REIT Report — Office REITs

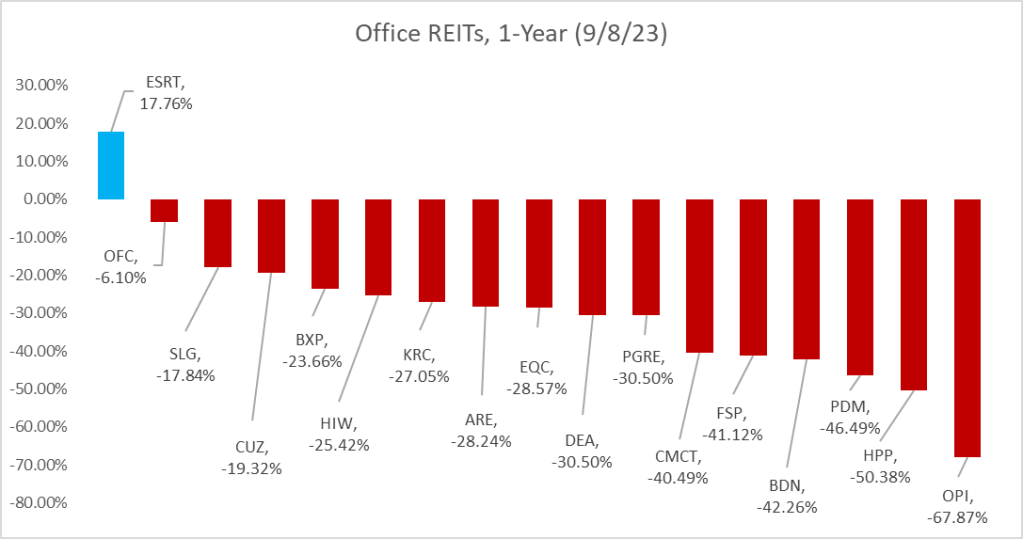

As I mentioned before, I track the REIT universe pretty closely, and we have a REIT-based fund called ACCRE. Starting a couple of weeks ago, I began tracking publicly traded REITs that are members of NAREIT on a sector-by-sector basks. My goal is to cover the entire REIT universe each quarter then loop back through. Today, I’m taking a look at the 19 Office REITs in NAREIT, 17 of which have a one-year trading history. As you can seek, office REITs have generally had a tough year, with one rare exceptions.

Empire State Realty Trust (ESRT) is principally an office REIT, although they also own retail and multi-family assets focused mainly in Manhattan and surrounding Greater New York. Their name comes from the fact that their flagship property is the Empire State Building. As of June 30, they own about 8.6 million rentable square feet of office space, 718,000 rentable square feet of retail, and 721 residential units across 3 residential properties. In the 2nd quarter, ESRT earned $0.14 per share (EPS), with core funds from operations (FFO) of $0.26 per share. They report a 90.3% occupancy rate across their entire commercial portfolio, and 91.6% on their Manhattan properties. Same-store cash net operating income (NOI) increased 1.1% year-over-year. Over the past year, ESRT’s stock has returned 17.76%.

Corporate Office Properties Trust (OFC) owns and operates 22.9 million square feet spanning 192 buildings in what they call their “core” portfolio. (OFC also owns two other buildings in what they call their “other” segment). Of these offices, 20.9 million square feet in 186 buildings are leased to defense/IT tenants. Their overall occupancy rate is 95%, with a reported 96.8% in the defense/IT sector. In the 2nd quarter, they reported EPS of $0.27 and FFO/share of $0.60. Over the past year, their stock has fallen 6.1%.

S.L. Green Realty (SLG) claims to be New York City’s largest real estate owner. They own 60 buildings containing 33.1 million square feet, of which 28.8 million are in Manhattan. They reported a net loss of $5.63 EPS for the 2nd quarter, compared to a positive $0.70 the same quarter last year. This loss was attributed to a previously-reported write-down of the carrying value of a leasehold interest at 625 Madison Avenue. FFO/share for the 2nd quarter came in at $1.43/share, compared to $1.87 for the same quarter last year. Manhattan occupancy was reported at 89.8% as of June 30. Their stock declined 17.84% over the past year.

Cousins (CUZ) is an Atlanta based office REIT primarily focused on sunbelt properties. They own 20 million square feet in Arizona, Texas, Tennessee, North Carolina, Georgia, and Florida, reportedly 90% occupied. CUZ reported $0.15 EPS in the 2nd quarter compared to $0.23 the same quarter last year. FFO/share was $0.68, compared with $0.70 the same quarter last year, and NOI for the 2nd quarter was 8.1% higher than the same quarter last year. CUZ stock fell by 19.32% over the past year.

Boston Properties (BXP) owns 191 properties totaling 54.1 million square feet primarily in six key markets: Boston (49 properties), Los Angeles (27), New York (26), San Francisco (37), Seattle (2) and Washington, DC (36). Total occupancy as of the end of the 2nd quarter was 88.3%. EPS for the 2nd quarter was $0.66, compared with $0.50 in the same quarter last year, and FFO/share was $1.86 versus $1.73. The stock was down 23.66% over the past year.

Highwoods Properties (HIW) is headquartered in Raleigh, NC, and owns 27.6 million square feet of office space in Texas, Tennessee, Virginia, North Carolina, Georgia, Florida, and Pennsylvania. Reported occupancy is 89%. EPS for the 2nd quarter was $0.40, compared to $0.48 the same quarter last year, and FFO was $0.95 compared to $1.00 a year ago. The stock price is down 25.42% over the past year.

Kilroy Realty (KRC) is primarily an office REIT, but also owns life science, retail, and residential properties. KRC owns a total of 120 properties with 16.2 million square feet of space and with reported occupancy of 90.8%. They also own 1,001 residential units. EPS was reported at $0.47 for the 2nd quarter, an increase of 17.5% from the same quarter last year, and FFO/share was $1.19, up 1.7%. The stock price over the past year declined 27.05%.

Alexandria Real Estate Equities (ARE) owns 74.9 million square feet of offices in Seattle, the San Francisco Bay Area, San Diego, Greater Boston, New York City, Maryland, and the Research Triangle, with a focus on the life sciences niche. They also have 3 non-US properties. EPS for the 2nd quarter was $0.51, down from $1.67 the same quarter last year. FFO was $2.24, compared to $2.10. Year-over-year, the stock price is down 28.24%.

Equity Commonwealth (EQC) is the office REIT founded by the late Sam Zell, who passed away in May. While based out of Chicago, EQC owns 1.5 million square feet in four office buildings in Colorado, Texas (2), and DC., reporting an 82% occupancy rate. For the 2nd quarter of this year, EQC reported EPS of $0.12, compared with $0.01 the same quarter last year. FFO/share was $0.22, compared with $0.04 the same quarter last year. EQC’s stock fell 28.57% over the past year.

Easterly Government Properties (DEA) focuses on GSA-leased properties throughout the U.S. They own or joint-venture 86 such properties encompassing 8.6 million leased square feet, of which 85 are leased primarily to the U.S. government. For the 2nd quarter, EPS was $0.05 compared to $0.08 last year, and FFO/share was $0.29, compared to $0.33. DEA’s stock price is down 30.5% over the past year.

Paramount Group (PGRE) owns or joint ventures 18 office properties in New York City and San Francisco, with occupancy reported at 88.8%. EPS for the 2nd quarter was negative $0.22, compared to $0.00 the same quarter last year. FFO/share was $0.18 compared to $0.24 last year. The stock price is down 30.5% over the past year.

Creative Media and Community Trust Corp (CMCT) focuses on office and multifamily properties in emerging communities, with an emphasis on technology, media, and entertainment. They currently own 25 properties, including 13 offices (1.3 million rentable square feet) one 503-room hotel, and three multi-family properties. CMCT reports an 83% occupancy across all of their office properties, up from 78.1% last year, and 83.9% for the multi-family. Their stock is down 40.49% over the past year.

Franklin Street Properties (FSP) focuses on infill and central business district (CBD) office properties in the sunbelt and mountain west, as well as selected opportunistic investments. They own 20 properties and one consolidated sponsor REIT totaling about 6.3 million square feet in 7 states. Occupancy is reported at 73.3%. For the 2nd quarter, they reported a negative EPS of $0.08 (compared to a negative $0.09 for the same period last year), and FFO/share of $0.07 (compared to $0.10 last year). Their stock has declined 41.12% over the past year.

Brandywine Realty Trust (BDN) owns 24 million square feet of office space primarily in Austin (23 properties), and the Greater Philadelphia/Washington, DC corridor (138 properties) with a reported occupancy of 89.6%. For the 2nd quarter, they reported a negative EPS of $0.08 compared to a positive $0.03 last year. FFO/share was $0.29, down 18% from the previous year. The stock price is down 42.26% year-over-year.

Piedmont Office Realty Trust (PDM) is an Atlanta-based REIT with 51 properties encompassing 16.7 million square feet in Atlanta, Boston, Dallas, Minneapolis, New York, Orlando, and the Northern Virginia/DC area. They report that their properties are 86.2% leased, which is down slightly from the 2nd quarter last year. EPS for the 2nd quarter was negative $0.02, compared to $0.06 for the same period last year. FFO/share was $0.45 compared to $0.50. The stock is down 46.49% over the last 12 months.

Hudson Pacific (HPP) is headquartered in Los Angeles, and principally owns offices (50) and movie studios (4) on the west coast including British Columbia and in the U.K. plus 8 development properties. They also own approximately 90 sound stages and 1,600 production vehicles in Hollywood. Occupancy rates for their offices is reported at 85.2%, and for the studio properties at 86.5%. Hudson is actively repositioning and developing properties. For the 2nd quarter of this year, EPS was a negative $0.26, compared to a negative $0.05 for the same period last year. FFO/share was about $0.29 in the 2nd quarter, a decline of about 30% from the previous year. HPP stock is down 50.38% for the last 12 months.

Office Properties Income Trust (OPI) focuses on single-tenant offices, with a large number of government tenants. They own 155 properties spanning 20.8 million square feet in 30 states and D.C. and report a 90.6% occupancy. EPS for the 2nd quarter was a negative $0.25, compared to negative $0.33 the same period last year, and FFO/Share was $1.11, compared to $1.22. Their stock is down 67.87% over the past year.

We’re also tracking Orion Office REIT, which has no trading history to report yet. Orion was formed as a result of the spin-off from the Realty Income and VEREIT merger. Its portfolio is comprised of substantially all of the office properties of both companies and is primarily focused on single-tenant net lease offices in attractive suburban markets, particularly in the Sunbelt. As of the end of the 2nd quarter, they owned 81 properties in 29 states with an aggregate of 9.5 million leasable square feet of office and an occupancy rate of 86.5%. EPS for the 2nd quarter was a negative $0.28, compared to negative %0.27 for the same period last year, and FFO/share was $0.48 compared to $0.50.

Finally, American Strategic Investment is technically still a member of NAREIT, but it terminated its election to be taxed as a REIT earlier this year, and effected a reverse stock split along with a secondary offering of Class A shares. They currently own office properties in New York City, and are now expanding into hotel and parking lot operations.

Again, I’m not an investment advisor, and this is not a solicitation or recommendation to invest in anything. Further, I and the entities I’m involved with may have positions or interests in one or more of the securities discussed here. However, if you have any questions about this, please don’t hesitate to reach out.

John A. Kilpatrick, Ph.D., MAI

Leave a comment