Archive for October 2024

Where will YOU sleep tonight?

Over the past few years, I’ve focused this blog on Real Estate Investment Trusts. While I’m NOT backing away from investments in that arena (I still own ACCRE, which is a small REIT fund-of-funds), I am presently focusing more of my attention on housing. Where most of us sleep at night comes in several different varieties – single family detached homes, owner-occupied condominiums and other attached housing, rental homes and condos, and of course rental apartments.

According to the most recent statistics I have, there were about 145.3 million ‘housing units’ in America as of July 1, 2023, or about 1 for every 2.3 people. Of the occupied units, about 65.8% are ‘owner occupied’ (both single-family and attached), while the remainder are some sort of rental units, such as single family rental houses or apartments. Over the past couple of years, we’ve seen an increase in housing units of about 1% per year, more or less. That’s about two to three times the rate of growth in the population, so… sounds like everything’s OK, right?

Yet, there is enormous angst about housing availability and affordability in all corners. At the low end of the economic spectrum, about 1.25 million people experienced homelessness a some point in 2020, the last year for which HUD has published data (according to the US Government’s Interagency Council on Homelessness). As we move up the economic ladder, the working poor, when they can find housing, are forced to pay increasingly large portions of their budget for shelter, thus crowding out food, health care, and other necessities of life. Even the so-called ‘middle class’, if you can still call it that, find homeownership prohibitive.

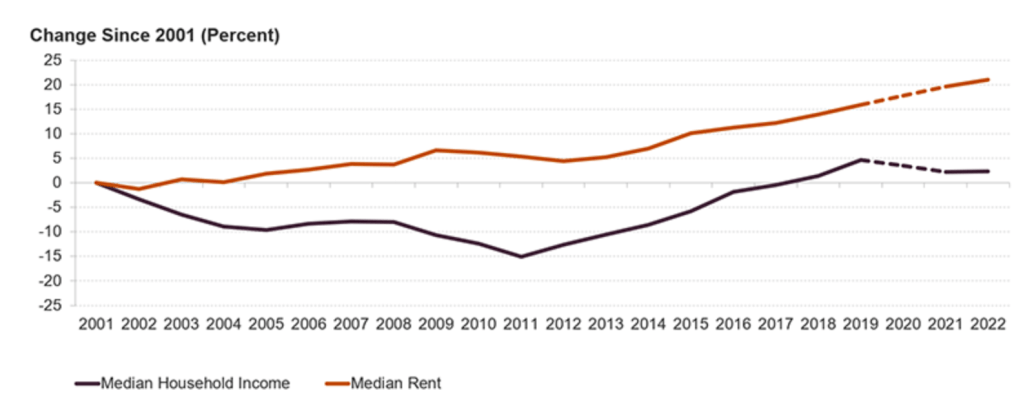

Most pundits (and I’m citing CNBC here) tell us that as a general rule, the total cost of housing (rent or mortgage payment plus utilities) should be no more than 30% of the household’s budget. Ironically, renters, who are often the ones who cannot afford home ownership, seem to have it worse. As of the 2021 American Housing Survey, over 50% of renters report paying over that 30% threshold. When broken down by income level, about 64% of households earning less than $50,000 per year report paying over the 30% benchmark. According to Harvard’s Joint Center for Housing Studies, rent has increased over 20% since 2001 even after accounting for inflation, while median household income is virtually unchanged.

For those trying to join the ranks of homeownership, the story is even worse. Taking the longer view, in 1985, the median household income in America was $22,400, and the median home price was $78,200, for a ratio of 3.5. Even back then, steep interest rates consumed nearly half of a typical household income in mortgage payments. Today, in America, with lower interest rates fueling a housing demand, the median sales price of a dwelling is $433,100, and the median household income is $74,600, resulting in a ratio of 5.8.

Wells Fargo and the National Association of Homebuilders conduct an annual survey of homebuilder sentiment, which is a weighted average of current housing starts, anticipated starts over the next 6 months, and ‘buyer traffic’, which is essentially a measure of buyer interest in new homes. As of October, 2024, the index stood at 43, which for the sake of comparison, is about where it stood in the middle of the 2008-10 housing crash. Not surprisingly, housing starts right now are only 992,000 per year, about where it stood 40 years ago.

Many buyers and apartment developers blame interest rates, but that’s only part of the story. Costs have skyrocketed all across the nation, not just ‘hard costs’ (sticks, bricks, and labor) but also ‘soft costs’ such as regulatory burdens, permitting fees, and marketing costs. In the ‘hottest’ areas – the places where people want to live – the cost of land has also become burdensome. Forty years ago, merchant builders considered land should cost between 30% and 40% of the selling price of a single family dwelling. Today, in the top markets, that number can exceed 50% or more.

Over the course of the next few weeks and months, I’m going to explore some of these issues in more detail. As always, if you have any specific questions or comments, please let me know.

John A. Kilpatrick, Ph.D., MAI

Are you rich yet?

What a terrible thing to ask, and yet Kiplinger’s tells us that the top 1% of Americans (about 1.3 million households) have a minimum household net worth of about $6 million. Those households control about 23% of all wealth in America. Another block of about 1.3 million households — those between the top 2% and the top 1% — have a minimum household wealth of about $2.5 million, more or less. Of course, these numbers are highly inexact, because… well… I’ll get to that.

By some estimates, real estate makes up as much as 50% of the total net worth for the top 2% of Americans. Again, this is hard to estimate, since typical households don’t have their real estate re-appraised on a daily basis. However, some real estate sectors have done very well, particularly residences, real estate supporting private businesses, and some industrial properties. Before the pandemic, I generally used the VERY heuristic rule of thumb that the super-wealthy (lets say, half a billion net worth and above) had about 25% of their net worth in real estate of some kind or another.

If you’re Jeff Bezos or Warren Buffett or such, you have people who look at this stuff regularly. However, of you’re in one of those 1.3 million households who have a net worth between, say, $2.5 million and $6 million, you probably don’t give it much thought. But maybe you should. I wrote about this in my most recent book, Valuation and Strategy. Here are just a few points, in no particular order:

- Have you considered intergenerational transfers? How exactly will your estate be divided? Is there a way to structure it in an advantageous fashion, considering the often onerous costs of selling property out of an estate?

- Do you own real estate supporting a family business? Is it coupled with the business itself, or is it a separate entity? Do your children or other family members want to continue the business, and do all of them want to participate? Perhaps there are ways to separate the business from the real estate in order to equitably prepare your family members for the inevitable.

- Is any of your real estate financed? What does that look like now? As I write this, interest rates are trending downward after a couple of years at uncomfortable levels. Does this change anything?

- How has your investment real estate changed in value relative to your non-realty investments? Are your asset allocations where you want them to be? Are you comfortable with the risks moving forward?

I would note that the average registered investment advisor is pretty good at not losing you money in the stock market, but ill-prepared to advise on the nuances of real estate investing. That said, most real estate brokers are ill-equipped to advise on wealth management issues. There are people out there who can help you, and with the economy in some flux, now would be a good time to take a long hard look at your real estate holdings.

As always, if you have any questions about this, please don’t hesitate to reach out!

John A. Kilpatrick, Ph.D., MAI