Archive for August 7th, 2023

Shelter Inflation

The Federal Reserve Bank of San Francisco published a great piece on shelter inflation today (that is, home ownership and rental costs, which are heavily related). If you’d like to read the piece, you can download it here.

In short, even though core inflation is falling, shelter inflation has remained high. i would note that real estate researchers have long recognized that real estate prices (both rents and costs) are sticky upwards. That means that while prices/costs of real estate are quick to move up, they are sluggish to move down. There are a lot of structural reasons for this.

The FRBSF noted that house prices and asking rents went through a period of extraordinary growth starting in early 2020, and the growth rate slowed sharply in 2023 but did not turn into a decline. Notably, shelter costs are a component of the consumer price index, so inflation tends to be doggedly sticky even as other components of the CPI are relaxing. As a case in point, the FRBSF uses the following graphic to illustrate the problem:

Data courtesy the Bureau of Labor Statistics and Haver Analytics

Excluding shelter costs, inflation is nearly back to the FED’s target level of 2%, and in fact below other central bank targets of 3%. However, the shelter cost component is driving core inflation up to levels that the FED simply won’t (and shouldn’t) tolerate.

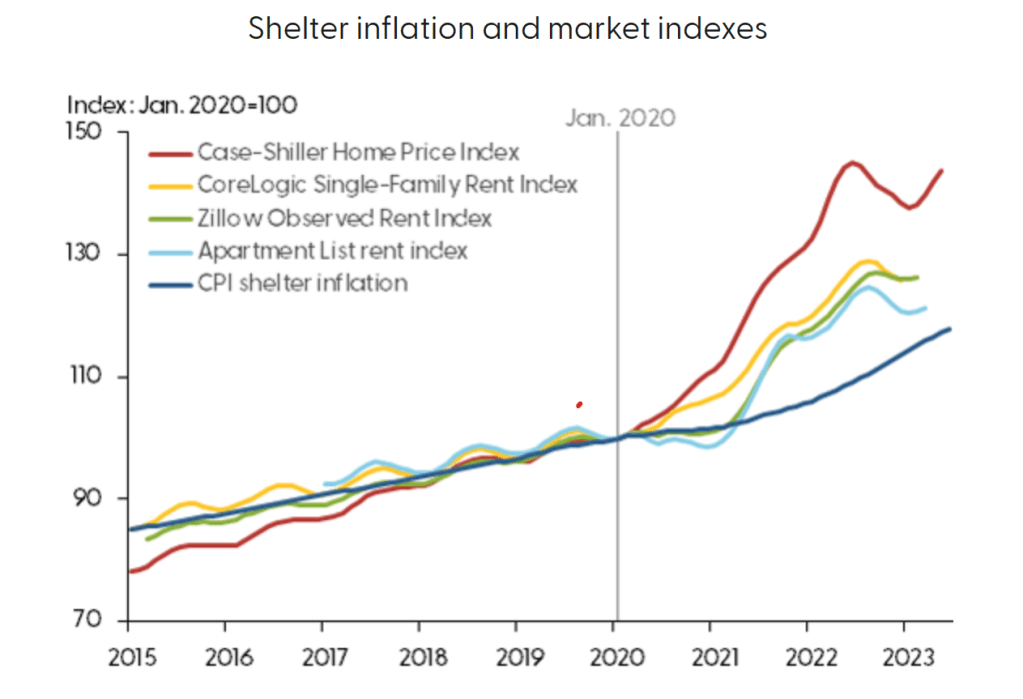

Part of the problem is how we actually measure shelter inflation. The CPI component includes lagged effects, and is not sensitive to current asking rates (either rents or current prices), as the FRBSF demonstrates in the following graphic:

Data courtesy the Apartment List, CoreLogic, S&P/Case Shiler, FRED, and Zillow

The article suggests that shelter inflation should amelorate, and they predict that by mid-2024, shelter year-over-year shelter inflation should actually turn negative. However, for the remainder of this year, and early 2024, we should still see increasing housing costs both in rentals and in the home ownership arena.

One caveat, though — the authors note that shelter costs are difficult to project, and in fact some models have shelter costs changes over time declining but not turning negative. Nonetheless, none of the models currently project shelter costs increases at higher rates than we’re currently experiencing.

As always, if you have any questions about this or any other real estate topics, please don’t hesitate to reach out. Best wishes,

John A. Kilpatrick, Ph.D., MAI