Archive for October 24th, 2023

Are REITs Growth Stocks?

Are REIT shares “stocks” or are they “real estate”? This is a matter of no small debate in both academia and the industry, and most tests of the question surround the degree to which REIT share prices are colinear with the broader market (say, the S&P 500). My own studies suggest more real estate than stock, but with some stock features.

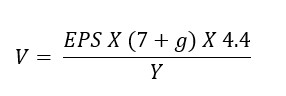

With that in mind, to the extent that REITs are just high-dividend growth stocks, then the intrinsic value of REIT shares should conform to normal growth market expectations. For example, if a share price deviates from its underlying intrinsic value, then that should give us a “buy” or “sell” signal. One of the more common and simple ways to measure the intrinsic value of a growth stock is via the Graham Model, developed by Columbia University professor Ben Graham and outlined in his 2006 book The Intelligent Investor. His model is fairly simple, although over the years it’s been modified a bit. He showed that the intrinsic value (V) of an “investment quality” growth stock should be a function of the most recent earnings per share (EPS), the expected growth rate of the company’s earnings (g), the price/earnings multiple for base-line growth companies (8.5), and the ratio of the long-term average of AAA corporate bond yields (4.4) to current bond yields (Y):

In recent years, investors have used a somewhat more cautious approach, assuming only 1 X g and an industry PE of 7:

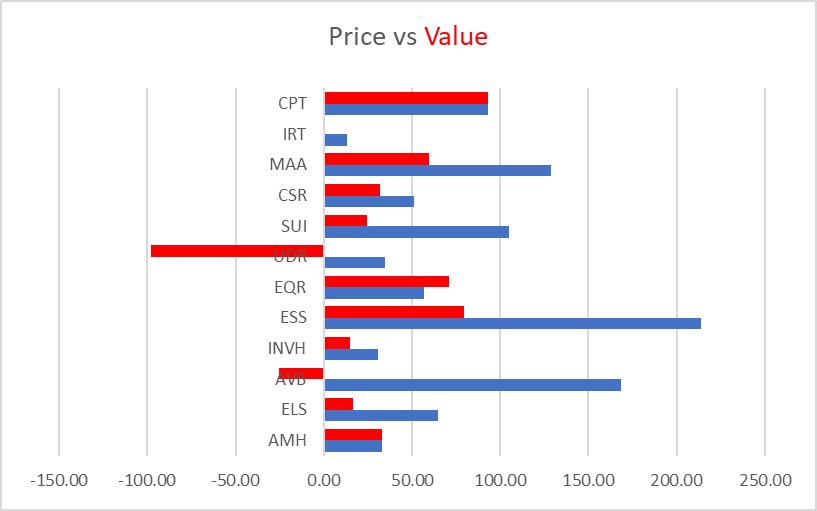

To test this out, I’ve examined all of the Residential REIT shares we looked at earlier this month which reported positive earnings per share for the 2nd quarter. I’ve used the more conservative version of the model. For “g” I’ve used the annualized 5-year growth expectations of industry analysts as reported by Yahoo finance and the Moody’s seasoned AAA rated long-term bond yield as of the end of September (5.13%). The results suggest that nearly all of the REITs are presently trading above intrinsic value, and only two (CPT and EQR) are slightly below. Indeed, two of the REITs show negative intrinsic value, because analysts project negative annualized growth rates for those REITs over the next five years.

If you want to try this at home, many industry analysts will use a safety buffer, say 65% of intrinsic value, as a Buy/Sell threshold.

Some might argue that since REITs are really a dividend-paying investment rather than a pure growth play, then a model such as Gordon’s would work better, and there is some argument for that. However, Gordon’s Growth Model requires some factors that are not as easily derived from the market (e.g. – rate of return for the company in question) as well as some speculation about dividend growth rates. As a compromise, perhaps this model could be modified using Funds from Operations (FFO) rather than EPS, since the former is more closely aligned with cash available for dividend payouts. I plan to tinker with this a bit in the future, and I’ll get back to you with the results.

So that’s it for today, folks. As always, I’m not an investment advisor, and this is not a solicitation or recommendation to invest in anything. Further, I and the entities I’m involved with may have positions or interests in one or more of the securities discussed here. However, if you have any questions about this, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI