REIT Report — Residential Sector

The Residential REIT sector generally spans three subsectors – apartments, single-family detached rental communities, and “lifestyle” REITs which invest in manufactured housing, RV parks, and marinas. The thee subsectors have been driven by similar forces over the past years. First, there is an organic demand for new rental housing as population growth drives household formation. The market for single family rental homes was particularly hot during the pandemic, and those REITs saw dramatic run-ups followed by a tough period failing to meet investor expectations.

The sector is also affected by the homeownership rate and housing affordability, which can increase demand for non-owner-occupied housing. Conversely, rental housing supply is impacted by the same forces that impact owner-occupied supply, such as increased building costs, increasing interest rates, and lack of space in desirable markets. Overall, rents have increased faster than inflation in most markets, but so have costs. REIT share prices performed extremely well during the pandemic, and particularly in the single-family detached rental market, and as a result there has been some negative re-bound as investors recognized that sky-high returns couldn’t continue year-after-year.

Finally, the lifestyle REITs are particularly sensitive to an aging population, who see manufactures housing (particularly in the sunbelt), RVs, and marinas as part of that slow transition into retirement.

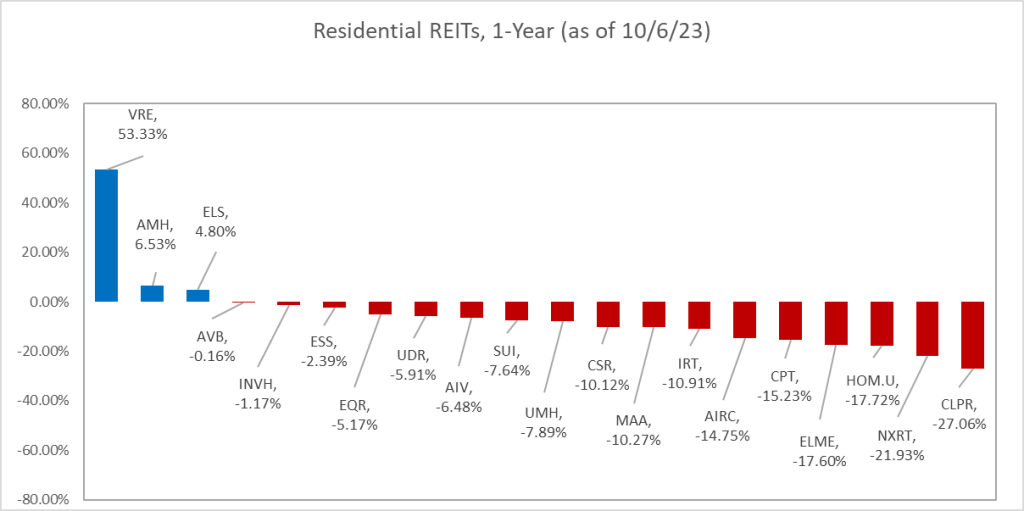

Mostly, the sector has had a tough year, price-wise, although many of these with strong fundamental had a good run over the five-year horizon.

Veris Residential (VRE) owns or joint ventures 24 apartment complexes spanning 6,691 units with reported occupancy of 95.7% and an average asset age of 7 years. They also own several non-core properties (three office properties and four parking/retail). They sold some discontinued office/hotel properties in the first half of the year, and list some others as classified for sale. They did not report any property acquisitions during the first half of the year, but report $256 million in land held for development and $37 million in construction in progress. Debt makes up about 63% of their capital stack. EPS for the 2nd quarter of this year was a negative $0.30, compared to a positive $0.25 for the same quarter 2022. Despite a substantial 44% increase in rental income, VRE suffered from an increase in interest expenses and other financing costs. As a result, FFO declined into negative territory in the 2nd quarter of this year. Even on a 6-month basis, FFO declined about 90% from the first half of 2022 to the first half of 2023. The stock is up 53 percent over the past year, nearly all of that the result of a hostile takeover bid from the Kushner Companies back in October, 2022. The bid was rebuffed by Veris, but the market appears to have acknowledged (and thus already priced) some hidden value in the company. Interestingly, over a 5-year horizon, when most residential REITs did fairly well, Veris is actually down 20%, even including the Kushner offer.

AMH REIT (AMH), known also as “American Homes 4 Rent”, focuses on single-family rental home communities. As of the end of the 2nd quarter, AMH owned 58,693 single family properties in 21 states, including 648 properties classified as “for sale”. During the 2nd quarter, they sold 415 dwellings for net proceeds of $126.8 million (about $306,000 per property) and a gain on the sales of $62.6 million. AMH did not report any acquisitions during the first half of this year, but did report $750 million in single family properties under development. As of June 30, total real estate assets were carried at a book value of $11.5 Billion. Debt makes up about 40% of their capital stack. For the 2nd quarter of this year, net EPS was $0.27, compared to $0.16 during the same period last year. FFO grew by about 8.9% over that period. AMH is up 6.53% over the past 12 months, and up over 68% over the past 5 years, with fairly spectacular growth during the pandemic when the market for single family rentals was hot.

Equity Lifestyle Properties (ELS), One of several REITs founded by the late Sam Zell, ELS owns manufactured home communities, RV Parks, and marinas. Their manufactured home communities are age-qualified, catering to the “active adult” lifestyle, and span about 200 properties with 72,700 manufactured home sites. The RV park portfolio includes 200 parks under the Thousand Trails and Encore Resorts labels, in 30 states and British Columbia with 62,700 RV sites. They own 23 marinas, primarily in Florida (19) totaling 6,900 boat slips. In the past 18 months, ELS has acquired 7 more properties and expanded several others. EPS for the 2nd quarter of this year was $0.34, compared to $0.33 for the same quarter last year. FFO for the 2nd quarter totaled $0.66/share, compared to $0.64 the same period last year. The stock is up 4.8% over the past year and 38.7% over the past 5 years.

Avalon Bay Communities (AVB) holds direct or indirect ownership interest in 294 apartment communities in 12 states spanning 88,650 units. As of June 30, AVB had land holdings and intentions for developing an additional 43 communities spanning 14,993 units. EPS for the 2nd quarter came in at $2.59, compared to $0.99 for the 2nd quarter last year, primarily as a result of a net gain on the sales of two apartment communities totaling $187 million. For comparison, FFO totaled $2.66 per share in the 2nd quarter, compared to $2.43 per share the same quarter last year. The stock is slightly down (-0.16%) over the past 12 months, and down about a half percent over a five-year period.

Invitation Homes (INVH) invests in single family rental homes. They own 82,837 units in California, Seattle, Phoenix, Las Vegas, Dever, Florida, Atlanta, the Carolinas, Texas, Chicago, and Minneapolis. Their typical rental home is 1,870 square feet, three bedrooms, two baths. Average occupancy is 97%, and average monthly rent across the portfolio is $1.22 per square foot, ranging from a low of $0.92 in the Carolinas to a high of $1.73 in Southern California. Typical annual turnover was about 26% in the 2nd quarter, and the average home remained unoccupied for 33 days. They acquired 188 homes in the 2nd quarter and sold 361 for a gain on the sale of $46.8 million. EPS for the 2nd quarter was $0.22 compared to $0.18 for the same quarter last year. Much like AMH, the stock had an exciting period a few years ago. Over the past 12 months, the stock is down 1.17%, but gained 51.5% over the past 5 years.

Essex Property Trust (ESS) is primarily focused on west coast apartments. Nearly all of their holdings (51.572 apartments) are in 252 communities in California and the Seattle Metro market. They additionally have about 10,000 apartments in co-investments, preferred equity interests, or under development. Apartment occupancy in the 2nd quarter was in the range of 96%-97%. Same-property revenues increased 4% from 2nd quarter 2022 to 2nd quarter 2023. EPS for the 2nd quarter was $1.55, compared to $0.87 the same quarter last year. Core FFO increased to $3.77/share in the 2nd quarter from $3.68/share the same quarter last year. The stock is down 2.39% this year, and down 9.51% over the past 5 years.

Equity Residential (EQR) also known as Equity Apartments, was also founded by Sam Zell. They own or joint venture 304 apartment communities with 80,212 units. Their primary markets are Southern California (about 27% of NOI), San Francisco, Washington DC, New York, Seattle, Boston, and Denver. The average rental rate per apartment was $2,995 during the 2nd quarter, with 95.9% reported occupancy, 20.6% annual turnover, and an average annual rental rate increase of 8%. During the 2nd quarter, EQR acquired 2 new communities with 549 apartments at a purchase price of $186.6 million, or about $340,000 per apartment. During that same period, they sold 7 properties spanning about 247 units for $135.3 million ($548,000/unit) and a gain on the sales of about $100 million. Debt makes up about 43% of their capital stack. EPS for the 2nd quarter was $0.92, compared to $0.78 the same quarter last year. FFO during that period increased by 9.6%. The stock is down 5.17% this year, and down 5.38% over the past 5 years.

UDR REIT (UDR) was previously known as United Dominion Residential Communities. They own urban apartments in such upscale locales as Manhattan’s upper west side and San Francisco’s Mission Bay District. Their holdings include both apartments and retail space, and some are subject to net ground leases. As of June 30, they owned 162 properties in 13 states plus DC spanning 53,832 apartments along with an interest in 9,956 apartments through unconsolidated partnerships or joint ventures. They report same-store occupancy at 96.6%, with average apartment rent at $2,493. They did not acquire any new properties in the 1st half of this year, other than taking title to a 136-apartment home operating community in San Francisco through a foreclosure proceeding. However, they sold the retail component of a development community in Washington, DC, for gross proceeds of $14.4 million (and net gain of $100,000) and also sold four wholly owned operating communities totaling 1,328 apartment homes in various markets in a swap for a 51% interest in the newly created joint venture. UDR received $247.9 million in cash in this transaction and recorded a net gain of $325.9 million. EPS for the 2nd quarter was $1.05, compared to $0.01 for the 2nd quarter, 2022. FFO for those periods was $0.63 and $0.52, respectively. Debt makes up 54% of their capital stack. The stock is down 5.91% this year, and down 6.04% over the past five years.

Aimco REIT (AIV), also known as Apartment Investment and Management Company, operates in three business segments: development/redevelopment, operations, and other. The first segment consists of 12 properties: 3 apartment communities with 1,185 units, of which 276 were completed as of June 30, a single family rental community with 16 dwellings, a 106 room hotel, and land parcels held for development The second segment has 21 apartment communities with 5,600 units. The “other” category includes one office building and a property called St. George Villas. Debt makes up about 65% of their capital stack. EPS for the 2nd quarter 2023 was negative $0.02, compared with $1.57 the same quarter last year. It would appear that in 2022, their bottom line benefitted with a substantial recognition of lease modification income related to a termination of a lease of four properties. The stock is down 6.48% over the past year, but up 15.48% over the past 5 years. They had a very significant run over the period from early 2020 to late last year, up nearly 50% in about 30 or so months, but they’ve backed off since then due most likely to the headwinds of apartment development.

Sun Communities (SUI) is also in the manufactured home (354 communities), RV (182 RV properties), and marina (135) subsector. In the 2nd quarter, they sold two manufactured housing communities, one in Maine (155 developed sites for $6.8 million) and one in the UK (730 developed sites for $240 million). At year end, 2022, they acquired 22 properties of various types for a total of $2.2 Billion. So far in 2023, they have acquired two properties, a manufactured home property and a marina, for $107 million. EPS for the 2nd quarter was $0.72, compared to $0.61 for the same period last year. FFO for those same periods was $1.96 and $2.02, respectively. Same property NOI increased by 6.3% from the 2nd quarter 2022 to 2nd quarter 2023. Debt is about 54% of their capital stack. SUI is down 7.64% this year, but up 22.73% over the past 5 years, mostly as a result of doubling in price between early 2020 and late 2021. However, the stock ran out of steam in early 2022, and is down nearly 50% since then.

UMH Properties (UMH) invests in manufactured home communities. They own 135 such communities in 11 east-coast and mid-west states with 25,700 homesites. They also own 9,600 rental homes on about 37.4% of their sites, and occupancy in the rental homes is reported at 93.9%. They added 534 new rental homes in the first six months of this year, and intend to add 800-900 total this year. They also have an ownership interest in and operate two such communities in Florida through a joint venture. In the first half of this year, they acquired one new facility in Georgia with 118 newly developed homesites at a price of $3.7 million, of which $234,000 was land. Debt makes up about 54% of their capital stack. EPS for the 2nd quarter was negative $0.07, compared with negative $0.41 the same quarter last year. FFO during that same period rose by about 8%. The stock is down 7.89% this year, and down about 3% over the past 5 years.

Centerspace (CSR), also known as Centerspace Homes, owns 75 apartment communities with 13,479 units. Debt makes up 49% of their capital stack, but notably 49 of their apartment communities are unincumbered by mortgages, and they also have in excess of $200 million undrawn on a credit line. Centerspece did not acquire any new properties in the first half of 2023, and disposed of 9 properties totaling 1,567 units during that time period for an aggregate sales price of $144.3 million and an aggregate gain on the sale of $60 million. Their two largest markets were Denver and Minneapolis, each of which has more than 10% of their holdings. EPS for the 2nd quarter of this year as a negative $0.23, compared with a negative $0.30 during the same period last year. Core FFO per share for the same periods was $1.28 and $1.12, respectively. Centerspace is down about 10.12% over the past 12 months, but up about 8.58% over the five year horizon, mainly due to a big price bubble in 2021.

MAA REIT (MAA) focuses on luxury apartment rentals. Specifically, they own and operate 290 communities (not including those under development) in the southeast, southwest, and mid-Atlantic regions plus one unconsolidated unit in a joint venture with a total of about 102,000 apartments. About 34 of these communities also have retail components of various kinds. As of June 30, they had 6 communities under development totaling 2,310 units. Total expected cost for the new units will be $735 million, or about $318,000 per apartment. EPS for the 2nd quarter was $1.24, compared to $1.82 for the same quarter in 2022. The difference appears to come from gains on the sale of some properties in 2022. Quarterly same store rental revenues increased from 2022 to 2023 by about 8%, and FFO grew by about 14%. MAA is down 10.27% over the past 12 months, but gained 37.74% over the five year horizon.

Independence Realty Trust (IRT) owns and operates in “non-gateway” markets. They have 119 multifamily properties with 35,249 units, generally in the sunbelt. As of June 30, they held one property in Chicago classified as “for sale” with 374 units which they expect to sell in the 2nd half of this year, and they also sold one property in Indiana for $37 million, realizing a gain of $985,000. Debt is about 43% of their capital stack. EPS for the 2nd quarter this year was $0.05, up from negative $0.03 the same quarter last year. FFO per share for the same periods was $0.28 and $0.26, respectively. Same store occupancy declined a bit over the period, from 94.1% to 93.1%, but average effective monthly rent rose by 8.9%. Their stock is down 10.91% over the past 12 months, but up 43.3% over the 5 year horizon.

Apartment Income REIT (AIRC), also known as AIR Communities, operates 73 apartment communities with 25,739 units, in 10 states and DC. They also own one land parcel. EPS for the 2nd quarter this year was negative $0.01, compared to $1.26 for the same period last year. FFO/share for these periods was $0.58 and $0.66, respectively. Indeed, same-store rents increased by 8.9% over this period. The principal difference appears to be gains/losses on dispositions of assets. During the 2nd quarter, they sold 4 apartment communities with 718 units for a gain on the sale of $175,6 million. In contrast, during the first half of 2022, they sold 12 communities with 2,050 units, for a gain on the sale of $588 million. Debt amounts to about 65% of their capital stack. The stock is down 14.75% over the past 12 months, and down 20.82% ever since its December 15, 2020 spin-out from Apartment Investment and Management Company.

Camden Property Trust (CPT) owns 177 multifamily properties totaling 60,514 units, of which 5 were under development totaling 1,553 units. The largest number of their properties is in Texas, and other top markets include DC, Atlanta, Phoenix, and various parts of Florida. They also own land held for future development. Debt makes up 46% of their capital stack. EPS for the 2nd quarter 2023 came to $0.84, compared to $4.59 for the same period last year. The difference appears to stem from a 2022 gain on the acquisition of unconsolidated joint venture interests. By comparison, FFO for those periods increased by 7%. The stock is down 15.23% for the past year, but up 7.35% over the 5 year time frame, in no small part due to its run-up in the 2020-2021 period when its stock price nearly doubled.

ELME Communities (ELME) owns 8,900 apartments primarily in the DC area and the sunbelt and about 300,000 square feet of commercial space in the DC area. About 92% of their revenues come from real estate rents. They report same-store occupancies at 95.6%, about the same as a year ago. Debt constitutes 33% of their capital stack. EPS for the 2nd quarter was negative $0.03, compared to negative $0.10 for the same quarter last year. FFO was positive and increased 24% over that same period. It’s stock is down 17.6% over the past 12 months, and down 50.9% over the 5-year timeframe, with a nearly steady decline over that period.

BSR Real Estate Investment Trust (HOM.U) is a Canadian REIT which trades in the Toronto exchange. They own 31 multi-family properties consisting of 8,666 total units, 85% of which are in Texas, 11% in Oklahoma, and 4% in Arkansas. FFO/Unit for the 2nd quarter 2023 was US$0.23, an increase of 9.5% over 2022. Weighted average apartment rents increased by 6.3%, and same community revenues increased by 8.5%. BSR had no acquisitions or disposals from 2022 to 2023. Their weighted average occupancy rate is 95.3%, and they report a 56% retention rate. BSR stock is down 17.72% over the past 12 months, but up 31.74% over the 5-year horizon.

Nexpoint Residential Trust (NXRT) owns and operates 40 properties totaling 15,127 units acquired since 2014. They report a 93.9% occupancy and a weighted average monthly rent of $1,497. There were no acquisitions or sales during the first half of this year. Debt makes up 78% of their capital stack. EPS for 2nd quarter 2023 was negative $0.15, compared to negative $0.30 for the same period last year. However, same-store rents increased by 7.6% over that period, but core FFO declined by 3.2% from 2022 to 2023. The stock is down 21.93% over the past 12 months, and down 6.44% over the five-year period.

Clipper Realty (CLPR) owns nine properties, all in New York City. Eight of these are either residential or a combination of residential and commercial, and one is a development site. The only acquisition over the past two years was additional land for the development site. Debt makes up 98% of their capital stack. EPS for the 2nd quarter 2023 was negative $0.10, compared with negative $0.08 for the same period last year. FFO over that same period increased by 5.1%. CLPR shares are down 27.06% over the past 12 months, and down 60.42% over the past 5 years.

So that’s it for today, folks. As always, I’m not an investment advisor, and this is not a solicitation or recommendation to invest in anything. Further, I and the entities I’m involved with may have positions or interests in one or more of the securities discussed here. However, if you have any questions about this, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI

Leave a comment