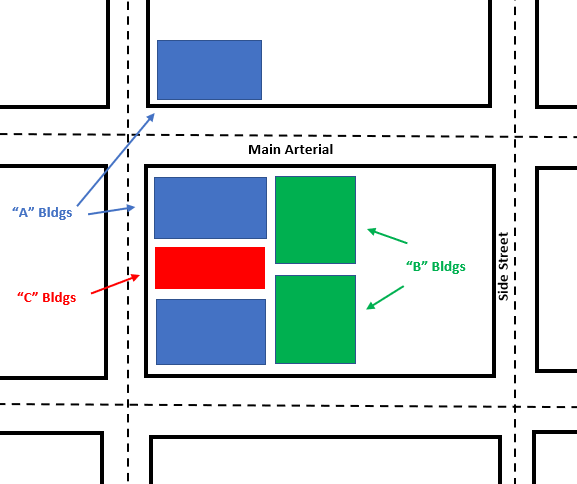

Class C Props in Class A Locations

Last week, I talked about one value-added proposition for real estate investing — looking for 1 + 1 = 3 opportunities. Today, I want to take that theme another step with the idea of looking for Class “C” properties in Class “A” locations. First, though, a little terminology may be in order. There are no hard and fast definitions for Class “A”, “B”, and “C” properties. One can generally think of a Class A property as the top of the heap (perhaps even including Trophy Properties). Considering an office building, these will usually be very large, have top-tier security and decorated lobbies, more than sufficient elevators, and attract the top-tier tenants. Class A properties will almost always be large, and located on major arterials in the central business district (“CBD”) There are of course exceptions, but this is the norm in major cities. Corner locations (or even full city blocks) are preferred. Class B properties in the CBD will be located near Class A, but will not feature the same caliber of amenities. Lobbies will be smaller, and the building services will be somewhat reduced. These buildings will usually (but not always) be located on interior lots on main arterials, but not on corners or full city blocks in the CBD. Of course, in secondary neighborhoods, where there are no Class A buildings, the Class B building may occupy what would be a Class A spot if it was downtown.

From a location perspective, the Class C properties are usually located in secondary or tertiary neighborhoods. These are bare-bones properties, often smaller, plainly built and decorated, and with very few amenities. However, there are important exceptions to the rule, and this is what we’re seeking today. Consider a small, plain building located on a side street in the CBD. First, from a purely theoretical perspective, why is it there? Among office buildings, there are often tenants who need close access to Class A tenants but do not want (or need) to pay Class A prices. In the retail sector, there are many businesses that want benefit from the traffic generated by the top-tier retailers on the corner. Of course, in any CBD there will be a need for small lunch counter-type restaurants, bank branches, and the like.

It’s axiomatic that no one wants to invest in a declining market (although there are exceptions!). However, in an improving market, these “C” properties may get overlooked. After all, serious investors want to snatch up the “A” properties and plaster their names on the big signs, right? However, an improving market probably sees an increase in class “A” tenants, and as such an enhanced demand for the sort of spill-over tenants that occupy the C properties. Class C properties are more likely to be owned by individuals (rather than institutions) who may not have the resources to properly maintain them or keep abreast of technology. As such, they can be very likely candidates for the sort of 1 + 1 = 3 strategy I talked about last week.

Consider apartments, for example. Older apartment complexes may look the part, with older appliances, tired landscaping, peeling paint, and worn out carpets. Even the parking lot may look tired and worn. However, these are cheap things to fix. An older apartment complex in a good neighborhood can be a very real investment opportunity, given the resources to fix-up and modernize. Smaller rental units in great neighborhoods — duplexes and single family residences — can also fall into this category.

The lesson last week was to look for tired properties that need some repair or rehab. The lesson this week is to look for those tired properties in great locations. I discussed a lot of this in Real Estate Valuation and Strategy. As I mentioned last week, over the course of the next few blog posts, I’m going to share some ideas that work in the real market, at a variety of value points such that even the most fledgling investor can find some opportunities.

As always, if you have any questions or comments, please reach out! I look forward to hearing from you.

John A. Kilpatrick, Ph.D., MAI — john@greenfieldadvisors.com

Real Estate Investing: Making 1+1=3

Several years ago, I had a client – a family fund, actually – that had a neat, very long term investment strategy. To simplify, imagine that they started with $2 million. They found a “fixer upper” property that could be purchased for $1 million, and then spent the other $1 million on repairs, upgrades, etc. After the fix-up, the property was worth $3 million. They then finance the property, taking out $2 million in cash, and do it again. Do this 100 times, and you have $300 million in property and $100 million in net equity. Neat, eh?

Now, there are three caveats to this precise strategy. First, you need to start with $2 million. Second, you need to think VERY long term. Finally, it’s helpful (but not necessary) to have a market where real estate values are steadily growing. However, these aren’t barriers to entry, and even a more modest investor in a flat market can make this math work.

One of the important benefits in real estate investing is the value of entrepreneurial effort. In the stock market, informational efficiencies and rational expectations generally prevent significant abnormal returns for your effort. While there are noteworthy exceptions, the stock market investor is usually a tape reader (as they used to call them) and a victim of the systemic shifts in the market.

Conversely, the savvy real estate investor enjoys a significant return for his or her effort, and in the case of my client, this entrepreneurial effort can be capitalized into a non-taxed increase in value. The key, however, is finding value-added projects, where the value increase exceeds the cost. All too many real estate investors miss the mark on this, and end up with no net increase in equity, or worse spending more than they receive in value return. The graphic below simplifies the decision rule. Consider investments where the value exceeds the cost, rather than the other way around. As simple as this seems, all too many real estate investors trip up on this simple rule.

Another key element — you make money when you buy real estate, not when you sell. My clients were careful to seek out investments that needed a facelift — ugly properties that could benefit from some significant sweat equity.

So, how and where do you find these diamonds in the rough? I have a few ideas, and in fact discuss many of them in Real Estate Valuation and Strategy. Over the course of the next few blog posts, I’m going to share some ideas that work in the real market, at a variety of value points such that even the most fledgling investor can find some opportunities.

As always, if you have any questions or comments, please reach out! I look forward to hearing from you.

John A. Kilpatrick, Ph.D., MAI — john@greenfieldadvisors.com

ACCRE LLC Report, Feb 2021

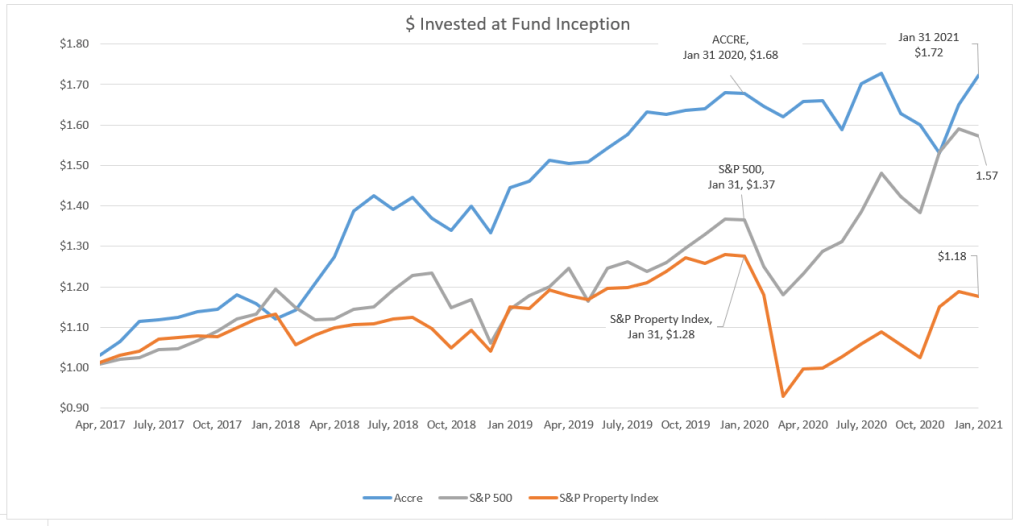

February started off like gangbusters, and indeed by mid-month we’d reached record return levels. Then the air leaked out of the tires the last week of the month, leaving us disappointed. We continue to outpace the S&P and the global REIT index overall, but February did little to contribute to those numbers.

As you can see, a dollar invested in ACCRE at the inception would be worth $1.68 today (an annualized return of about 14.5%), compared to that same dollar in the S&P which would be worth $1.61. The S&P Global REIT Index has performed very well this year, climbing out of its negative return hole last year into positive territory, albeit still only at $1.22 overall for the life of our fund.

On a risk-adjusted basis, ACCRE’s Sharpe Ratio continues to best the S&P, albeit somewhat less than last month. Part of this is a very real improvement in returns to the S&P, and part is a slightly higher level of volatility for ACCRE. I would note that for the past few months, ACCRE has been nearly uncorrelated with the S&P, but in February returned to its normal correlation of about 50% (positive).

| S&P 500 | |

| Average Daily Excess Return | 0.0424% |

| Standard Deviation | 1.3131% |

| Sharpes Ratio | 3.2322% |

| ACCRE Fund | |

| Average Daily Excess Return | 0.0451% |

| Standard Deviation | 1.1966% |

| Sharpes Ratio | 3.7693% |

| Overall Correlation (life of fund) | 52.1749% |

| Correlation (month of February) | 49.6623% |

Again, for the uninitiated, the Average Daily Excess Return is the daily return minus the return that would have been earned in a risk-free asset (here, the coupon-equivalent 13-week T-Bill, measured daily). The Sharpes Ratio is the ratio of those excess daily returns to the standard deviation of those returns (the measure of volatility) and serves as a proxy for risk-adjusted returns. ACCRE usually has higher excess returns and almost always has lower volatility, hence a higher risk-adjusted returns.

Best wishes to you all, and if I can answer any of your questions on REITs or real estate strategies, please drop me a line.

Philadelphia FED Survey

One of my frequent economic touchstones is the quarterly survey of economic forecasters conducted by the Philadelphia FED. Obviously, they can’t pick “black swan” events (e.g. — COVID) but once the economy is in a steady state, they are usually very good at seeing intermediate term trends.

The improvement in sentiment from before the election is palpable. Their panel of forecasters project real GDP growth this quarter (that’s nominal growth minus inflation) at 3.2% annualized, with an overall growth at 4.7% in 2021 and 3.7% in 2022. These represent significant improvements over previous forecasts.

Unemployment will continue to nag us, but is on a downward trend. According to their forecasters, we should end this quarter with unemployment at 6.3%, trending down to 5.1% in early 2022. Non-farm job growth is projected at 223,400 per month this year. Inflation is expected to nudge up a bit, although that’s not entirely a bad thing coming out of a recession, as it indicates increased demand. The previous survey anticipated inflation at an annualized rate of 2.0% in early 2021, but now forecasters expect that at 2.5%. That said, the general projections for inflation for the coming decade, barring any flocks of black swans, is in the range of 2.2%. With that, 10-year treasuries are forecasted to average 2.8% over the coming decade, up from an early forecast of 2.7%.

Most interestingly, forecasters were also asked about the probability of another negative-GDP quarter this year (signaling a return to recession). Before the election, the average sentiment was a 20.4% chance of a quarterly GDP contraction this year. After the recession, this has nudged down to 19.1%. While that may not look like much of a change, it is a meaningful shift in forecasters’ sentiments. Survey respondents were also asked about economic output and productivity for the coming decade. A year ago, they projected the ten-year average annual productivity growth at 1.4%, while now they’ve raised the bar to 1.75%, a significant increase in their forecast of U.S. output and productivity.

Finally — and this is probably of most interest to our readers — the forecasters were asked about house prices this year and next. They looked at six different house price indices (see below), and forecasters projected median house price increases ranging from 4.7% to 7.9% this year, slowing somewhat to 3.5% to 5.3% next year.

| 2021 Median | 2022 Median | |

| S&P CoreLogic Case-Shiller: US National | 6.8% | 4.5% |

| S&P CoreLogic Case-Shiller: Composite 10 metros | 4.7% | 3.9% |

| S&P CoreLogic Case-Shiller: Composite 20 metros | 7.5% | 5.0% |

| FHFA: Purchase Only (US Total) | 5.6% | 3.5% |

| CoreLoic: National HPI including distressed | 5.6% | 5.3% |

| NAR Median: Total Existing | 7.9% | 5.1% |

As usual, if we can answer any questions about this, or if you have any comments, please don’t hesitate to reach out!

John A. Kilpatrick, Ph.D., MAI — john@greenfieldadvisors.com

A New Twist on Rails to Trails Takings

In 2019, the Appraisal Institute, the Appraisal Institute of Canada, and the International Right of Way Association produced Corridor Valuation, an anthology on a complex subject which is surprisingly common in (pipelines, rail lines, power lines, etc.). I had the very real privilege of contributing two chapters, one on telecommunications corridors (fiber optic cable, etc.) and co-authoring the chapter on Rails to Trails corridors with my esteemed colleague, David Matthews.

Each year in America, on average, about 2200 miles of rail lines are abandoned, and often converted to public use, such as hiking/biking trails. However, the legal nuances are a bit more complex than meets the eye. Often, the railroads did not acquire “fee simple title” to the corridor, but rather acquired a perpetual easement with the proviso that if the rail corridor was ever abandoned, the land reverted to the adjacent property owner. “Abandoned” was usually a process over many years, and as these rail lines became effectively abandoned (although perhaps not legally so), the adjacent property owners made use of the land for residential developments. golf courses, and a host of other uses.

Without re-typing our entire book chapter, sufficient to say someone happened upon the idea that converting these “abandoned” rail lines to public use (e.g. — hiking/biking trails) was a good idea. However, there are costs involved. In a case that made its way to the US Supreme Court not too many years ago, it was decided that these adjacent property owners should be compensated not only for the loss of the land (that otherwise would revert to them) but also for “severance damages” which would be the loss of value to their adjacent property for now having a public use in their back yards.

So… I gave you all of that as a prologue to this. There is a really interesting rails-to-trails case coming out of Oregon right now. Many of the adjacent property owners around the US have argued about the loss of security from having hikers/bikers in their back yards. The project in Yamhill County, Oregon (southwest of Portland) spanned farmland. The argument posed by the farmers was that the new Yamhelas-Westsider recreational trail would inhibit the use of pesticides and endanger food safety (along with the common argument that the trail would invite trespassers). Oregon law requires a 100-150 foot exclusion zone depending on the pesticide being sprayed. If a bicyclist or pedestrian passes within that area, apparently the farmer is supposed to stop spraying.

This is a terrifically interesting argument, and I would have been very interested to see this litigated. However, the county’s board of commissioners voted last week to withdraw the land use application, even after spending in excess of $1 million on the project (and probably obligating to pay the state back another $1 million). The phrase “cut our losses” came out of the final commission meeting to end the project. Notably, Oregon’s Land Use Appeals board had blocked the project at least three times, finding that the county did not sufficiently study the impact on farming.

I doubt we’ve seen the end of this. A lot of money has been spent on both sides, and the proponents of the trail have are well organized. This will be a very interesting case if and as it moves forward.

ACCRE LLC Report, January, 2021

Well, wasn’t THAT an interesting month! In times of market turmoil, investors often turn to real estate as a safe haven, and we certainly saw that happen in January. The overall S&P was down a bit but the volatility continues to be noteworthy. As such, ACCRE did quite well compared to both the overall market (S&P 500) and the global real estate in general (S&P Global Property Index). We’ve had two very nice months in ACCRE, and hope to see that trend continue in the new year.

Unquestionably, the S&P had a better 2020, but is off to a comparatively lackluster start in 2021. We hope for the best, of course, but it’s important to note that one reason for ACCRE is to provide diversification in an otherwise healthy portfolio. It continues to do that, and continues to provide above-average risk adjusted returns. The overall correlation between ACCRE and the S&P is a bit higher than last month, but continues to be much lower than the historical average.

| S&P 500 | |

| Average Daily Excess Return | 0.0405% |

| Standard Deviation | 1.3203% |

| Sharpes Ratio | 3.0710% |

| ACCRE Fund | |

| Average Daily Excess Return | 0.0485% |

| Standard Deviation | 1.1922% |

| Sharpes Ratio | 4.0651% |

| Overall Correlation (life of fund) | 51.9201% |

| Correlation (monthly) | 21.4110% |

Again, for the uninitiated, the Average Daily Excess Return is the daily return minus the return that would have been earned in a risk-free asset (here, the coupon-equivalent 13-week T-Bill, measured daily). The Sharpes Ratio is the ratio of those excess daily returns to the standard deviation of those returns (the measure of volatility) and serves as a proxy for risk-adjusted returns. ACCRE usually has higher excess returns and almost always has lower volatility, hence a higher risk-adjusted returns.

Best wishes to you all, and if I can answer any of your questions on REITs or real estate strategies, please drop me a line.

Property taxes and the dark store theory

This is a continuation of my piece from last week on Property taxes. I suspect that this will be an issue of no small concern to property investors, appraisers, and financial advisors in 2021 and beyond, not just as a result of COVID, but certainly exacerbated by COVID.

I was recently looking at a 10,000 square foot stand-alone commercial building — an “out-parcel” in a shopping center. For a variety of reasons (COVID being only one of them) this shopping center has fallen on hard times, and the tenant (a big national chain) has declared bankruptcy. This store, and nearly all of the properties near it, are vacant, and there is little forecast that this will change in the near future.

So, the total taxable value of the property back when everything was hunky-dory was about $2.2 million. Today, the total taxable value is… you guessed it, $2.2 million. The question which perplexes property owners, appraisers, and tax assessors is the valuation of these “dark stores”. Do they get valued at their highest-and-best use (even though they are vacant) or as some value-in-use, recognizing the current economic condition. More to the point, even when these properties are up-and-running, should the value be reflective of the current contract rent or some other theory of valuation?

As an aside, about 30 years ago, I published a paper on the impact of the failure of anchor tenants in strip shopping centers. The original tenants are typically very stable, boring grocery stores. The other tenants, who on a per-square-foot basis are usually much more profitable to the landlord, draw business as a result of proximity to the grocery anchor. After one fails or moves out, all too often, the landlords scramble around for a substitute, picking up an anchor tenant that may be very risky and/or fails to provide traffic to the other tenants. The result is often a financial failure of the whole shopping center.

Back in February, 2017, the Texas Comptroller published a piece on the Dark Story Theory and how it impacts property tax assessments. There is a lot more written on the subject, and a full literature review would be beyond the scope of what I hope to accomplish today. This theory first gained purchase with the big-box landlords, but it is now the theory du jour with many tax advisors in the commercial sector. In short, the Dark Story Theory holds that a big-box retailer really only has value due to the unique tenant. As such, these properties should always be valued as if they are vacant (or “dark”), because these locations would be difficult to sell to subsequent buyers without the big-box tenant. The Texas Comptroller article notes that the most vigorous proponent of this theory in that state, at least in 2017, was Lowes Home Improvements Stores, with 141 operating locations in that state. In Texas, Bexar County alone estimates it would cost the schools $850 million per year in property tax revenues if this theory was to succeed. As of 2017, Bexar County had spent $300,000 on Lowe’s tax appeals.

Note that the definition of market value for commercial properties, for tax purposes, may be somewhat different than the definition used for a simple home mortgage. Texas law, for example, taxes property at its current use, including any rents it generates. Note that many dark stores are still generating rent for the landlords due to the complex build-and-lease-back provisions in the original development.

This is not an issue limited to Texas. A study out of the U. North Carolina in 2018 showed that this theory has caught on with commercial property owners throughout the U.S., and that the reductions sought often amount to 50% or more of the otherwise assessed value. With millions of dollars in annual tax expense at stake per building, the landlords can afford to hire the best talent and litigate these appeals. Courts are increasingly finding merit with the landlords’ arguments. In 2008, the Wisconsin Supreme Court held in Walgreen Co. v. City of Madison, 311 Wis. 2d 158 (2008), that the market value for tax purposes must be based on market rents rather than contract rents, because the latter, “artificially increased sales prices cause by unusual financing arrangements[.]” The Walgreens decision has resulted in over 140 property tax appeals in that state alone. A bill to effectively reverse this decision failed in the Wisconsin legislature in 2018.

In Indiana, the state tax court was persuaded by appraisers and attorneys for Kohl’s to rely on sales data from nine “dark box” retail stores. This was effectively upheld by the State’s Supreme Court. (See Howard Cty. Assessor v. Kohl’s Indiana LP, 57 N.E.3d 913, Ind. T.C. 2016, review denied, 86 N.E.3d 171). In North Carolina, the Lowes Store in Kernersville (Forsythe County) was valued at $16 million. Using the dark story theory, Lowes appealed with a $6 million valuation, which was upheld by the Property Tax commission. (Matter of Lowe’s Home Centers, LLC, COA17-220, 2018 WL 708657, N.C. Ct. App. Feb. 6, 2018)

With the implosion of certain sectors of commercial real estate becoming more of a reality in the COVID recession, we can surmise that these theories will be more vigorously litigated in the coming months. There is very real money at stake on both sides of this issue.

Property taxes on the rise

Fair and Equitable is the monthly journal of the International Association of Assessing Officers, the primary professional group for tax assessors around the U.S. In the current edition, there is a striking article about rising property taxes due to COVID. In summary, it’s not very good news.

In most towns, cities, and counties, one of the primary sources of operating budgets is property taxes. However, many, and perhaps most cities also rely on sales taxes, tourism taxes, and sometimes even local option income taxes. All of these latter sources of revenues have gone in the tank since the onset of the COVID recession. A study out of the U. of Wisconsin indicates that the shortfall for 2020 is $165 Billion across all cities. Many cities which are highly dependent on tourism — Nashville, New Orleans, and Las Vegas immediately come to mind — are particularly hard-hit.

Many states have hard caps in property tax increases, although some do provide exceptions for emergencies. Houston, for example, has an annual tax increase limit of 3.5%, but may exceed this in the case of declared emergencies.

For the uninitiated, the property tax bill you receive every year is the product of two things — the property ‘assessment’ (determined by the local property assessor or appraiser) and the ‘tax rate’ (sometimes somewhat archaically called ‘millage’), set by the taxing authority, such as the city, county, or school district. This gets particularly cumbersome during recessions because, arguably, the assessed values of some properties, particularly in this case commercial properties (such as restaurants, bars, or such) may decrease even as the local taxing authority needs to raise more money. Hence, to get a 5% increase in tax revenues when some properties are declining in value, the local county council may need to actually raise the tax rates by 10% or 20%. Nashville, for example, just raised tax rates by 34%. Notably, Tennessee has been historically less dependent on property taxes as a source of revenue, with the average tax bill in that state about 40% below the national average. As a result, Tennessee tax payers may feel some very real sticker shock in 2021.

What’s more, if some properties go down in value more than others (as is happening now), the burden of higher taxes falls disproportionally on property owners who are still solvent.

Property owners are advised to take a very serious look at tax assessments in light of the potential declines in property values. Some assessors are trying to get ahead of the game. For example, New Orlean’s assessor Erroll Williams has made pro-active, across the board cuts in the values of hotels and restaurants by as much as 57%. Cook County, Illinois, Assessor Fritz Kaegi is in the midst of a re-evaluation of every commercial property in his jurisdiction.

All in all, a phone call to your friendly, neighborhood real estate appraiser is probably warranted. If and as we can be of any assistance, please let me know.

John A. Kilpatrick, Ph.D., MAI — john@greenfieldadvisors.com

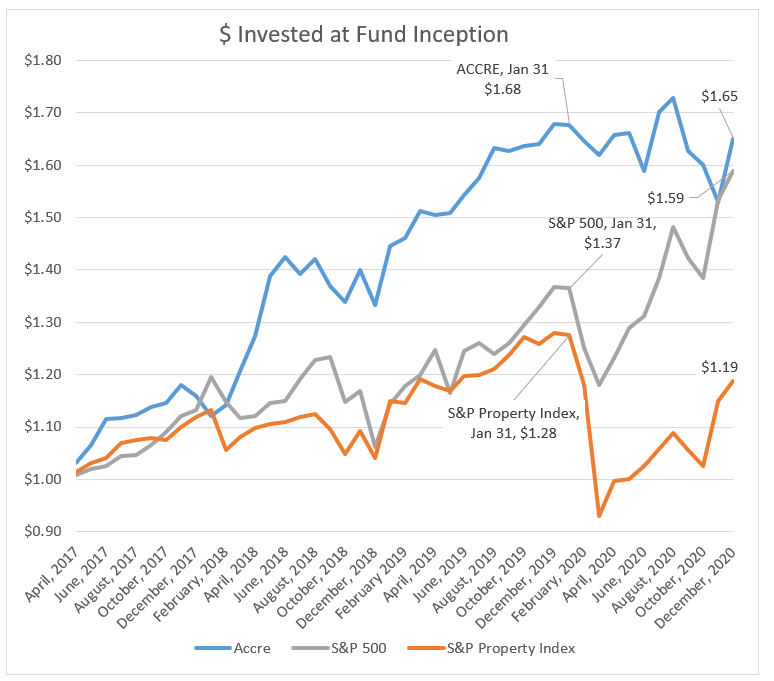

ACCRE LLC Report, December, 2020

Let’s all start by admitting that the S&P 500 has been on a tear this year. If you had put a dollar in an S&P Index Fund on March 31, it would have been worth $$1.38 when you sang Aude Lang Sine last week. Personally, I hope it keeps going! ACCRE is designed in no small part to hold value during market swings, to outperform REITs in general, and to attenuate a well-diversified portfolio. It did all of those this year, and particularly in December. Let’s get down to the basics.

I use January 31 as a benchmark date — that was nominally the beginning of the COVID bear market. As you can see (below) ACCRE did very well compared both to the broad market and to the S&P Property Index. Indeed, but for some market reversals in the fall, we’d be well ahead today. December was a great month for us, and we’re back in the lead against both benchmarks. A dollar invested in ACCRE at the inception would be worth $1.65 today, compared to $1.59 for that same dollar in the S&P 500 and $1.19 in the Property Index.

We feel like we’re well positioned for the coming year, and in fact we were up on the first day of trading, today, while the main market indices all tanked.

One important measure is our Sharpes Index, which looks at excess returns (returns in excess of what we would have earned in treasury bills) adjusted for risk (volatility — measured by the standard deviation of those returns). An additional measure is the correlation with the S&P 500. We generally measure this over the life of the fund, and it hovers around +50%, which is where we want it to be. However, in December, this hit about +15%, suggesting that the market may be looking at real estate very differently from other securities.

| S&P 500 | |||

| Average Daily Excess Return | 0.0424% | ||

| Standard Deviation | 1.3215% | ||

| Sharpes Ratio | 3.2034% | ||

| ACCRE Fund | |||

| Average Daily Excess Return | 0.0448% | ||

| Standard Deviation | 1.1975% | ||

| Sharpes Ratio | 3.7398% | ||

| Correlation (overall) | 52.3091% | ||

| Correlation (December) | 14.6899% |

Well-curated real estate continues to be viewed as a safe haven, with very real value opportunities when and as this recession is over. As always, this in no way constitutes investment advice, and your own financial investments should be made in consultation with appropriate advisors.

If we can answer any other questions, or be of any assistance, please let us know.

John A. Kilpatrick, Ph.D. — john@greenfieldadvisors.com